Wednesday 30 September 2020

4 Years Post-Retirement as Full-time Employee

Thursday, 29 September 2016

Read? Round The Coast Of Singapore Walking Trail (1)

4 years already!

Time passed so fast!

Sometime, Uncle8888 came across the similar places that he had walked or jog before and smiled at the image of a senior walking sometime under hot sun! LOL!

Uncle8888 started his retirement journey as Johnny Walker to keep himself occupied and also at that Pokemon Go was still hot in him. Catch Them All! Walk and Catch them!

After walking the coast of Singapore; he then continued to jog all the six Park Connectors! This is how he replaced his previous working time in office cubicle with walking and jogging time in the open space and quite often returning home at night! "Work" far longer hours than in office cubicle!

Read? Revamped Pang Sua Pond in Bukit Panjang reopens

Read? Retiring in Comfort in Singapore - Replacement Income

Financially, 4 years post-retirement

COVID-19 really validated the sustainable retirement income for life strategy - Three Taps Solution model with Cash Reservoir to minimize any asset draw-down or sequence risks during market low cycle !

Read? My All-Weather Income Streams As Singaporean Retiree

Monday 28 September 2020

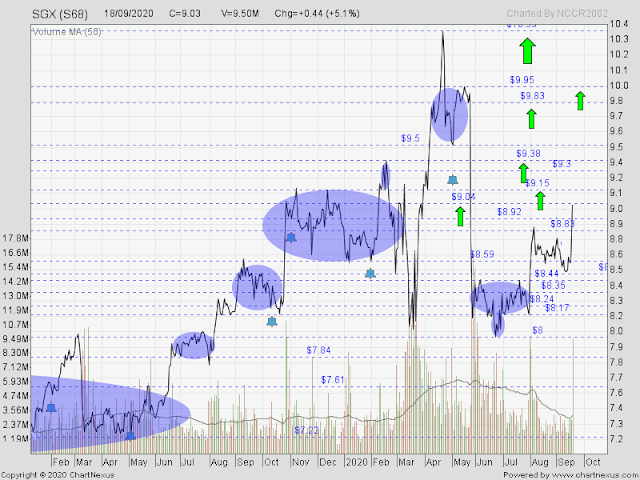

SGX : Partial Sold @ $9.28 for Round 5-2

Read? SGX : Partial Sold @ $9.01 for Round 5-1

Last highest sold is $9.01 in Round 5-1

Round 5 - 2 : ROC +9.1%, 112 days, B $8.48 S $9.28

Round 5 - 1 : ROC +5.9%, 102 days, B $8.48 S $9.01

Round 4 : ROC +8.5%, 6 days, B $8.01 S $8.74

Round 3 : ROC +8.8%, 12 days, B $8.21 S $8.99

Round 2 : ROC +13.6%, 3 days, B $7.46 S $8.52

Round 1 : ROC +12.3%, 61 days, B $6.87 S $7.76

DBS : ONE STEP CLOSER TO SGD 6.00

From Cyberspace ...

September 26, 2020, 23:30•

4.2K

ONE STEP CLOSER TO SGD 6.00

$DBS(D05.SI) ...OIL BAD DEBTS!

------------------------------------------------------------

LOL!

Real person. Real waiting for $6 in GFC!

Read? On why sound investing principles will always work???

Real People. Real Story on DBS!

This ex-colleague who was some time also Uncle8888's lunch kaki.

During GFC 2008/2009; he was very keen to invest bigger on DBS; but in Mar 2009 he was still waiting for DBS to reach $6 before accumulating slowly!

When the market recovered he regretted big time; but; he did learn important lesson on investing!

This time in Jan 2016; when DBS went below $15; he started to accumulate slowly using his CPF fund as he has already reached 55 (Feeling rich with his bigger War Chest? How often can we beat CPF OA 2.5% with blue chip yield?)

In Investing; Your Account Size Really Matters! - CW8888

When DBS has crossed $19; he began to divest slowly. Uncle8888 last heard that he has fully divested all his DBS.

