Saturday 31 October 2020

Create Wealth From Long-term Investing and Short-term Trading

hyom 31 October 2020 at 10:29:00 GMT+8

Createwealth8888,

Indeed! Got to live up to your blog's name.

With your wealth of experience in both long-term investing and short-term trading, which one do you think is more profitable?

Delete

Why this blog was named as Create Wealth From Long-term Investing and Short-term Trading?

Sunday, 19 November 2006

Read? The journal begins ...

Uncle8888 started this journey to pursue FI and get out of rat race from Jan 2000 after reading this book Rich Dad. Poor Dad and very determined to get out of Rat Race and achieve FI by age 55 in 2011.

Read?Your Investment Portfolio is your Accelerator on the Road to Financial Independence!

This blog was started end of 2006 and STI Bull was charging towards Bull Peak in Oct 2007!

From 2003 onwards; Uncle8888 was investing and active contra trading genius! When he has enough working capital on hand he could consider to hold for long/wrong term! Otherwise; LL he had to take profits or cut losses! That is short-term trading. Right?

In Nov 2006 ..

Uncle8888's Mind is full of confidence that long-term investing for Panadols and short-term trading for kopi, lunches, dinners and even overseas travel expenses can be paid by Mr Market!

Both long-term investing and short-term trading were working together!

Create wealth through long-term investing and short-trading trading! Steady!

Read? Chasing the last $100K (last mile) and may fall hard!

CASH REFUNDS FOR CPF SAVINGS USED FOR PROPERTY PURCHASES. (3)

Read? CASH REFUNDS FOR CPF SAVINGS USED FOR PROPERTY PURCHASES. (2)

A shop assistant who is few weeks before reaching 55 and his real conversation with CPF 过来人

Assistant : Can I ask you sensitive question on CPF as I am reaching 55 in a few weeks. You are CPF 过来人 ?

Uncle8888: Of course, you can!

Blah blah ....

He is single and both parents had passed away and currently living in three room HDB with one room rented out. But, over the years; he doesn't like the "ma fan" with tenants and thinking of downgrading to 2 room HDB; but he heard that the money has to be refund back to CPF. He asked Uncle8888 chun bo?

He said he doesn't bother to read on CPF and also didn't bother to attend zoom session with CPF on "Reaching 55 session".

Ask CPF 过来人 better!

Walau!

1. He doesn't invest and unlikely to invest too!

2. He is not into digital! No PayNow! Counting paper money best!

3. He has few FDs with banks!

4. As shop assistant, he works over weekends and long hours! The shop only closes for 5 days during CNY! i.e. 360 workdays with leaves and rest days in the weekdays!

Uncel8888 broke the news of Best 55th Birthday Present from CPF; but he got a few weeks to seriously about it before reaching 55 to get the current saving rate in Singapore!

CPF after 55 is his best saving bank in Singapore! His eyes open wide and looking at Uncle8888 like Chun Bo?

First thing first. Ask him to get a PayNow and will receive his money from CPF after 55 within 10 seconds!

Before the clock strikes at midnight at 55; he can consider refunding any amount of his housing loan back to CPF and treat it as his saving bank to earn the best rate now and any time; he can withdraw the refunded money!

BTW, he also doesn't bother with what is 4% compound interest in CPF SA and NOT so interest CALCULATIVE! LOL!

Probably; he is a simple man with simple needs and works long hours and so left with little energy and time to think too much!

Too much time on hand; we may tend to think and worry too much! True right?

Hmm .. should CPF sponsor Uncle8888 with T-shirt : Ask Me Anything on CPF! LOL!

Friday 30 October 2020

DBS : Buy and Hold vs Trading on Core Position

The data point of one!

This is not Back testing on digital data!

It is real retail investor and with real money on the table!

Buy, RIGHT and hold!

It is not right to anyhow poke buy and hold investors!

Realized gains from stocks only go up! LOL!

Buy, RIGHT and hold over 18 yrs

Average yearly ROC is about 20% p.a

Even if DBS stock price crashes to $10 over the next five years; average yearly ROC with future dividends is likely to be more than 9% p.a. over 23 yrs

How about trading on one's core position?

What is the Moral of the Story behind this data point of one?

Don't anyhow poke at buy & hold and those who are still waiting for the next big market crash like AFC, Sep 11, SARS, and GFC!

Thursday 29 October 2020

Dow sinks more than 900 points for its worst drop since June amid rising virus cases globally. Will STI panic and down -3%???

