Monday, 30 November 2020

SGX : Bought Back @ $8.89 for Round 8

Read? SGX : Sold @ $9.31 for Round 7-1

Round 7-1 : ROC +2.2%, 40 days, B $9.08 S $9.31 (Highest price sold)

Round 5 - 2 : ROC +9.1%, 112 days, B $8.48 S $9.28

Round 5 - 1 : ROC +5.9%, 102 days, B $8.48 S $9.01

Round 4 : ROC +8.5%, 6 days, B $8.01 S $8.74

Round 3 : ROC +8.8%, 12 days, B $8.21 S $8.99

Round 2 : ROC +13.6%, 3 days, B $7.46 S $8.52

Round 1 : ROC +12.3%, 61 days, B $6.87 S $7.76

SGX : Sold @ $9.31 for Round 7-1

Read? SGX : Bought Back @ $8.78 for Round 7-2

Round 7-1 : ROC +2.2%, 40 days, B $9.08 S $9.31 (Highest price sold)

Round 5 - 2 : ROC +9.1%, 112 days, B $8.48 S $9.28

Round 5 - 1 : ROC +5.9%, 102 days, B $8.48 S $9.01

Round 4 : ROC +8.5%, 6 days, B $8.01 S $8.74

Round 3 : ROC +8.8%, 12 days, B $8.21 S $8.99

Round 2 : ROC +13.6%, 3 days, B $7.46 S $8.52

Round 1 : ROC +12.3%, 61 days, B $6.87 S $7.76

Sunday, 29 November 2020

Singapore is our Home Sweet Home? No???

COVID-19 may be appeared at the right time for some of us to learn reality on the ground for both investing and living our life especially retirement life.

You may have heard of this grand idea of retiring overseas at cheaper costs and funded by "passive" income from dividends and rental income from our Singapore assets and CPF.

COVID-19 Real People. Real Story!

He spent most of his time as retiree in his JB's security guarded landed property in JB; but some time he will travel back to Singapore's "home" for short stay.

COVID-19 scared the shit out of him; and luckily he has made quicker decision to move back to STAY in his Singapore's "home" before border shutdown at midnight! But his doggie is still stuck at JB's home!

Luckily; his JB neighbor is kind enough to take care of his doggie!

When is COVID-19 ending; and his retirement life in JB will be back to old days?

Finally; he realized he can't carry on asking for his neighbor favor to take care of his doggie for such a long time. He applied for Doggie Passport to bring back his doggie "home" in Singapore!

What is the moral of the story?

Last GE 2020; what were hot issues from Oppo? FTs and PRs stealing good jobs?

When our public hospitals were also fill up by more sick PRs and FTs; then you will know what Singaporeans will be shouting loud and clear at MIW!

Like it or not! Our citizenship will made us Priority Class in times of COVID-19 or COVID-XX? No?

Second class residents at overseas for limited medical services during crisis! You can shout at their politicians and kpkb?

For retirement planning; we should be preparing to retire at FUTURE cost of living in Singapore; and now we have articles telling you that you can retire cheaper at overseas as second class resident and funded by "passive" income from assets in Singapore.

Friday, 27 November 2020

STI Investing reaches $2b milestone

STI Investing reaches $2b milestone

“Within the STI, the five stocks DBS, UOB, OCBC, SATS and Ascendas REIT have seen the highest net institutional inflows so far this month, with their average 23% gains driven by $1.4b of net institutional inflows,” said SGX.

“The Assets under Management (AUM) of the two STI ETFs took 17 years to reach the $1b milestone in June 2019, and just 17 months to reach the $2b threshold,” reported SGX. “The SPDR STI ETF crossed the $1b threshold for the first time in its history back in June 2020, and the two STI ETFs have seen approximately $900m of net inflows or net unit creations in 2020 to 24 November.”

Basic Healthcare Sum for 2021

CW8888: Last year to top up MA as self employed to earn 4% interest rate in MA. 65 in 2021. Sianz! Sigh!

The Basic Healthcare Sum (BHS) is the estimated savings required for basic subsidised healthcare needs in old age. The BHS is adjusted yearly for members below age 65 to keep pace with the growth in MediSave withdrawals. Once members reach age 65, their BHS will be fixed for the rest of their lives.

From 1 January 2021,

1. For members below 65 years old, their BHS will be raised from $60,000 to $63,000.

2. For members who turn 65 years old in 2021, their BHS will be fixed at $63,000, which will not change thereafter.

For members aged 66 and above in 2021, their cohort BHS had already been fixed and will remain unchanged.