Sunday 27 September 2020

Is “NOW” The Right Time To Invest in SGX market?

Interesting question!

Somehow this time was about that Right or Wrong Time when Uncle8888 believe that Investing is the way to reach FI and get out of Rat Race after reading this book : Rich Dad. Poor Dad!

LOL!

New central green corridor connecting East Coast Park and Changi Beach Park to be created: Heng Swee Keat

There are currently 34 Nature Ways in Singapore, stretching 130km in total. Over the next 10 years, National Parks Board (NParks) hopes to create 300km of Nature Ways, and to make every road a Nature Way in the long-term.

NParks will be engaging the community on these plans and will work with residents to develop programmes for these green spaces.

New nature-based amenities will also be built and connected to the network of corridors, Mr Heng said. These include more community gardens, more therapeutic gardens in parks, and nature play gardens for children, said Mr Heng, who visited Pulau Ubin on Saturday with Minister for National Development Desmond Lee.

The visit by Mr Heng and Mr Lee marked the 9th edition of Ubin Day, which was first held in 2002. Ubin Day aims to celebrate the rich heritage of the island, with its associated activities shifted online this year due to the COVID-19 pandemic.

---------------------

Hmm .. when this is completed; Uncle8888 still got power legs to walk or not???

Read? Jog The Singapore's Park Connectors - Round 7

Read? Round The Coast (ACCESSIBLE) Of Singapore Walking Trail (7)

Financially Me, It is about Earning, Spending, Saving and Investing

From Past to Present, financially me is about earning, spending, saving and investing!

Investment Portfolio from Jan 2000 to Sep 2020 (21 yrs). Just SGX stocks!

Discounting the future investment income based on current state of investing mind; but our mind is NOT something we have control when we are aging farther down the retirement road!

Friday 25 September 2020

Buy & Hold for Golden Eggs or Trading Buy Back and Sell? Which strategy works better?

Uncle8888's own data point of ONE for DBS

1) Buy and hold for Golden Eggs i.e passive income surviving the emotional roller coaster ride through market cycle.

2) Trading through buy back and sell and also collecting Panadols for X Rounds.

DBS at today closing price.

Hmm ... showed that he is a lousy trader or what?

Thursday 24 September 2020

Dow closes more than 500 points lower as tech pressure mounts, Apple slides 4%

Stocks fell sharply on Wednesday, adding to September’s struggles, as tech shares took another leg lower and investors fretted over uncertainty around the coronavirus pandemic and further stimulus.

The Dow Jones Industrial Average closed 525.05 points lower, or 1.9%, at 26,763.13. Earlier in the session, the Dow was up 176 points. The S&P 500 slid 2.4% to 3,236.92 and the Nasdaq Composite pulled back by 3% to close at 10,632.99.

“Investors are being whipsawed by conflicting COVID headlines and the growth vs. cyclical debate,” said Adam Crisafulli of Vital Knowledge in a note. “The result is sentiment souring on both growth and cyclical for the moment (which obviously means stocks are for sale broadly).”

Shares of Amazon and Netflix dropped 4.1% and 4.2%, respectively, to lead Big Tech lower. Facebook slid 2.3%. Alphabet closed 3.5% lower. Apple ended the day down 4.2% and Microsoft dipped 3.3%.

Shares of Tesla fell 10.3% after Elon Musk offered new delivery predictions for 2020 and detailed a new battery design that he claims will make Tesla’s cars cheaper to produce. The stock was also under pressure after Tesla sued the U.S. government to overturn tariffs on China.

--------------------------------------------

Panic selling of banks in SGX?

See got chance to buy back DBS 24-2? :-)

Wednesday 23 September 2020

Warren Buffet's Rule 1 & 2

Rule No.1: Never lose money. Rule No.2: Never forget rule No.1. - Warren Buffett

Parroting Warren Buffet's Rule 1 & 2 here!

Currently, meeting 35% of Rule 1 & 2, another 6 to 8 years to fully meet 100%!

Never lose money ever again as Mr Market can't never take back what has been spent! LOL!

