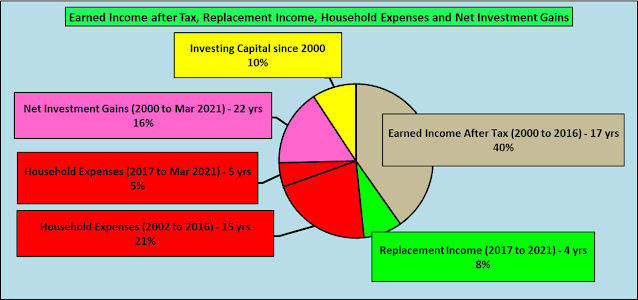

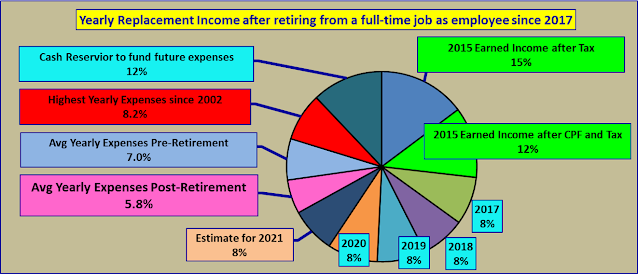

Uncle8888 has been cashing out 100% of his investment income i.e. dividends and trading profits to Cash Reservoir (bank account) to fund household expenses since 2017. He is quite surprised that even with ZERO compounding rate investing strategy as retiree who is depending on investment income; his investment portfolio can hit another new record high in Mar 2021!

Tuesday, 30 March 2021

Dow closes at new record overnight

Dow Jones Industrial Average closed 98 points higher at a fresh record of 33,171. The S&P 500 declined fractionally on the day to 3,971.09 while the Nasdaq Composite dipped 0.6% to 13,059.65.

No FOMO in SG Bulls as more and more eating Ang Mo steaks?

Is STI going to narrow down safe distancing from Uncle DOW?

Monday, 29 March 2021

Sunday, 28 March 2021

Saturday, 27 March 2021

S&P 500 closes at a record, Dow jumps 450 points as stocks rally in the final minutes of trading

U.S. stocks climbed on Friday, finishing the volatile week on a high note as stocks benefiting from a successful economic reopening outperformed again.

The Dow Jones Industrial Average closed 453.40 points higher, or 1.4%, to 33,072.88. The blue-chip benchmark was up only 65 points earlier in the day. The S&P 500 rose 1.7% to 3,974.54, hitting a record closing high and bringing its 2021 gains to 5.8%. The Nasdaq Composite erased a 0.8% loss and ended the session 1.2% higher to 13,138.72.

All three major benchmarks rallied to their session highs into the close with the Dow jumping tacking on more than 150 points in the final 8 minutes of trading. It was broad-based late buying. Beaten-up tech like Apple rallied into the green in the final minutes. Banks, energy and materials were all big winners in the final minutes and on the day.

Friday, 26 March 2021

Wednesday, 24 March 2021

Tuesday, 23 March 2021

Saturday, 20 March 2021

Here’s How Much DBS Group Would be Worth Today If You Had Invested S$10,000 in it One Year Ago

Read? Here’s How Much DBS Group Would be Worth Today If You Had Invested S$10,000 in it One Year Ago

What about if you had invested many years ago?

Real people. Real Return!

The Truth About Multi-bagger : Real And Illusion (2)

Read? The Truth About Multi-bagger : Real And Illusion Share

Read? Oceanus : Bought @ $0.02 for Round 1

Read? Thirty Years Reflections on the Ten Attributes of Great Investors

Oceanus is the latest illusionary multi-bagger added; BUT it is just for fun play and doesn't help to add any wealth. It is bo lampar punting (i.e. fun play) after badly burnt previously for catching falling knives in 2008! But, itchy hand is always there. Just controlling the itch so that it doesn't get hurt badly! LOL!

In long-term investing; it is always about position sizing and also our gut too i.e. size of our lampar!

