Most of monthly expenditures are now through Tap and Go i.e. pay wave and credit card payments so the current month expenditure is more or less known when received billing notice for the previous month from credit card. It is a good tool for monthly budgeting to live below our means! Over-spent last month so tighten a bit for current month so that next month will help to lower it! :-)

Sunday, 31 October 2021

Saturday, 30 October 2021

Rethinking on Where does the money come from???

Read? Investing Made Simple by Uncle8888 (6)

Read? Where does the money come from??? (2)

Uncle8888 also remembered Warren Buffet once said: "The Stock market is a financial redistribution system. It takes money away from those who have no patience and gives it to those who have."

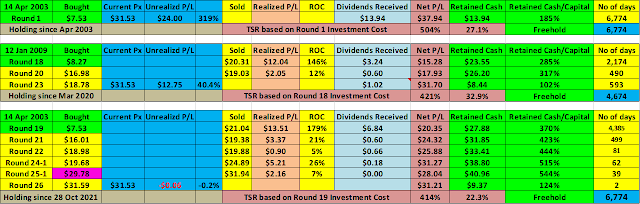

DBS Hits ATH @ $32.06 On 28 Oct 2021

Read? DBS : Bought @ $31.59 For Round 26

Real person! Real data point of one for debating the popular topic in investing - Time in the Market and/or Timing the Market!

Data point of One!

Talking is easy!

Executing is damn difficult!

When Your Bank RM Called??? (7)

Time flies fast; but this time is boring! Only consolation out of these two boring years is that he was shown his basic living expenses by Mr. COVID since he is an Ant in retirement planning. Ants love Numbers!

Read? When Your Bank RM Called??? (6)

12 months of interests payment have passed. Another 24 months to go before receiving monthly few hundred bucks till 2040 when the loan period end by surrendering the policy to fully redeem $144K loan.

Let see how fast can interest rate rises in 2022 and 2023!

Thursday, 28 October 2021

DBS : Bought @ $31.59 For Round 26

Walan! Bought back in the same day!

New ATH @ $32.06! DL@ $31.58

Read? DBS : Round 25 - 1 : Sold @ $31.94

DBS : Round 25 - 1 : Sold @ $31.94

Read? DBS : Bought @ $29.78 For Round 25

Last sold @ $24.89

Round 25-1 : ROC +6.9%, 38 days, B $29.78 S $31.94

Wednesday, 27 October 2021

DBS - New ATH

Read? DBS : Bought @ $29.78 For Round 25

Last sold @ $24.89 but it shot to the Moon!

This round can do better?

Mai bang head again!

Sunday, 24 October 2021

Financially Me, It is about Earning, Spending, Saving and Investing (5)

Read? Financially Me, It is about Earning, Spending, Saving and Investing (4)

Read? It Is NOT SEXY To Talk About Saving And Earned Income As Investment Bloggers (2)

How many investment articles or blog posts have you came across telling us that our earned income and savings play a critical role in our investment based on luck, skill and war chest (money from savings)?

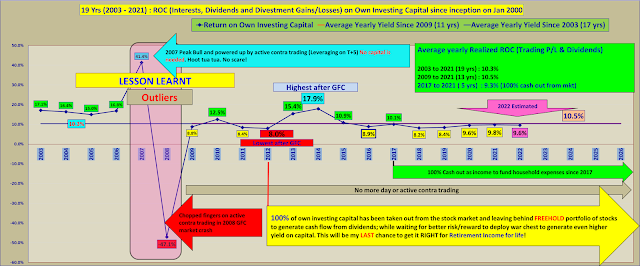

One picture that tells the full story behind 39 years as employee; and 22 years as Panda retail investor in an uninspiring, boring and zombie SG stock market!

Saturday, 23 October 2021

Wednesday, 20 October 2021

“Shorting” Without Shorting (Short Selling)???

Read? “Shorting” Without Shorting (Short Selling)

Uncle8888 smiles when he read it!

Finally; someone wrote a long blog post on "shorting" without shorting for kiasu and kiasi investors who can't short!

Hmm .. somehow it sounds like Uncle8888's blog mast head on long-term investing and short-term trading strategy to make pillow stocks and on the way to freehold multi-baggers generating investment income for life during retirement!

Read? Pillow Stocks : The Less Stressful Long-term Investing When We Get Some Of Them Right!

Read? Just a few multi-baggers may be enough for your kid's university fund - Updated

Top three Rounds after Rounds i.e. short-term trading on Core positions while HODL!

Buying back could also mean sucking Panadols again on paper losses; but it is just less bitter and sleep better with these pillow stocks!

Read? Kep Corp : Bought @ $5.18 for Round 101

Read? SembCorp Industries (SCI): Bought @ $2.08 for Round 57

Read? DBS : Bought @ $29.78 For Round 25

Tuesday, 19 October 2021

Panda's Investment Portfolio Hits A New All Time High Record In An Uninspiring And Boring SG Stock Market!