Tuesday 22 September 2020

Round 24 - 1 : Bought back @ $19.68

Last sold @ $19.88 was an Alamak sale!

Today bought back @ $19.68. Another Alamak?

Stock futures rise in overnight trading after S&P 500 posts 4-day losing streak

Stock futures rose slightly in overnight trading on Monday following a steep sell-off on Wall Street.

Futures on the Dow Jones Industrial Average rose about 100 points. The S&P 500 futures gained 0.4% and the Nasdaq 100 futures were up 0.5%.

The market’s September sell-off intensified on Monday with the Dow Jones Industrial Average dropping 500 points, suffering its worst day since Sept. 8. The S&P 500 lost 1.2%, posting its first four-day losing streak since February. The Nasdaq Composite dipped just 0.1% after a late-day comeback rally.

Hmm... can continue fishing in STI?

Got chance to buy back SGX and DBS?

Monday 21 September 2020

Sunday 20 September 2020

Made 10,000 People Millionaires??? (2)

When Uncle8888 read this in the morning, he smiled!

That was more than one decade ago when he poked late local "Guru" whose life goal was to make 10,000 people millionaires through his investment training course! But, Uncle8888 still respected late "Guru" who had never ban or moderated him in his forum despites occasional poking - Chun bo?

Read? Made 10,000 People Millionaires???

Saturday 19 September 2020

Lack of Entrepreneurship Or Money Earned Enough or Money Can't Never Earn Enough Why Try or Bother?

I am the Free Rider in SGX on investment income after 11 Years of Short-term Trading and Long-term Investing as Panda/Koala Retail Investor

SGX : The Past is not bad. The Present is lousy! The Future is uncertain?

So how?

What if you have became a free rider from the past SGX and most likely continue to receive yearly and relatively "passive" income? You still go and bang your head against Wall Street?

What is the Secret to become to become Free Rider in SGX?

Hmm ..

Be addicted to continuous doses of Panadols until your heart and brain becoming immune to emotional pains; and then one day you realized OMG, I am a Free Rider now!

Read?The income edge in the stock market

Chances of losing money after a decade is 25%; when dividends are included, it is cut to just 2%

I HAVE a simple rule about investing. I put any cash that I don't need for at least the next five years into the stock market. I don't pay too much attention to pundits who warn about markets being dizzyingly-high or worryingly-low that could drop further. That's because over any rolling five years, the stock market should be higher at the end of the period than at the beginning.

Don't just take my word for it. If you look at the Straits Times Index at any point in time and go back five years, there is a 40 per cent chance that the index would have been lower. That might not seem too alluring. But that's because dividends haven't been accounted for, yet. When the payouts are included, the probability that the investment would be worth more after any rolling five years jumps to 83 per cent.

Is 10 years an eternity?

What is even more remarkable is that the chances of losing money over any ten-year period after including dividends are reduced even further. Some might think of 10 years as an eternity. But it's not, if we plan to invest for decades.

Many of us will need to do that if we are putting money aside for our retirements. If we invest with a 10-year time horizon in mind, the chances of losing money after a decade is 25 per cent. When dividends are included, it is cut to just 2 per cent.

To put that into perspective, if we put our money into shares every month for 10 years, we would be making 120 separate deposits. Of those discrete investments, only two would be lower after a decade. With the odds so overwhelmingly in our favour, why would we want to miss out. Additionally, the more often we invest, the greater could be our chances of success.

A ten-year investing horizon is a convenient period to consider because we generally benchmark investments against risk-free assets such as 10-year Treasuries. This is where investing in shares really comes into its own. The average total return in the stock market over 10 years is 70 per cent, which equates to an annualised rate of 5.5 per cent. That compares favourably with a risk-free return rate of 0.25 per cent.

Comfort and joy

What is undeniable, though, is that it can be uncomfortable (or it could even be exhilarating) over any ten-year period from the moment an investment is made.

