Saturday, 30 April 2022

Earned Income After Tax vs Net Investment Gains

Take Risks : Investment Portfolio Management And Position Sizing

Read? Take Risks

Yes! Especially true for investing strategies!

Winners lead!

Losers guide!

Position sizing is critical for winners to lead and losers to guide to stay alive in the market!

See losers chopped fingers and NOT guide!

Read? Do You Know Any Mederka Generation Relatives Who Don't Talk About Market Any More???

Dow tumbles more than 900 points and the Nasdaq drops 4% on Friday to close out a brutal month

Sell in May and Go Away started???

In local market SGX; it is Collect dividends in May and Go away sucking Panadols!

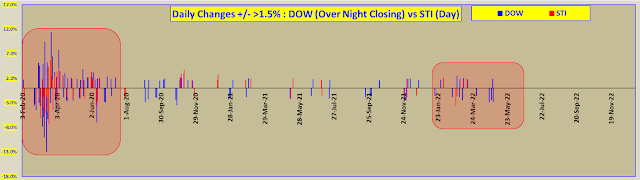

It looked like STI doesn't follow DOW volatility liao!

Thursday, 28 April 2022

Panda's Investment Portfolio Hits A New All Time High Record With 3-Bagger Portfolio In An Uninspiring And Boring SG Stock Market! (14)

Uncle8888's Three Little Pigs are taking their turn to dance to new 52WH to power up his portfolio to new ATH! Shiok! Sector rotation in play really help!

Kep Corp shiok! Today XD @ $0.21 and then up another $0.20. Total $0.41. It really helped to push portfolio to new ATH @ 207%

A new ATH from 188%, 189%, 191%, 193%, 196%, 198% ,199% , 201% , 202% , 204% and 207%!

When will be the Party music ends???

Wednesday, 27 April 2022

Sunday, 24 April 2022

What Wrong With Yield Pig???

Read? 10% dividend yield for 10 years? Fact or Fiction? (2) - updated after 9 yrs!

Read? Three Little Pigs In The Stock Market - Part 3

Next week, SCI XD on 26/4 and Kep Corp XD on 28/4 for 2022H1.

Looking forward to add more passive income in 2022 H2 as yield pig!

Saturday, 23 April 2022

Dow plunges more than 900 points for its worst day since 2020, falls for a fourth straight week

Stocks plunged on Friday, with the Dow Jones Industrial Average suffering its worst one-day loss since the throes of the pandemic, as the latest raft of corporate earnings and the prospect of rising rates spurred a wave of selling.

The Dow fell 981.36 points, or 2.8%, to 33,811.40. The S&P 500 was 2.8% lower at 4,271.78, for its worst day since March. The Nasdaq Composite declined by 2.6% to 12,839.29. Friday’s loss was the biggest for the Dow since Oct. 28, 2020.

UnitedHealth fell more than 3%, shaving more than 100 points off the Dow. Caterpillar also took out nearly 100 points from the 30-stock average, dropping 6.6% on the day. Goldman Sachs, Home Depot and Visa were also big downside contributors.

Those losses put the Dow down 1.9% for the week, its fourth straight weekly decline and its ninth losing week of the last 11. The S&P 500 posted a 2.8% weekly loss, marking its third straight one-week decline. The Nasdaq was the laggard this week, losing 3.8%.

-----------------------------------------------------------

Will uninspiring STI follow Uncle DOW big fall on Monday?

How many will panic selling or shorting?

Friday, 22 April 2022

Panda's Investment Portfolio Hits A New All Time High Record With 3-Bagger Portfolio In An Uninspiring And Boring SG Stock Market! (13)

Monday, 28 March 2022

Read?My Three Little Pigs : Kep Corp, Sembcorp Ind and DBS

After resting for 26 days; Panda is back to dancing to a new ATH @ 204%! This time banks are down; but Corpses are rising high!

Uncle8888's Three Little Pigs are taking their turn to dance to new 52WH to power up his portfolio to new ATH! Shiok! Sector rotation in play really help!

A new ATH from 188%, 189%, 191%, 193%, 196%, 198% ,199% , 201% , 202% and 204%!

Saturday, 16 April 2022

Investing Is A Tale Or Story Of Hindsight Wisdom, Regret And Sorry??? (2)

Read? Investing Is A Tale Or Story Of Hindsight Wisdom, Regret And Sorry???

Read? 5 Worst-Performing Straits Times Index Stocks Over the Past 10 Years

Uncle8888 smiled when he read 5. Keppel Corp: -11.4%

Finally, in fifth place is Keppel Corporation (SGX: BN4), the Singapore-based conglomerate that has interests in property, infrastructure and offshore & marine businesses.

Over the past 10 years, Keppel shares have delivered a total return of -11.4%.

During the 2010s, its offshore & marine segment was hit hard as oil prices plummeted in the middle of the decade.

See lah! It shows that investing is tale or story of hindsight wisdom, regret or sorry!

If we changed the time frame of Kep Corp to over past 20 years; then buy and hold over long term becomes buy and freehold - investment income for life!

Read? One Day; I Will Breakeven!

Friday, 15 April 2022

Investing Is A Tale Or Story Of Hindsight Wisdom, Regret And Sorry???

Olam and SML right issues at that time; Uncle8888 was like ....

WTF to throw more good money at bad money!

TemaSICK again!!!

Wednesday, 13 April 2022

Sunday, 10 April 2022

DBS : Passive (Buy and Freehold) for passive income vs Active (Trading on Core position) for cash flow?

Read? On why sound investing principles will always work??? (2)

Time to sell DBS if you happen to follow that forum on DBS crashing to $6 by the Guru?

Your entry price for that position matters the most and there after you have options to be active cum passive on core position and that is why we MUST buy slowly when market started going down and crash and recover.

Buy and Freehold on dividends paying blue chips are more relaxing and assuring that some income will flow into our bank accounts especially when we are retirees.

Trading on core is NOT easy as there is no sure formula. Hmm .. Okay if you believe in those investing or trading ads telling you winning formula on their methods. Go for them as course fee is cheaper than your losses! LOL!

Read? DBS: Bought Back For Round 30 @ 31.88

Saturday, 9 April 2022

Thursday, 7 April 2022

Saturday, 2 April 2022

How To Know Our Financial Independence Number And 4% Withdrawal Rule?

Read? What Next After Reaching the EDGE of Financial Independence???

Uncle8888 based on his tracking of annual household expenses to derive the number to reach Financial Independence with 4% Withdrawal rule. i.e. FI = Net worth assets excluding residential home = 25 x Highest household expenses tracked since 2002!

Somehow SARS and COVID soften the FI number based on 4% withdrawal rule. We can expect more such virus in the coming decades!