Thursday, 18 March 2021

Encountering At Least One Major Economic or Market Crisis Is Good For Our Future Prospective!!! (Good to refresh!)

Read it in forum page!

Emotional

How should I put it? It has been probably the darkest few months in my work life. And it is not over yet...

I am unsure if I should share this but I decided to post it anyway. If it doesn’t benefit anyone else, it helps me air my pain.

I have been attending many farewells lately. Too many that it starts affecting my emotions. I am unsure c19 is the only contributor but it is one of the factors.

It is not easy seeing departments closed and colleagues asked to leave. It is not new but never at this magnitude.

And yet, it is all about timing. Colleagues near retirement welcomes the nice send off while colleagues around my age felt very lost and uncertain.

While I do what I can to help by spreading words and provide referral, I struggle inside myself. Thinking hard what I should do between now and till I can stop working for a living.

I am not sure about you, it is rather tough for me. Especially as a sole breadwinner. Though I will not have cashflow problem if I stop work for a while, I have not reached the level I can stop work for good.

One side of my brain filled with reluctance for change, the other side preparing for the worst that may come. Far from efficient, I know. Emotion itself is not efficent.

Having worked over 20 years and landed at my currect situation is no fun at all.

But life will go on. And I will continue to focus on my simple financial goals - ensure me wifey will not need to work for money and me kid will not need to worry about money till ready to work.

By the time I write to this point, I feel better already. Appreciate you spending time reading this junk. Cheers.

Read? Encountering At Least One Major Economic or Market Crisis Is Good For Our Future Prospective!!!

Read? Home for Living and not for profit taking - Part 2

Wednesday, 17 March 2021

It is quite unreasonable for investors to expect both High Growth AND High Dividends???

Read? How to Lose All Your Capital through P2P or Venture Capital(CoAssets, Gobear), 1M65 SG stocks, etc

He makes a serious point about dividends - I've written about it before, but a factor I missed was about how profits reinvested are usually ultimately used in development of the business.

SEE ALSO: How I got an 9% dividend every year - and why I gave it up

In fact, that's kind of the purpose of why a company would sell its shares in the first place.

Aside from the reasons why a high dividend can be unsustainable as written above, it stands to reason that a company has to keep developing at the rate of its profit payout - or it starts to go into major decline.

In other words, a stock that pays out high dividends often compromises growth to a certain degree.

It is quite unreasonable for investors to expect both High Growth AND High Dividends.

That's likely why not a lot of stocks - including REITs, have succeeded in paying out high dividends over a 5 - 10 year period without having some kind of growth kick in the face.

------------------------------

Uncle8888's comment to the above

Venture

Read? Venture Corp : Bought $19.18 for Round 2

Last sold @ $19.20

This time, hope to do better!

Hoseh! Long white candle on high vol!

Tuesday, 16 March 2021

Stock market news live updates: Futures dip after Dow, S&P 500 set records

Stock futures dipped on Monday, following a session in which the broader market notched new record highs, as traders looked ahead to retail sales data on Tuesday and a Federal Reserve policy meeting later this week.

During Monday's regular session, Wall Street rallied in choppy, directionless trading, as investors struggled to balance economic optimism against steadily rising Treasury yields.

The Dow Jones Industrial Average rose by over 100 points and the S&P 500 Index also inched to a new high, bolstered by the signing of a new $1.9 trillion stimulus bill that's poised to spur consumer spending and ignite economic growth. Most Americans are poised to receive $1,400 stimulus checks, which began arriving over the weekend, and Wall Street economists have already begun hiking their gross domestic product (GDP) estimates for the remainder of the year, amid expectations that the stimulus will unleash a consumer rebound.

Still, Washington's aggressive spending spree, and super-accomodative monetary policy, has focused growing attention on runaway deficit spending — which is at least part of the reason why government borrowing costs have begun to spike, even as the Federal Reserve remains committed to fostering growth through lower yields and higher inflation.

The central bank will render its verdict on monetary policy on Wednesday, which is widely expected to confirm a bias for more easy policy.