Even with 100% investment income cashing out from portfolio to support household living expenses since 2017 i.e. 5 years without a single cent of re-investing back to the stock market; Panda's investment portfolio still manage to hit a new all time high record today; and it also shows that Panda investor can have the Cake and eat it too! Bagus!

ROFL on some smart financial advices given in the social media or articles!

Read? The Difference Between Smart Financial Advice and Smart Financial Advice For You (3)

Really; this similar to something like ...

Guys! You looked seriously undernourished!

You should be taking more nutritious foods and supplements!

No?

Monday, 18 October 2021

Singtel : Sold @ $2.53 as Round 2-1

Read? Singtel : Bought @ $2.33 for Round 3

Lim some kopi-O first while waiting for toast bread to be ready! Sell slowly!

Round 2.1: ROC 8.2%, 131 days, B $2.33 S $2.53

Round 1: ROC 3.8%, 110 days, B $2.38 S $2.48

Sunday, 17 October 2021

CW8888's Blog Mast Head : Create wealth through long-term investing and short-term trading.

Saturday, 16 October 2021

圣约翰岛猫咪Sandy去世 岛民游客纷表不舍

RIP, Sandy the Cat!

Mar 2016 photo of Sandy the Cat!

Read? 圣约翰岛猫咪Sandy去世 岛民游客纷表不舍

Read? Give The Cat A Fish!

COVID-19 Threw Me A Number For Basic Costs Of Living In Singapore

Zero overseas travelling expenses in 2020 and 2021!

High medical costs as a private patient (previously on company's Class A medical benefits and down-grading is unlikely as it is better to stay with current specialists)

Health is wealth; but some health issues are not really within our control. Blame our DNA!

Friday, 15 October 2021

Scare No Buy. Buy No Scare!!!

If you have been visiting investment/trading forums; you may come across posting by somebody at the forum .. Scare no buy. Buy no scare!

Really true!

Uncle8888's last buying of stock is on Monday, 26 September 2016

Read? SGX : Bought @ $7.46

Scare No Buy over 3 years+ and back to Buy No Scare is on Friday, 21 February 2020

Read? ComfortDelgro : Bought @ $2.01

Buy no scare but sucks Panadols since Feb 20! LOL!

Thursday, 14 October 2021

Is CPF really the equivalent of a 65:35 fund ?

Read? Is CPF really the equivalent of a 60:40 fund ?

Hor! Of course; it is! LOL!

The 35% CPFIS tool is there after AFC when the MIW shifted CPF 100:100 to 65:35 and stop f... MIW for not protecting your retirement fund if you lose your money in your investment!

Wednesday, 13 October 2021

STI - Snail Pacing Up And Down In Narrow Range (2)

Friday, 8 October 2021

Read? STI - Snail Pacing Up And Down In Narrow Range

Can STI Snail make it this round?

Squid Game's Tug Of War In The Stock Market

Saturday, 19 September 2009

Read? Think of Investing in Stock Market as Game of Tug of War

In Children's game of tug of war; it is rather fair on equal number of players on each side; but as retail players in the stock market; it is clearly an unfair game; one side will have many retail players and joined in by heavy weight and powerful BBs. The winners of the momentarily Game will be laughing to the bank at the other side of players as suckers!

Do we know Squid Game's Tug Of War Tactics in the stock market?

When to join which side?

22 years of playing Squid Game's Tug of War in the stock market!

Monday, 11 October 2021

Luck, Skills And Money As Retail Investors

Singapore Man of Leisure 9 October 2021 at 12:20:00 GMT+8

CW,

Lol!

To focus on money management, you need to have money first...

That's why snake-oils have to prioritise Method as that's what their customer base wants - HOW to get rich!

Not how to protect your wealth.

Then again, we have also been transparent when we were climbing up the mountain, we also never focused on money management...

You with your contra trades and over staying your welcome in 2008; me with my margin trading; while others so heavy into properties until banks savings only a few thousand...

Weren't we glad we didn't know what cannot be done then!?

Heng ah!

Reply Delete

---------------------------------------------------------------

Uncle8888 believe he doesn't have the best luck till now at 65!

Tio 4D First prize - highest $5K 1 Big 1 Small. Buy bigger always tio jiak! Sianz!

Tio ToTo prize. Highest is 4 numbers!

Read? Luck??? When It Comes. Hard To Stop it!

Read? Dumb Luck With Heavenly Trigger!!!

Hmm ... like that then Uncle8888 was unlucky to read that book Rich Dad. Poor Dad at the wrong time and triggered him to seriously started his journey to Get Out of Rat Race when STI was near its high at 2583 and then crashed down to 1198.