U.S. stocks fell sharply on Wednesday amid concerns over the latest increase in coronavirus infections and its potential impact on the global economy.

The Dow Jones Industrial Average dropped 943.24 points, or 3.4%, to 26,519.95, posting its fourth straight negative session. The S&P 500 slid 3.5%, or 119.65 points, to 3,271.03, while the Nasdaq Composite fell 3.7%, or 426.48 points, to 11,004.87. The Dow and the S&P 500 both suffered their worst day since June 11.

Wednesday 28 October 2020

DBS Bank Is Planning to Launch a Digital Asset Exchange

Read? DBS Bank Is Planning to Launch a Digital Asset Exchange

Like that; can say Uncle8888 also has one toe in this Bitcoin craze through his long-term 2-bagger DBS holding since 2003???

Tuesday 27 October 2020

STI No Panic Selling

Dow closes 650 points lower, as concerns mount over rise in coronavirus infections

STI steady!

Show Uncle DOW your Ball!

Sunday 25 October 2020

When Your Bank RM Called??? (3)

Read? When Your Bank RM Called??? (2)

Spur 24 October 2020 at 21:46:00 GMT+8

Hi Uncle8888,

The interesting part is the 2 statements of the "Disclaimer" in very fine print. ;)

---------------------------------------------------------------------------------

Read? Singapore Three Month Interbank Rate1995-2020 Data

After 55, money in CPF is Uncle8888 Best Saving Bank while money in POSB is his Worst Saving Bank.

To continue leaving extra cash in his Worst Saving Bank or having 27% more fixed income on top of his CPF RSS since the gross return is same as 2.5% CPF OA CAGR?

In the worst case; just redeem the $144K loan and paid penalty. The penalty may or may not end up with cut losses after X or XX yrs.

Ant really thinking too much on Maths! LOL!

Saturday 24 October 2020

When Your Bank RM Called??? (2)

Saturday, 21 March 2015

Read? When Your Bank RM Called???

Wah! The last call from bank RM was 5 years ago!

This time, bank RM introduced him Premium Financing to increase his retirement income by leveraging on the next decade of possible lower interests rate environment of 1% to 3%.

Gross XIRR over 20 years Annuity Plan is 2.5% CAGR without leverage!

2.5% CAGR is comparable to CPF OA! Decent return for fixed income with death benefits. Right?

Time to take advantage of low interest rate environment and leverage up?

Thursday 22 October 2020

Wednesday 21 October 2020

More CPF top-ups, people below 35 saving for retirement: CPF

Read? More CPF top-ups, people below 35 saving for retirement: CPF

CW8888 : SA/RA 4% compound interest is too juicy to ignore.

SINGAPORE: More people made top-ups to their Central Provident Fund (CPF) accounts despite the challenging economic conditions this year, including a growing number of first-timers and young adults.

The CPF Board said in a news release on Wednesday (Oct 21) that more than 198,000 top-ups were made under the Retirement Sum Topping-Up scheme between January and September, an increase of 34 per cent from the same period last year.

The top-ups amounted to S$1.81 billion, up 23 per cent from the same period last year.

There were close to 148,000 top-ups totalling S$1.47 billion during the January to September period in 2019.

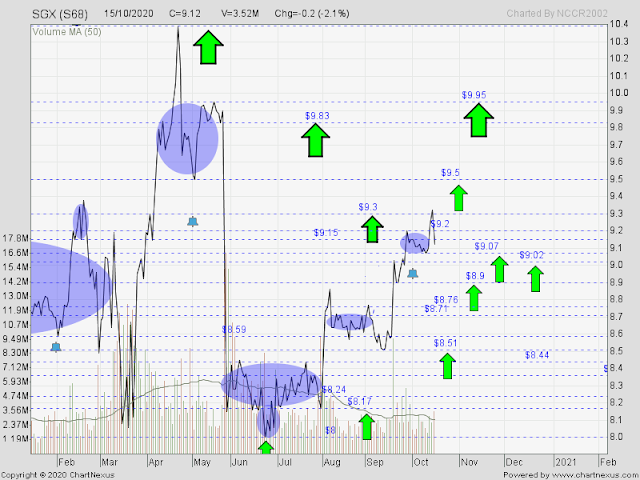

SGX : Bought Back @ $9.08 for Round 7-1

Read? SGX : Partial Sold @ $9.28 for Round 5-2

Round 5 - 2 : ROC +9.1%, 112 days, B $8.48 S $9.28

Round 5 - 1 : ROC +5.9%, 102 days, B $8.48 S $9.01

Round 4 : ROC +8.5%, 6 days, B $8.01 S $8.74

Round 3 : ROC +8.8%, 12 days, B $8.21 S $8.99

Round 2 : ROC +13.6%, 3 days, B $7.46 S $8.52

Round 1 : ROC +12.3%, 61 days, B $6.87 S $7.76

Sunday 18 October 2020

I am on Retirement Sum Scheme (RSS) (4)

Read? I am on Retirement Sum Scheme (RSS) (3)

Does CPF RSS or CPF Life provide decent return on your forced savings for retirement?