Last week, the benchmark 10-year Treasury yield spiked to a pre-pandemic high around 1.6%, up about 50 basis points in a month. Another warning sign has emerged via Bitcoin (BTC-USD), where prices over the weekend topped $60,000, a new record high before paring those gains on Monday.

With large amounts of fiscal and monetary stimulus backstopping activity, economists at BlackRock are anticipating "a much stronger post-Covid economic restart than what we would expect in a normal recovery. The rapid upward adjustment in U.S. Treasury yields and more muted movement in inflation-adjusted yields make sense in this respect, and are still consistent with our New nominal theme" of higher prices and government liquidity, the firm noted.

Sunday, 14 March 2021

Time in the Market > Timing the Market??? (4)

Read? Time in the Market > Timing the Market??? (3)

Jan 2000 to Mar 2021 ( 22 yrs) : Timing the Market and Time in the Market

Feb 2020 to Mar 2021 (14 mths) : Timing the Market i.e. waiting for Bear market since 2009

Let see the outcome in the next Bear market by timing the Market!

Friday, 12 March 2021

Thursday, 11 March 2021

Dow rallies 460 points to close at a record as bond yields fall, House passes new stimulus

The Dow Jones Industrial Average soared more than 400 points to a record after falling bond yields and a new stimulus package spurred investors to snap up stocks that will benefit from a faster recovery from the pandemic.

The blue-chip Dow jumped 464.28 points, or 1.5%, to close at a record high of 32,297.02. The S&P 500 added 0.6% to 3,898.81, led by energy and financials. The Nasdaq Composite closed less than 0.1% lower at 13,068.83 after gaining as much as 1.6% earlier in the day. The tech-heavy benchmark enjoyed a 3.7% rally in the previous session for its best day since November.

House Democrats passed a $1.9 trillion coronavirus relief bill Wednesday, sending it to President Joe Biden, who is expected to sign Friday. Biden said checks of up to $1,400 should start going out this month.

Wednesday, 10 March 2021

Oceanus : Bought @ $0.02 for Round 1

Read? Oceanus

Joining 4D Punting Game in SGX for fun play!

Oceanus is the latest new stock pick!

1) Total number of different stocks bought and sold; or still holding since Jan 2000 = 59

2) Total number of different stocks bought and sold; or still holding since COVID-19 = 13

Read? Message from Peter

Dear Shareholders,

Good afternoon. On behalf of all of us here at Oceanus, we would like to extend our heartfelt thanks to all of you for your continued support. It is your unwavering belief and commitment to our enterprise that enables us to achieve our goals as set forth in the “Clean Up” and “Build Up” phases.

Equity markets worldwide continue to speculate on tomorrow while we focus on the present. We can assure our shareholders that we are continually building strong foundations to ensure growth and business continuity.

Just for your info, the team is busy as usual – working hard on the growth and teching up the business as planned.

We remain wholly focused on our goals – to build a robust business model and deliver value to all our stakeholders.

Staying close to our motto, we believe in building a sustainable business for the security of tomorrow.

Best Regards

Peter Koh

Group CEO

Real and Illusion Of Wealth In The Stock Market. It is selling that counts! (3)

Read? Real and Illusion Of Wealth In The Stock Market. It is selling that counts! (2)

Read? Lion HST vs CSOP HS Tech (3)

It is selling that counts!!!

It is always about Entries and Exits otherwise; it will be Panadols!

Excellent Entries on potential Touchstones can then be retained for farther observation to be Freehold generating passive income for the next decades!

Lion turning Kitty liao! No Panadols! LOL!

Tuesday, 9 March 2021

Dow rises 300 points to touch a record, Nasdaq sheds 2% as rotation out of tech continues

The Dow Jones Industrial Average climbed on Monday as investors piled into economic comeback plays after Senate approval of a new Covid stimulus package, while a continuous sell-off in high-flying tech shares put pressure on the broader market.

The blue-chip benchmark gained 306.14 points, or 1%, to 31,802.44 led by Disney. At its session high, the 30-stock average jumped 650 points to hit an intraday record high. The S&P 500 erased a 1% gain to close 0.5% lower at 3,821.35. The Nasdaq Composite slid 2.4% in volatile trading to 12,609.16 as Apple dropped 4.2% and Tesla fell 5.8%. Alphabet and Netflix both slipped more than 4%.