He was lucky or unlucky? Not sure but he did learn something very important and practically true!

Moral of the Story : Money but no luck! Buy slowly but keep losing more!

Read? Lucky Or Unlucky When You First Get Started Investing Over Market Cycles

Moral of the Story : Money and luck! Huat ah!

Read? Unexpected Token Of Appreciation From Follower (Ex-colleague)!

Sunday, 10 October 2021

Unexpected Lesson Learnt In COVID-19 On Fighting Market Volatility As Retiree

How to fight market volatility as retirees who are depending on their investment income?

A practical approach from unexpected lesson learnt in COVID-19 with an unplanned War Chest as one data point case study!

Read? Have you spend enough time thinking on your money management strategies? (4)

We have no control over market volatility!

We either go and fight it or slowly withdraw from it!

How to fight a War against market volatility?

Of course, we need War Chest!

How much is enough?

We have to find out ourselves! No model answer to this question!

Saturday, 9 October 2021

Have you spend enough time thinking on your money management strategies? (4)

Read? Have you spend enough time thinking on your money management stratgeies? (3)

How often have you came across investment articles or blog posts mentioning the importance aspects of money management as part of investing strategies especially during retirement phase across future crisis.

See for yourself!

Pumped in so much money into the market just to maintain!

COVID-19 has validated Uncle8888's money management strategy to sustain his replacement income from his investment portfolio during retirement phase!

Friday, 8 October 2021

Thursday, 7 October 2021

We love to extrapolate our winnings in the market. Wrong?

Uncle8888 smiles when he read this from investment blogosphere ..

If I can maintain or do better than June 2021 profit consistency for the next 12 months, then I can start to consider switch to become full time stock trader.

If you have successfully switched from 9-5 jobs -> Full time trader OR unsuccessfully going to switch from Full time trader back to 9-5 jobs, would like to hear your stories / experiences / tips :)

It is like seeing his own past. In 2007, he had earned more than his boss and was thinking he could quit his job as employee soon and do full time trading! LOL!

Read? My War Room (7) - The Last Mile

Read? Shocking Truth on some Stock Gurus!

Wednesday, 6 October 2021

Tuesday, 5 October 2021

Older men are more likely to panic sell stocks: MIT study

Read? Older men are more likely to panic sell stocks: MIT study

Read? After A Few Market Cycles ... Did More Veterans Learn Something??? (2)

Researchers at the Massachusetts Institute of Technology are diving into the demographics of people that panic sell stocks during a market crash.

Investors who are male, over the age of 45, married or consider themselves as having “excellent investment experience” are more likely to “freak out” and dump their portfolio during a downturn, according to a paper published last month that analyzed more than 600,000 brokerage accounts.

The researchers say their work can be used to create predictive models, which would help identify individuals at risk of panic selling.

“Financial advisors have long advised their clients to stay calm and weather any passing financial storm in their portfolios,” wrote Daniel Elkind, Kathryn Kaminski, Andrew Lo and colleagues. “Despite this, a percentage of investors tend to freak out and sell off a large portion of their risky assets.”

The extreme emotional swings of being a stock-market investor has long fascinated behavioral scientists. While the MIT study didn’t explore why exactly investors panic sell, the intense fear and desire to give up and get out of the market is well-known to any trader.

Countless studies have shown that people are better off staying put in a broad diversified portfolio, yet the promise of big riches and the terror of losing it all continues to drive frenetic trading patterns.

In the study, the researchers defined a panic sale as a plunge of 90% of a household account’s equity assets over the course of one month, of which 50% or more is due to trades.

“Panic sales are not random events,” the researchers wrote, saying its possible to identify clear trends in the data. They found that specific types of investors, such as those with less than $20,000 in their portfolio, also tend to liquidate more often.

“Subtle patterns in portfolio history, past market movements, and demographic profile can be exploited by deep neural networks to accurately predict if an investor will panic sell in the near future,” they added.

Sunday, 3 October 2021

Growth-Dividends or Dividend-income Investing Goals

Since retiring from his full-time job as salaried employee in 2016; Uncle8888 has transited his yearly goals from growth-dividends to dividends-income and finds that dividends-income yearly goal is easier and within his control to achieve the expected target or at least nearer to target. It is a matter of calibrating his War Chest to to achieve!

2021 is more or less done!

Looking forward to 2022 yearly goal - buy more or trade more whichever comes first!

Now, he can understand why younger investors also choose to set dividend income goals! LOL!

Saturday, 2 October 2021

2021 Q3 Investment Performance As Retiree Depending On Investment Income

2021 Investment income

Stocks only go up! LOL!

Keep buying!

Actually is ... sianz!

The trick is to keep pumping capital into the market and then stocks only go up!

But for NOT retirees depending on investment income for survival; stocks never go up!