Thursday 30 June 2022

Tuesday 28 June 2022

Better Know The Difference Between 1M65 And 4M65 - Real Wealth In CPF vs Illusionary 4M65 Wealth In The Market Depending On Market Timing

Uncle8888 learnt first hand through Crash got Sound when he was reaching 55!

Same same!

It happened to Uncle8888 when he was near 55! So what is stopping Mr Market from repeating History when you are reaching 65!

1M65 is real wealth in CPF; but 4M65 through investing in the market is an illusionary wealth depending on market timing; so we better be lucky to survive through market cycles to cash out and keep it safe or return 4M back to CPF for real 4M65 when we are nearer to 65!

Long, long ago, in his late 40s; his long time FA shared this CPF SA hack (or he was actually hacked); and of course he would believe in good story of maximizing his SA and RA 4% compound interests; and invested $100K from CPF SA in XXX Global Balanced Fund!

Global Balanced Fund should closely match 4% CPF SA risk free return. Right? Don't ever believe projected return!

Hmm .. Uncle8888 was once also into passive investing! LOL!

May be Uncle8888 is just unlucky as this XXX Global balanced fund happened to go through GFC; but when it started to recover he was nearer to 55 and decided it was time be realistic that it is NOT easy to beat 4% year on year compounded interests in CPF SA or CPF RA. He sold this fund and refund back to CPF SA.

Happy lor as there is net profit after GFC Big Bear ....

Read? Turning 55 Soon? Here's A CPF Special Account Hack You'd Want To Know!

Sunday 26 June 2022

Timing Is Everything. Yes?

Read? Timing Is Everything. No?

Really true even in investment training space. Timing is everything and when timing turned sour or bad then trouble begins!

Those days when Uncle8888 started serious attentions into into Market - Option trading for passive income was so hot! Big option trading booths especially Freely School Of Options Trading at investment seminars giving out door gifts at the main entrance. Shiok!

Read? Smart Money Grabbers over dummy investors (9) - Mai siao siao. Course conducted by Dr.

Read? MAS: Don't trade in binary options on unregulated platforms

Read? Smart Money Grabbers over dummy investors - III

Actually; Uncle8888 likes to attend these free previews if they provide free makan. Why not when he has plenty of free time and no additional transport cost to these venues as he is on monthly pass.

Read? No selling free investment webinar

Timing is everything even in investment training space.

Right timing to sell hot courses.

From option trading to value/growth investing, passive income/from S-REITs, not enough capital to build retirement income from S-REITs? Don't worry. Just leverage up!

Then S-Reits to Crypto and soon back to pivoting to growth investing?

Timing Is Everything. Yes or No?

Saturday 25 June 2022

Dow rallies 800 points on Friday to cap big comeback week for stocks

The Dow Jones Industrial Average rallied more than 800 points on Friday, rebounding off the lows of the bear market last week and capping its first weekly advance since May.

The Dow rose 823.32 points, or 2.68%, to 31,500.68, with gains accelerating in the final hour of trading. The S&P 500 was 3.06% higher to 3,911.74. The Nasdaq Composite advanced 3.34% to 11,607.62.

The major averages wrapped up a big comeback week for stocks. The S&P 500 is up nearly 6.5% for the week, while the Nasdaq Composite gained 7.5%. The Dow is 5.4% higher.

Friday 24 June 2022

S- REITs As Retirement Income For Cash Tight Retirees??? (2)

Read? S- REITs As Retirement Income For Cash Tight Retirees???

Probably; Uncle8888 is the odd Panda/Koala retiree in Singapore who is dis-interested in accumulating S-REITs as retirement income and still able to survive from dividend income generated from his Panda/Koala portfolio across market cycles.

Monday 20 June 2022

One Real Life Data Point Of CPF SA Shielding Immediate Outcome

Read? CPF Special Account (SA) Shielding: How You Can Perform This

Uncle8888's ex colleague who turned 55 this year did CPF SA shielding with his FA; and after 55 he sold his CPF SA shielding fund and returned the money back to his CPF SA.

His immediate loss from this SA shielding is -2.7%.

Never mind! It just needed 2 years of additional 1.5% in CPF SA to recover this loss and; then from 57 yrs old onwards; every year gets additional $2K interests! Shiok!

Help me! I am still losing money in my Investment Quadrant (6)

Read? Help me! I am still losing money in my Investment Quadrant (5)

"We don't need to win back in the same manner that we have lost it " - Createwealth8888.

Hmm .. OK OK! Applicable only in ....

DIY individual stock pick and not in Fund/ETF/Unit Trusts!