The tech-heavy benchmark closed more than 10% below its Feb.12 closing high, falling into correction territory.

Hmm ... Koala/Panda now got chance to smile back at Lion No King in the Zoo???

Monday, 8 March 2021

Early, Late or FOMO Comers Into The Party Made World of Big Differences???

O&G stocks like Keppel Corp have been hated and avoided by most retail investors even its Rig biz will be exited in 3 yrs! Right?

But ..

Early, Late or FOMO comers into the Party will make world of big Differences!

That is why long-term investing is always personal investing! One man's freehold dividend is another man's Panadol!

Read? The sun rose for Keppel - in a sunset industry!

Read? Just a few multi-baggers may be enough for your kid's university fund - Updated

Sunday, 7 March 2021

You See That Room Over There Full of Millionaires!

Anything new in the market across market cycles and technology miracles, innovation and the Next Big Things?

The only things that are new are the new players into the market. New can be also those late buyers or retirees who have FOMO!

In Dec 1999, during Dotcom Bubble; Uncle8888 attended Cisco IP equipment training course at Cisco's office in Shenton Way; the Trainer proudly pointed to that room and said "You see that room over there full of millionaires" Those were days when they opted for share options as bonus instead of collecting cash and could also participate in monthly Employee Share Purchase scheme at discount as part of their saving plan!

Uncle8888 then was so envy! Millionaire employees! Cisco ruled Planet Earth!

Saturday, 6 March 2021

RSS Monthly Payouts Anytime From Age 65

Received letter from CPF on RSS monthly payouts anytime from age 65 as follows:

65 - $1,188 (Huat number 88. LOL!)

67 - $1,391 (17% more than in 65 for two years delay)

70 - $1,800 (Automatically monthly payouts. 52%more than in 65 for five years delay )

100% liquid net worth from Sep 2021 onwards!

No more CPF money being locked up by MIW i.e. you can see but cannot spend! LOL!

Friday, 5 March 2021

Dow Dives, Tech Stocks Sell Off On Powell Speech As Yields Spike; Tesla Crumbles 7%

The Dow Jones Industrial Average slid 450 points Thursday in the wake of Fed Chairman Jerome Powell's speech, as the 10-year Treasury yield spiked back above 1.5%. Tesla stock dived 7%, while DraftKings briefly jumped on a deal with the UFC before reversing lower.

Among the Dow Jones leaders, Apple (AAPL) fell over 1% Thursday, while Microsoft (MSFT) moved down 0.3% in today's stock market. Visa (V) is in buy range above a new buy point.

Tesla (TSLA) looked to extend Wednesday's 4.8% drop, diving 7% Thursday. IBD Leaderboard stock DraftKings (DKNG) jumped as much as 3.5% before reversing sharply lower after announcing a deal with the UFC.

STI tumble Today???

Monday, 1 March 2021

The truth about Warren Buffett’s investment track record : Morning Brief

Read? The truth about Warren Buffett’s investment track record : Morning Brief

Great stock pickers pick a lot of losers

And just because Buffett may be one of the greatest stock pickers in history doesn't mean all of his stock picks have been winners over time.

Just a quick glance at Berkshire's current top 15 stock investments reveals plenty of positions that are held below cost (i.e. they've lost money).

It's not hard to find times Buffett lost money on a trade or missed out on a big opportunity. Just a year ago, Berkshire dumped airline stocks near their lows just before they roared back along with the other reopening trades.

But a successful investor shouldn’t be judged by his or her mistakes. Rather, they should be judged by the degree to which they are able to achieve their long-term goals.

This goes for all investors who will repeatedly buy too late, sell too early, and miss out on big opportunities that become obvious in hindsight.

So if you're making a lot of mistakes but have a sound strategy and the discipline to stick to it during periods of underperformance, then maybe you too can be as imperfectly successful as Warren Buffett.