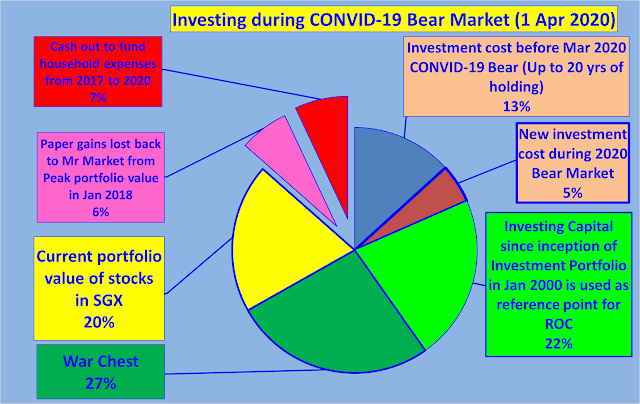

CW8888: Unprecedented craziness in the market and anything could happen can happen! Never say NEVER in the market.

Read? An oil futures contract expiring Tuesday went negative in bizarre move showing a demand collapse

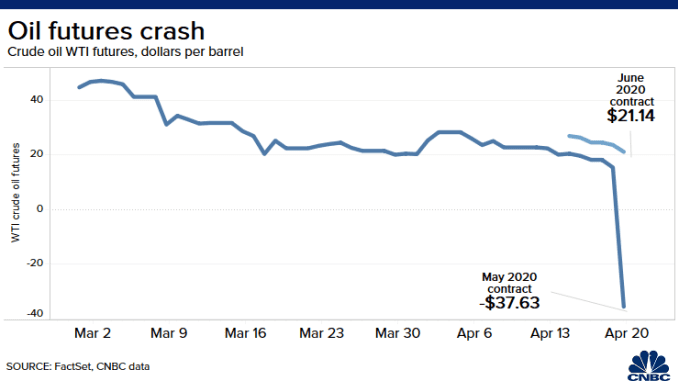

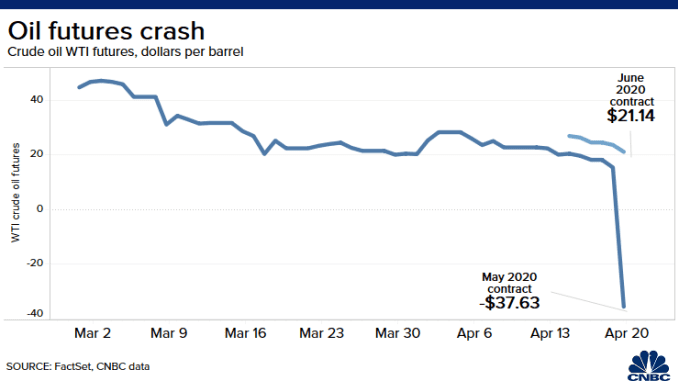

A futures contract for U.S. crude prices dropped more than 100% and turned negative for the first time in history on Monday, showing just how much demand has collapsed due to the coronavirus pandemic.

But traders cautioned that this collapse into negative territory was not reflective of the true reality in the beaten-up oil market. The price of the nearest oil futures contract, which expires Tuesday, detached from later month futures contracts, which continued to trade above $20 per barrel.

West Texas Intermediate crude for May delivery fell more than 100% to settle at negative $37.63 per barrel, meaning producers would pay traders to take the oil off their hands.

This negative price has never happened before for an oil futures contract. Futures contracts trade by the month. The June WTI contract, which expires on May 19, fell about 18% to settle at $20.43 per barrel. This contract, which was more actively traded, is a better reflection of the reality in the oil market. The July contract was roughly 11% lower at $26.18 per barrel.

The international benchmark, Brent crude, which has already rolled to the June contract, settled 8.9% lower at $25.57 per barrel.