Sunday 19 June 2022

From Sunshine Boy In The Old Days To Modern Sunshine Boys. Who Are They Now???

Read? The Shoeshine Boy

Read? Smart Money Grabbers over dummy investors (9)

In 2005 to 2008; the shoeshine boys in the Gurus space was passive income through option trading?

In 2018 to 2021; high yield as passive income from crypto?

Another space to watch : When Gurus started one by one switching their secret sauce or magical formula to get rich in order not to lose out revenues from Bei Kambing or when your favourite bloggers also switch their long held strategies that made them money to latest FOMO. Double confirmation to get out!!! LOL!

E.g. From value investing to option trading, from S-REITSs to Crypto

It is time to cut down or get out???

Uncle8888 as veteran also behaves as Bei Kambing in HK Tech! FOMO! KNS! His face kena hit by shit!

Read? Lion HST vs CSOP HS Tech (3)

Friday 17 June 2022

Round 10 : Bought ST Engg @ $3.88

Last sold on 3 May 2004 and that was donkey years and never has chance to buy back lower! :-(

Round 9 : ROC +19.6%, 355 days, B $1.62 S $1.95

Wednesday 15 June 2022

Tuesday 14 June 2022

Will Recession And Inflation Fear Overtake Omicron To The Next STI Crash?

Read? Sell In May And Go Away!

Let see how June 2022 ends and looking forward to suck more Panadols in H1 2022 dividend season!

Stock futures rise after the S&P 500 closes in an official bear market

U.S. stock futures rose on Monday night after the S&P 500 dropped back into bear market territory ahead of the Federal Reserve’s two-day policy meeting this week.

Dow Jones Industrial Average futures rose by 67 points, or 0.2%. S&P 500 and Nasdaq 100 futures climbed 0.3% and about 0.5%, respectively.

Those moves came after intense selling of stocks during the regular session on Wall Street. The S&P 500 slumped 3.9% to its lowest level since March 2021, and falling more than 21% from its January record.

Meanwhile, the Dow tumbled more than 876 points, or 2.8%, which is roughly 17% off its record high. The Nasdaq Composite dropped nearly 4.7%, or more than 33% off its November record.

Investors are bracing themselves for the possibility of a larger-than-expected interest rate hike this week after CNBC’s Steve Liesman confirmed on Monday that the Federal Reserve will “likely” consider a 75-basis-point increase, which is greater than the 50-basis-point hike many traders had come to expect. The Wall Street Journal reported the story first.

Some investors are also expecting a more hawkish tone from the central bank after last week’s inflation reports showed prices running hotter-than-expected.

“I think they are going to do 75 basis points,” Ed Yardeni, president of Yardeni Research, said during CNBC’s “Closing Bell” on Monday.

“I think that Powell on Wednesday when he does his press conference will indicate that there’ll be another one coming at the July meeting and maybe another one at the September meeting. I think it’s time for him... to show that he really is concerned about inflation,” he continued.

Elsewhere, shares of Oracle jumped nearly 9% in extended trading after the software company reported an earnings beat boosted by a “major increase in demand” in its infrastructure cloud business.

Wall Street is also expecting the latest reading on the May producer price index on Tuesday before the bell at 8:30 a.m.

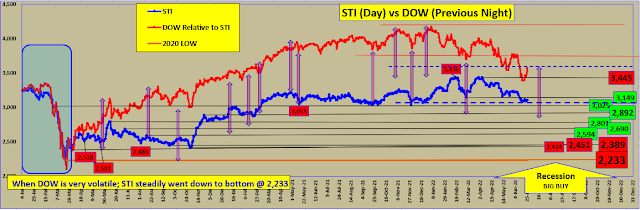

CW8888: Gap between DOW and STI is closing up to the next Bear?

Sunday 12 June 2022

How I Reduce The Impact From Inflation As Retiree With Plenty Of Spare Time And On B.M.W (Monthly Concessionary Pass)

mysecretinvestment11 June 2022 at 18:33:00 GMT+8

Nice one Spur!

"There is inflation in COEs, hawker centres and electricity bills

Deflation in stock markets

Confusion in investors"

What is a person to do?

Those who are working still can hope for salary adjustment but, but retirees?

Read? Inflation Rate At Kopitiam Is More Scary Than Headline Inflationary Rate

Hmm .. not all stalls at Kopitiam and Hawker centres raise their food price at the same inflation rate!

Uncle8888 as retiree with plenty spare time and on B.M.W monthly concessionary pass; he hunts around his area to check on food inflation rate and found out that inflation rate is not uniform across the board.