Decent return on savings over 33 yrs?

Do we still hate or dislike CPF?

Stocks Only Go Up.

Read? Stocks Only Go Up. Wait!?

True la!

Stocks only go up!

You don't believe. You can go and check on those investment bloggers in Singapore Investment Blogosphere who have posted their Sep 20 month ending stocks investment performance charts.

What do you see from their charts?

Mostly, Over long term; stocks only go up!

True right?

So you know how to do to achieve that?

Saturday 17 October 2020

Quick! Which is Easier? Properties or Stocks? The Fisherman and The Investment Banker???

Read? Quick! Which is Easier? Properties or Stocks?

Read? The Fisherman and The Investment Banker

Quick! Which is Easier? Properties or Stocks?

Is the Moral of the Story same as the Fisherman and Investment Banker?

Fisherman started off fishing at jetty and continues catching small fishes (yearly dividend income not so impressive) as you can't catch big fishes at the Jetty!

While the Investment Banker making so much money and has huge capital to invest in stocks. His yearly dividend income is impressive 6 digits! $XXX,XXX

The Fisherman fishing at Jetty for small fishes while the Investment Banker fishing at his yacht for big fishes. Which is easier for you?

Properties, high income with high saving rate or stocks (TA, FA, or FATA)?

Thursday 15 October 2020

Tuesday 13 October 2020

DBS - Time in the market or Timing the Market?

Real retail investors on DBS.

Time in the market or timing the market? Either one also NOT easy to do!

Investor A

Ex-colleague: Heard you very good at investing?

blah blah

Ex-colleague: How is the market?

CW: Banks and properties are cheonging! DBS at record high!

Ex-colleague: Sianz! I sold my DBS @ $14+

blah blah

CW: I am still holding some DBS bought at $7+ since SARS time.

blah blah

Ex-colleague : When are you going to teach me how to make money?

Monday 12 October 2020

How Do We Know Or Feel The Financial Impact/Burden Of Yearly Inflation After Two Decades Of Inflation??? (3)

Saturday, 3 November 2018

Updated with two years of data points i.e. total 19 years of data points on household expenses

How to overcome yearly inflation?

NOT though investing!

It is through

Get married and have more children!

In your retirement phase; you may not feel the impact of yearly inflation when your children started working and you no longer need to support them financially. LOL!

Any proof?

Retirement sum for married couple with children is NOT same as single person!

See for yourself! LOL!

110km, five days, two reporters: CNA sets out to explore Singapore on foot

Read? 110km, five days, two reporters: CNA sets out to explore Singapore on foot

Ha Ha! Nice!

Hope that more local walkers joining to walk one round the coast of Singapore!

SINGAPORE: "It's really no big deal," insisted my editor as we made what we thought was an entirely reasonable request to cycle rather than walk 110km on a journey to explore Singapore.

His justification for making us walk? Cycling the route wouldn't give me and my fellow journalist Gaya Chandramohan the time to savour the sights of Singapore - which is the point of this somewhat unusual assignment.

(CW8888: Walking allows us to pause anytime along the way to have real close look at any things that attract our attention.)

Our discussions initially centred around doing a complete loop of Singapore, sticking as close to the coast as possible. However, logistically this would prove to be a bit of a challenge, and so we decided to scale down sections of the route. (CW8888 : No worry lah! There are bus services even along ulu areas in Singapore! You can take whichever bus to next makan place for lunch or dinner! DON'T forget your TransitLink card!)

We've included some of Singapore's best sights along the coast - so West Coast and East Coast parks, Coney Island and Sungei Buloh nature reserve should feature prominently along our journey.

At the same time, we'll also be making it a point to try our best to savour the journey, so there should be stops at some of Singapore's most beloved foodie haunts - East Coast Lagoon food village, Hong Lim market and food centre among other places.

Our plan is put up in hotels as close as possible to the route, before continuing on our journey the next day.

A WALK TO REMEMBER

My colleague Gaya and I are by no means in great physical shape.