If we had invested in 1998, the return after 10 years would be 143 per cent. But if we had done the same in 1999, the return would have been a meagre 52 per cent after a decade. That is part and parcel of investing. But nobody ever buys shares just the once and never goes back into the market ever again.

At least, we shouldn't. We should try to develop a routine of investing regular amounts frequently. We should also take with a pinch of salt what experts might have to say about valuations.

Peter Lynch said the secret of successful investing is to never trust our gut feelings but discipline ourselves to ignore them. We should also learn to stand firm if the fundamental story of the company we invest in hasn't changed.

The market, incidentally, is not a great place to check the fundamentals of a business. But it can be a good place to see if anyone is doing something foolish.

Crystal clear

The alternative to the stock market could be to buy some of those risk-free 10-year Treasuries. That way, we are at least guaranteed to get our money back intact. But with an investment in the stock market, there is a risk that our investment could go down as well as up.

However, the loss is only crystallised if we don't stay the course. If we can hang on through the tough times, the chances of losing money over ten years is almost negligible.

Unfortunately, some people can't tolerate the roller-coaster ride that stock markets can take us on.

Or as Mr Lynch said: "Everyone has the brainpower to make money from stocks. Not everyone has the stomach."

The income edge

This is where income investors have a distinct edge. We focus on the income that a share could produce, rather than its share price. The problem with share prices is that they can be a function of market sentiment. When more people want to buy shares, prices will probably rise. But when there are more sellers than buyers, prices could fall. However, the dividends paid by a company don't change with market sentiment.

Instead, they are a function of the fundamentals of the business. So, market highs, market lows, market corrections and market crashes are irrelevant to income investors. We are guided by how much we pay for every dollar of income a share can deliver.

There can be times when we might have to pay more, and times when we could pay less. But we are continually buying tomorrow's income with today's money because one day that will be the only income that we will have to live off.

The writer is co-founder, The Smart Investor

Friday 18 September 2020

SGX : Partial Sold @ $9.01 for Round 5-1

Read? SGX : Bought @ $8.21 for Round 6

Last highest sold is $8.99 in Round 3

Round 5 - 1 : ROC +5.9%, 102 days, B $8.48 S $9.01

Round 4 : ROC +8.5%, 6 days, B $8.01 S $8.74

Round 3 : ROC +8.8%, 12 days, B $8.21 S $8.99

Round 2 : ROC +13.6%, 3 days, B $7.46 S $8.52

Round 1 : ROC +12.3%, 61 days, B $6.87 S $7.76

Why You Should Use Your CPF To Pay For Your Property And Mortgage

Uncle8888 also joins in the Fun!

Assuming you have the flexibility to pay home mortgage with either CPF or Cash; Uncle8888 will vote for CPF. Why?

If you are decades away from 55; your CPF is just Rich Asset making you feeling good! Every year you smile when you login into CPF online to check CPF interests. Passive income!

Passive income?

Chun bo?

Unfortunately; you kena retrenched and month after month still cannot find a job. Your CPF interests still passive income?

Before 55; CPF is NOT King. Your Cash is King!

You can use your Cash to invest 100% or less! Up to you! Your skills and investment outcome should be telling you whether you should continue to be investing MORE or saving MORE!

During emergency or unfortunately kena retrenched; your Cash is Handsome King!

When your investment outcome clearly indicates that you should be taking up the Saver route; then you start to refund your housing loan back to CPF OA. Finally, one day you realized your mistakes of listening to investment warriors in the cyber world to invest to become rich. Instead of becoming rich in the market; you are slaves in the market making them richer!

By this time of awakening; you should be nearer to 55 when you started to refund your housing loan to CPF OA.

When you reach 55; your CPF is Handsome King!

Thursday 17 September 2020

Who influence you into investing? (3)

Read? Who influence you into investing? (2)

Recent debate in investing forum and social media.

STI or Overseas markets?

Are you a devotee or one of eight immortals?

"The Eight Immortals cross the sea, each reveals its divine powers" (八仙過海,各顯神通; bā xiān guò hǎi, gè xiǎn shén tōng) indicates the situation that everybody shows off their skills and expertise to achieve a common goal.