Mee siam : 1 bus stop West from his block and 7 mins walk from main street to less convenient? coffeshop. Price is $3.20 (Reduce inflation by $0.30)

Fish soup : 2 bus stops East from his block. Price is $5 (Reduce inflation by $1)

How I Avoid Negative Sequence of Return Risk In 2020 & 2022 With A Simple And Practical Strategy i.e. War Chest And Cash Reservoir!

Read? Three Years After Retiring From Full Time Monthly Salary As Employee (2)

Let it flows! Let it flows! Let it flows!

Don't bother with compounding growth as retiree! Enough is enough! Sustainable retirement income to ease emotional rides in volatile market.

Unrealized P/L in the portfolio is not Real; but realized cash flowing into Cash Reservoir is Real and cover future household expenses!

Every single cent flows into the Cash Reservoir and Uncle8888 has discovered this simple and practical strategy worked during COVID-19 crisis as retiree and likely to also work in future market cycles to avoid negative sequence of return risk.

Saturday 11 June 2022

Stocks crushed after inflation hits 40-year high: Nasdaq falls 3.5%, S&P 500 suffers worst week since January

Why rushing out of market to take profits or cut losses to fight inflation?

Gurus always tell us to stay invested to fight inflation??? How come like that? Stay in cash to fight inflation???

Monday. STI crashes 2%?

OK. OK! How Scary Is Inflation???

Friday 10 June 2022

Personal Inflation Rate and Market Inflation Rate (2)

Read? Personal Inflation Rate and Market Inflation Rate

6 years after retirement from an office job!

Personal inflationary impact on work-related expenses are zero so it is zero inflation rate. LOL!

1. Office wear : clothing and shoe

2. TGIF long lunches and office contributions, celebrations, get together etc

3. Two coffee breaks

Tuesday 7 June 2022

DBS : ONE STEP CLOSER TO SGD 6.00 (3)

From Investing cyberspace ...

命里無時,求之不來 ...$DBS(D05.SI)

床前明月光,疑是地上霜。

舉頭希望 37.00,低頭見 6.00

Uncle8888 never fail to smile whenever this Guru 低頭見 6.00 and recalled his ex-colleague's real wait for DBS $6 to happen in 2009. LOL!

Read? DBS : ONE STEP CLOSER TO SGD 6.00 (2)

1.5 to 2 times the force of GFC coming for DBS to go down to $6?

Read? The Secret Behind Buy And Hold And Then Laughing To The Bank Revealed! (2)

Buy back is not easy due to our last ACTION price anchoring bias! --> Read? On why sound investing principles will always work??? (2)

Sunday 5 June 2022

Practical And Realistic Investment Portfolio Allocation ? 60/40 for Bonds/Equities But No Cash Over Market Cycles. How Come Like That?

Gurus, Experts, FAs and those commercially compensated investment writers and products endorsement love to advocate bonds/equities XX%/XX% but NO cash! It is like saying Cash is really trash!!! No allocation!

Chun bo?

Cash is both Trash and King over market cycles! Really?

You decide to believe who say it?

Practical and realistic investment portfolio allocation over market cycles is Bonds or Bond-like (CPF for SG)/Equities/ Cash and CPFIS in XX% /XX% /XX% based on our own investment journey

Climbing Investing Mount Everest

1) Going up Mountain.

2) Near Mountain top and how about going down to Base Camp to stay safe before trying out Mountain top at the next season.

3) Going down Mountain to Base Camp to stay safe for a longer time before deciding whether it is worth to test the Mountain top one more time?

Thursday 2 June 2022

What Is The Real Number or Power Behind FI, FIRE or Retirement Income? Power Of Earned Income & Savings Vs Investing Power?

In Investing, your account size really matters - Createwealth8888

Uncle8888 will be shocked if the above is mentioned in any investing course preview seminar or talks!

Read? Investing Made Simple by Uncle8888 (17)

CPF OA Investment Account that 35% ceiling sucks???

From Forum : " CPF OA Investment Account (that 35% ceiling sucks, only can buy every 11/12th of the month"

Uncle8888 smiled!

Monday, 29 March 2010

Read?? Resident wants ban on CPF cash for investments He was 59 yrs old in 2010 so he kena from GFC with 35% cap on CPFIS!

Read? Do You Know Any Mederka Generation Relatives Who Don't Talk About Market Any More???

Read? Save more than 60%. No need to invest??? (5)

Read? Who Are CPF Members Who Lost Their Money???

Read? Luckily, Me in Merdeka Generation Didn't Start Younger To Invest/Speculate in My 30s During 1990s

Factually; CPF OA 65% at 2.5 % CAGR nd 35% CPFIS is already a good bond-like/stocks allocation liao!

If we are good at investing; 35% CPFIS can do wonder!