Full disclosure, the loop covers more ground than I've run this year. In fact, the last time I've covered a distance more than 20km was a decade ago when I wore green, carried a field pack and swore never to do it again.

But here we are, and because passing out on camera is not an option, I have been going on a number of walks in preparation. These walks took me from my home in Simei to East Coast and Changi Village - covering a distance 15km each time.

There is undoubtedly a sense of accomplishment that comes with completing each of these walks, and there is an element of enjoyment, even for somebody who is not an avid walker.

But we're well aware of the challenges that could lie en route. For one, the sweltering heat could potentially be a problem - we aim to begin each leg of the journey at 6am every morning and try to beat the afternoon heat by completing the distance for the day within eight hours.

There are also practical concerns - plotting out a course online and actually navigating the route in reality are two completely different things.

Also, what if there are no toilets? (CW8888: Not an issue. Whenever you come across the next toilet after sometime; visit it. LOL!) (If real urgent; hide behind the bush)

But this is part of the adventure, which we will be updating you regularly on over the next 5 days.

And we will press on, and welcome any and all suggestions on what we can do on the way. Hopefully our walk will be able to pique your interest to get out there and explore.

To quote poet T.S. Eliot: “We shall not cease from exploration, and the end of all our exploring will be to arrive where we started and know the place for the first time.”

In our case, that place would be Taman Jurong Hawker Centre.

(CW8888: Remember to watch out pack of wild/house dogs along quiet road of Lim Chu Kang. These dogs probably don't often people walking along the road towards them. From far; Uncle8888 saw them; cross the road to opposite side to avoid walking pass the dogs and his long umbrella ready to fight and defend against a pack of dogs. Bo pian! Dogs barking non-stop. One big brother dog wanted to cross the road to chase Uncle8888 but stopped when it heard an ongoing car approaching it!)

Sunday 11 October 2020

Saturday 10 October 2020

Investing Your CPFIS - Not So Easy!

Read? New CPFIS fee caps should mean better investment outcomes

Over $27B in 2008 and under $17B in Q2 2020.

A drastic drop of more than 37% despites CPF member balances have grown significantly!

Probably; more and more CPFIS investors learnt through hard investing lesson. It is NOT easy to beat 2.5% compounding interests over market cycles!

Read? What you will never hear at any investment seminars?

Depending on Investment Portfolio As Retirement Income - Next Year May Be Hit Harder!

Next year, those have dividend income coming from our three local banks may be hit harder with full year impact of dividend cap imposed by MAS! Sianz!

Uncle8888 has to plan ahead! More trading income and more deployment of war chest in 2021!

COVID-19 teaches real life FIRE lesson on investment income.

What can actually happen! Even part-timers and free-lancers can lose lose their jobs!

Thursday 8 October 2020

Tuesday 6 October 2020

Sunday 4 October 2020

DBS : ONE STEP CLOSER TO SGD 6.00 (2)

Read? DBS : ONE STEP CLOSER TO SGD 6.00 (and followers paid subscription $$$ to follow this step closer to $6. LOL!)

Read? Round 24 - 1 : Bought back @ $19.68

or one step closer to $21?

Saturday 3 October 2020

Financially Me, It is about Earning, Spending, Saving and Investing (3)

Read? Financially Me, It is about Earning, Spending, Saving and Investing (2)

Read? Your Investment Portfolio is your Accelerator on the Road to Financial Independence!

Sound like broken Word Repeater!

The road to FI, FIRE or Semi or Full Retirement is NOT just based on our investing skills and starting as early as possible. How much capital we can inject periodically always matter!

When you look at Uncle8888's investment portfolio after 21 years without a single cent of capital injection since inception of investment portfolio in Jan 2000. It is flat! He was kiasi since 2000 as he thought that as single household income with five mouths to feed; he could not afford to lose any more money down the road as household expenses were expected to increase and retrenchment was always few years ahead of him! Sigh!

No uptrend compounding investment portfolio like we often see in long-term investment portfolio articles found in investment cyberspace! Super sianz!

Thursday 1 October 2020

Financially Me, It is about Earning, Spending, Saving and Investing (2)

Read? Financially Me, It is about Earning, Spending, Saving and Investing

The investment portfolio performance outcome after 21 years of long-term investing and short-term trading across market cycles from Jan 2000 to Sep 2020.

Sigh!

He didn't make $1M from the stock market! Sianz!

Bagus!

Blame himself for NOT taking up investment courses and be guided by "Gurus" to become Millionaire from stock market and FIRE???