BHS is the cap to the MediSave Account (MA) and contributions in excess of a member’s BHS will be automatically transferred to his or her other CPF accounts. A higher BHS will allow for more savings to be kept in a member’s MA for his or her healthcare needs. CPF members do not have to top up their MA if they have less than the BHS.

Wednesday, 25 November 2020

Stock market news live updates: Wall Street extends COVID-19 vaccine rally, Dow tops 30K

Optimism over the imminent deployment of a COVID-19 vaccine propelled the Dow Jones Industrial Average above 30,000 for the first time ever on Tuesday, extending a breathtaking rally that’s carried stocks deep into a bull market.

Encouraging developments in the fight against the coronavirus have sent markets on a tear, even as the coronavirus crisis deepens around the world. The Russell 2000 (RUT) index also set a new peak, and the Dow is up over 13% in November — more than 10,000 points higher than the multi-year low it breached in March, when panic over the virus’ spread cratered global markets.

The technology-heavy Nasdaq, which have been beaten down as investors rotate out of “stay at home” stalwarts benefiting from coronavirus-related lockdowns, also posted strong gains. In early dealings, Tesla (TSLA) hit a new record high, and now has a market capitalization north of $500 billion — even before it joins the S&P 500.

Investors also cheered news that President-elect Joe Biden was poised to nominate former Federal Reserve Chair Janet Yellen — who is well regarded by Wall Street — as Treasury Secretary. Markets were also ticked higher on news that the Trump administration would formally begin the transition process, in spite of President Donald Trump’s faltering effort to challenge the vote in key swing states.

“We believe that the recent reduction in political uncertainty in the U.S., though far from complete, is another supportive factor behind the recent stock rally,” said Mark Haefele, UBS Global Wealth Management’s chief investment officer.

Although a relentless wave of new COVID-19 infections has crashed down on the global economy — driving up hospitalizations and deaths in its wake — major drugmakers have indicated that an inoculation is right around the corner.

Tuesday, 24 November 2020

LION-OCBC SECURITIES HANG SENG TECH ETF for Panda/Koala Investors in SGX Local Market

The future of technology. Seize the opportunity.

Why you will love this

Capture the growth potential of the 30 largest TECH-themed companies listed on the Hong Kong Stock Exchange (HKEX)

An Excluded Investment Product (EIP) listed on SGX, available in SGD and USD

Low minimum investment amount, with trading board lot size of just 10 units

For Initial Offering Period only

S$0 commission from 23 November to 3 December 2020.

Minimum subscription of 5,000 units applies.

------------------------------------------------------------------

Uncle8888 as Koala/Panda investor now seize this opportunity to participate in HK Tech ETF!

Some more, saved money on commission. LOL!

He has contacted his broker to place an order to subscribe for this IOP. No balloting is required!

Who still say that Panda/Koala investor in SG has no opportunity to participate in overseas market e.g. HK market? LOL!

Monday, 23 November 2020

Sunday, 22 November 2020

CW8888's Return From his Human Asset and Investment Portfolio Since Jan 2000

Nothing really there to shout about his investing and trading skills. Why?

Never switch to Us market and invest tech stocks!

Go to US market if you want to become very rich in the stock market! LOL!

Saturday, 21 November 2020

I Should Give Up SGX Local Stock Market Long Ago???

SGX local market return is so bloody bad!!!

So better give up and move to US market to avoid banging his head later!!! LOL!

Friday, 20 November 2020

Uncle8888's Amazing STI Crystal Ball Charting. Chun Bo???

Follow the Dots, follow the Dashes and follow the Lines. Open your eyes wide and see closely and then.

Chun bo?

When to buy stronger Blue Chips?

LOL!

DBS will end up like Singtel???

Read? Mixed reactions to DBS India's proposed takeover of cash-strapped bank

Same animal meh?

It is "merged" with DBS India! Fire incompetent Management!

Got Singtel India meh?

So same same arh?

What is the difference?

Listen to Talking Heads or watching Putting Money Where Their Mouths are?

You follow them lor! LOL!

Tuesday, 17 November 2020

Stock futures rise after Monday’s record-setting session

Earlier in the day, the Dow and S&P 500 posted all-time closing highs. The Dow also notched an intraday record. Those gains came after Moderna released trial data showing its coronavirus vaccine was more than 94% effective, further raising expectations of a sharp economic recovery.

