Read? Stock futures are flat following a historic rebound as massive stimulus deal nears

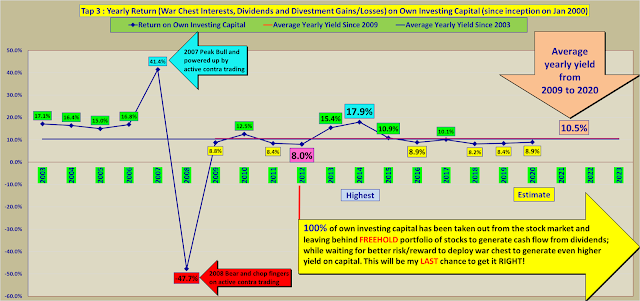

CW8888 : Craziness in the market and madness of Fear, Greed, FOMO and In Cash I am relief!

Stock futures were flat in overnight trading, following Tuesday’s historic rally, as investors awaited an unprecedented stimulus package to combat the economic impact of the coronavirus.

Futures on the Dow Jones Industrial Average climbed about 30 points. The S&P 500 futures were little changed.

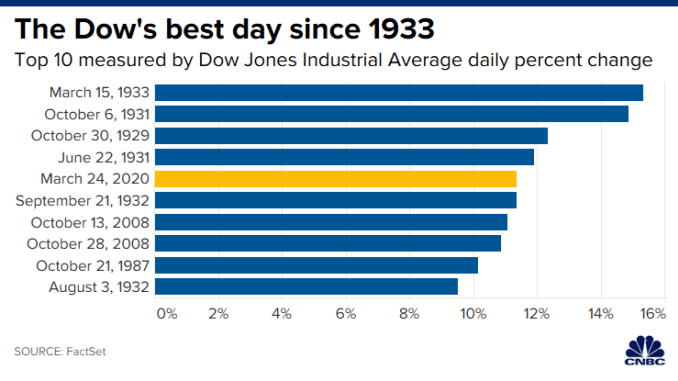

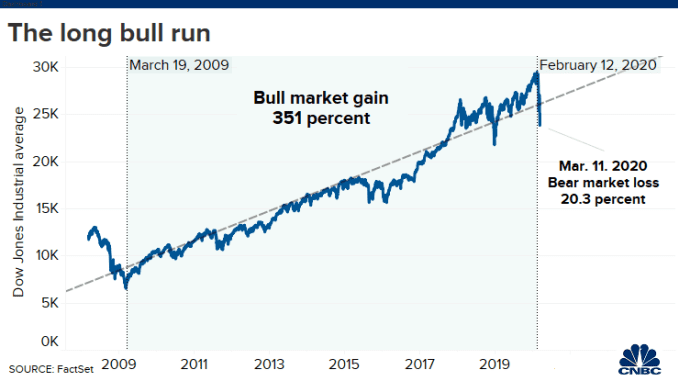

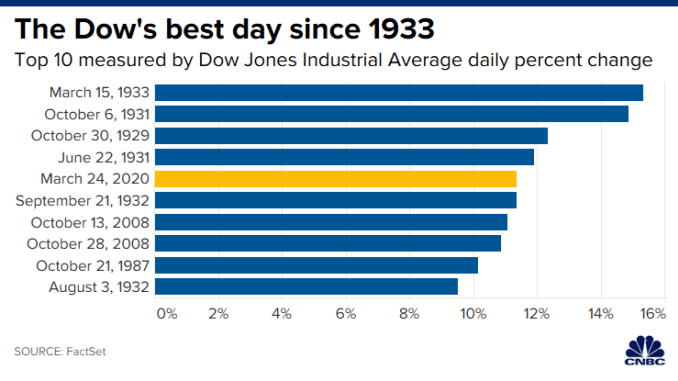

The action in the futures market followed an epic comeback on Wall Street. The Dow soared more than 2,100 points, or more than 11%, notching its biggest one-day percentage gain since 1933 and its best point increase ever. The S&P 500 rallied 9.4% for its best day since October 2008.

Even with Tuesday’s massive rebound, some on Wall Street struggle to see the light at the end of the tunnel, especially without a clear sign that the coronavirus outbreak will be contained soon.

“This was a one-day bull market,” CNBC’s Jim Cramer said on “Closing Bell” on Tuesday. “You had stocks that moved so much they basically moved as if the second half of the year is going to be good. I struggle to find out why the second half of the year should be good ...I hate this kind of rally. This was a machine driven rally, just like the sell-offs … I want to wait to see.”

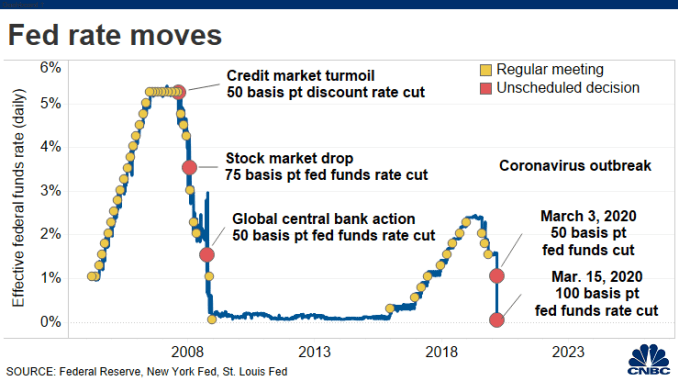

Lawmakers were closing in on a massive fiscal stimulus bill worth $2 trillion to blunt the economic damage from the pandemic, but talks could stretch into Wednesday morning as the two parties continued to work through the text and hash out final details.

House Speaker Nancy Pelosi told CNBC on Tuesday morning that there is “real optimism” Congress can clinch a pact within a few hours. Senate Majority Leader Mitch McConnell later said the bill is at the “five-yard line.”

Meanwhile, the coronavirus cases in the U.S. and globally still haven’t shown a sign of peaking. More than 400,000 cases have been confirmed worldwide, including over 50,000 in the U.S., according to Johns Hopkins University. So far, more than 600 deaths related to the coronavirus have been confirmed in the U.S. New York City reported nearly 15,000 cases Tuesday and 131 related deaths.

— CNBC’s Jesse Pound contributed reporting.