DEFINITION of 'House Money Effect' The tendency for investors to take more and greater risks when investing with profits. The house money effect gets its name from the casino phrase "playing with the house's money."

Uncle8888 is "suffering" from this house money effect bias.

But; what wrong with this bias?

This is the little lie he told himself that he won't lose any of his hard earned money from his human asset while still earning his own version of CPF Life on variable annuities.

House money effect bias is the little lie we tell ourselves that we won't ever lose our own hard earned money. It will help to calm our investing mind across market cycles so that we won't end up too much cash on hand earning too little cash flow from the volatile and unpredictable market cycles of Bulls and Bears.

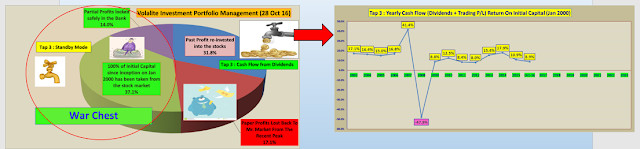

This image tells the story how Uncle8888's little lie made him don't feel like a Loser!

No comments:

Post a Comment