Similarly. every retail investors need to find your own skills and expertise in whichever market you have decided to achieve your investing goals and safely cross over the Sea to the Land of Financial Independence!

Once you arrived at Land of Financial Independence then you can chart your own journey to FIRE, Semi-Retirement or Retirement. You may not have to worry financially; but still have to worry over physical health, mental health and aging. LOL!

Uncle8888's crossed the Sea with Panda and Koala in Singapore Zoo!

Wednesday 16 September 2020

Is Temasek Better Off As Panda/Koala Investor in Singapore???

Our initial portfolio in 1974 reflected Singapore's early stages of industrialisation. Some of these companies, and others added since, have grown into iconic Singapore brands, such as DBS and the Singapore Zoo. Others, like Singtel, Singapore Airlines and PSA, have transformed into regional and global champions.

In recent years, we have been investing in several trends driven by social progress, demographic shifts and changing consumption patterns, enabled by technological advances.

We continue to seek innovative companies at the forefront of developing new, sometimes disruptive, solutions that create new opportunities, while addressing the growing needs of the world's population.

As at 31 March 2020, our net portfolio value was S$306 billion.

SCI after disowning its oily and smelly bearish Son

Look like the worst is over for SCI!

Now Uncle8888 is holding a young Bull and a tired Bear instead of one ugly Bear! LOL!

Tuesday 15 September 2020

For Ray Dalio, a Year of Losses, Withdrawals and Uneasy Staff

So very bad, in fact, that the billionaire risks losing his coveted title as king of hedge funds.

Read? For Ray Dalio, a Year of Losses, Withdrawals and Uneasy Staff

CW8888: What is the moral story on long-term investing for most of us as retail investors?

Monday 14 September 2020

Sunday 13 September 2020

The Power To Increase Price And Still Has Bloody Long Queue (2)

Read? The Power To Increase Price And Still Has Bloody Long Queue

Hmm .. realized the power of Brand in passing the cost of inflation to consumers!

Stronger brand. Increase price and maintain size!

Weaker brand then they must know their products well to directly or indirectly pass the cost of inflation to consumers by trying to fool their mind!

They know which product to increase price or decrease size to pass the cost of inflation to consumers without losing sales.

$3.00

$3.50

CASH REFUNDS FOR CPF SAVINGS USED FOR PROPERTY PURCHASES. (2)

CASH REFUNDS FOR CPF SAVINGS USED FOR PROPERTY PURCHASES.

Real life conversation ..

She has $100K+ from her matured Endowment policy. In her 50s; she is exploring where to put this extra cash?

She doesn't feel confident to put more money into the market as her current investment portfolio is also not doing well. SSB? Low interest. Bond?

How about CPF OA 55 2.5% Bond-like?

In her 50s, it is just a few more years away to unlock her CPF OA 55; whatever money she puts into CPF OA now can be treated as 2 to 3 years 2.5% Fixed Deposit. Right?

Look like CPF Board can consider starting new ads campaign on "Partial Refunding of your CPF CPF housing loan in your 50s" to secure a Happy 55 Birthday Present to reach out to more older CPF members in their 50s!

Saturday 12 September 2020

Should I be very disappointed by STI poor performance since last Bull market in 2007 to grow my Net Worth?

As retirees from full-time job without savings from monthly income; we are looking to Mr Market to grow our net worth; but STI is a poor performer!

So how?

Our neighbor grasses are so tall and green!

Cross over or already too late?

Wednesday 9 September 2020

STI has not recovered from even 2008 crash so what happened to our investment portfolio since 2008? (2)

Read? STI has not recovered from even 2008 crash so what happened to our investment portfolio since 2008?

Our job as savvy retail investor is to manage our portfolio and money management across market cycles. Our investment performance can be higher or lower than STI over very long run!

Daily STI level is just providing us with the clue to increase or decrease our stocks exposure to the market volatility and to maintain adequate war chest to fight the next few battles.

This task is especially critical and important for retirees depending bulk of their cash flow from investment portfolio.