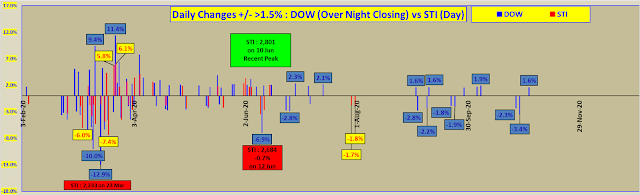

STI following Uncle DOW backside up???

Sunday, 15 November 2020

Cut your losses short and let your winners run???

One of the most enduring sayings on Wall Street is "Cut your losses short and let your winners run." Sage advice, but many investors still appear to do the opposite, selling stocks after a small gain only to watch them head higher, or holding a stock with a small loss, only to see it lose even more.

Read? Peter Lynch on His Secret to Superior Returns

All you need for a lifetime of successful investing is a few big winners, and the pluses from those will overwhelm the minuses from the stocks that don’t work out. - Peter Lynch

How about "Cut your losses short and let your winners run"???

No stop-losses! Die pain pain har?

How about to suit those who by nature who like to believe in "salted fish can turn over" one day or one day salted fishes decay to ashes! Maximum loss is 100% of invested capital! Cry until no tears hor!

Cut your losses short and let your winners run

CAP your losses and take Panadols for Heartache AND let your winners run and play round and round with your winners!

It is actually Short-Term trading or Wrong-Term investing AND Long-Term investing strategy! LOL!

Be OURSELVES since we are investing and trading for ourselves . We should be discovering what really work for us!

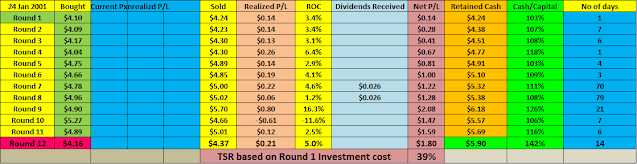

21 years from Jan 2000 to Nov 2020 across market cycles of Bulls and Bears

COVID-19 New stocks pick over 8 Months from Feb 2020 to Nov 2020

Finally, when market turns around, this strategy begins to show some truth. LOL!

Saturday, 14 November 2020

Financially Me, It is about Earning, Spending, Saving and Investing (4)

Hi Jacob,

I came across your blog and saw that you have successfully have your financial freedom. I was really curious how you did that as I was hoping for myself to successfully have financial freedom at age 55.

Hope that I can hear from you. :)

----------------------------------------------------------

Read? Financially Me, It is about Earning, Spending, Saving and Investing (3)

Read? Who Are My Trainers in Financial Education?

Read? More posts relating to NLB books

Thursday, 12 November 2020

Property price will rise!!!

Read? Singaporeans snap up properties during worst ever recession

"I know the price will rise", said the 32-year-old, who has spent nearly a decade working in real estate.

Some buyers like Jenny Lin, a 26-year-old accountant, have viewed the pandemic as an opportunity to get on the ladder of the world's third most expensive housing market after Hong Kong and Munich, according to property consultant CBRE.

War Chest As Calibrator To Regulate Cash Flow Across Market And Economics Cycle During Retirement (2)

Read? War Chest As Calibrator To Regulate Cash Flow Across Market And Economics Cycle During Retirement

During good time, we may kpkb our cash in war chest is rotting and earning near zero ROC!

But, when time turned really bad and dividends are cut then only we know What If I have ....

DBS XD today so total dividend income for 2020 is known!

Tuesday, 10 November 2020

Monday, 9 November 2020

Dow rallies more than 5% to a record high as Pfizer says Covid-19 vaccine is more than 90% effective

Stocks rallied to record levels on Monday as investors cheered trial data from drugmakers Pfizer and BioNTech indicating their Covid-19 vaccine is more than 90% effective.

The Dow Jones Industrial Average traded 1,563 points higher at the open, or 5.5% and hit an all-time high. The S&P 500 also reached a record, popping 3.7%. The Nasdaq Composite was the relative underperformer, trading 1.3% higher. The small-cap Russell 2000 index gained 4.6%.

The announcement was seen on Wall Street as a sign that the pharmaceutical industry may soon have a viable way to control a disease that has derailed the U.S. economy for much of 2020 and has killed more than 230,000 Americans

-----------------------------------

Hmm ... tomorrow morning STI also cheers?

Saturday, 7 November 2020

CASH REFUNDS FOR CPF SAVINGS USED FOR PROPERTY PURCHASES. (4)

Read? CASH REFUNDS FOR CPF SAVINGS USED FOR PROPERTY PURCHASES. (3)

Real CPF member. Real conversation!

In the financial and investment blogosphere; we always hear Top up CPF to secure our retirement plan, 1M65, 4M65, blah blah!

He is 47 and already fully met FRS in his SA and has no intention to sell or downgrade his residential condo home. He will be taking less talk about which is BRS!

Both, couple will be taking BRS and pledge their property!

For one simple reason.

Why let Government control your money and pay you back in monthly instalments from 65?

My money. Okay!

They want to have better control over their own money and decide how best to use it for whatever reasons e.g. better health and medical care!

LOL!

No snake oil so real life and true heart conversation with Uncle8888! We are all different! Ha Ha!

Data point of one? Think it should be more data points out there!

You have fully met FRS and has fully paid up residential property and no intention to sell. FRS or BRS?

No right or wrong! LOL!

Friday, 6 November 2020

if you take a 1 billion yuan loan, you are not scared at all, the bank is

In that speech, apart from labeling the global banking Basel Accords as an “old people’s club,” Ma said “systemic risk” is not the issue in China. Rather, China’s biggest risk is that it “lacks a financial ecosystem.” Chinese banks are like “pawn shops”, where collateral and guarantees are the hard currencies. As a result, some decided to go so big they are not allowed to fail. “As the Chinese like to say, if you borrow 100,000 yuan from the bank, you are a bit scared; if you borrow a million yuan, both you and the bank are a little nervous; but if you take a 1 billion yuan loan, you are not scared at all, the bank is,” Ma said.

--------------------------------

CW8888

When Ant goes globally and has 1 billion borrowers who can't pay back. Now who will be scared har???

Thursday, 5 November 2020

DBS : Buy and Hold vs Trading on Core Position (2)

Read? DBS : Buy and Hold vs Trading on Core Position

DBS Q3 2020 at $0.18

After Point X, Uncle8888 has been doing BOTH i.e. Buy & Hold long-term for Golden Eggs and trading short-term for daily or monthly allowances without fear of losing his hard earned savings.

Stocks only go up?

After Point X, possible?

Wednesday, 4 November 2020

How Much Can Current CPF OA1M65 Survive In Singapore?

Despite this, Mr Zaqy asked Dr Lim to spell out WP's minimum wage standards.

"Could I just confirm once again that the Workers' Party's S$1,300 minimum wage benchmark is gross income so that we could settle this and come to an understanding?" he said.

Dr Lim at first said that was correct and a "fair characterisation", but later said that WP's stand was for the S$1,300 minimum wage to mean take-home pay.

----------------------------------------------------------------------------------

Hmm ... based on WP's definition of minimum wage of $1.3K take-home pay!

Present batch of CPF OA1M65 in 2021/2022 can depend on passive income from their CPF up to 3 times of minimum wage from 65 to 88

CPF OA initial withdrawal at 4.5% giving $3.8K per month and adjust for yearly inflation at 2.5% from 65 to 88 i.e. $6.5K per month!

CPF RA and MA used for medical care!

Even CPF Millionaire couples are living slightly above the minimum wage baseline if they don't have other sources of retirement income other than CPF. So can we still don't invest to build up investment income for life when we are much younger?

Think, think and think!

Tuesday, 3 November 2020

Sunday, 1 November 2020

Create Wealth From Long-term Investing and Short-term Trading (2)

Read? Create Wealth From Long-term Investing and Short-term Trading

Read? Touchstone or Sardine?

Since COVID-19, Uncle8888 has been searching for the next batch of Touchstone; but Sardine or Bloody stone can also be picked up! Uncle8888 is NOT investment Guru!

Bloody Stones - Pain in the Ass!!!

ComfortDelgro : Bought @ $2.01 (2)

Round 12 : Bought Olam @ $1.48

50-50 Bet On Temasek Not Walking Away

Sardines or Touchstone?

SGX @ 8.21, 8.48, 9.08 and 8.78

Keep buying and selling until One day down the road when Touchstones become too obvious to ignore!

It has been Buy, RIGHT, and hold for long term Panadols transforming to Golden Eggs after Point X like those pervious Touchstones!