Read? When Your Bank RM Called??? (5)

Sillyinvestor 26 December 2020 at 11:29:00 GMT+8

Hmm CW,

You haven answer Hyom or I could not fathom enough. Any impact if interest rate raises? Is 10 years and is a long time

Reply Delete

-----------------------------------------------------------------------------------------------------

Doing some Maths to keep his mind functioning! LOL!

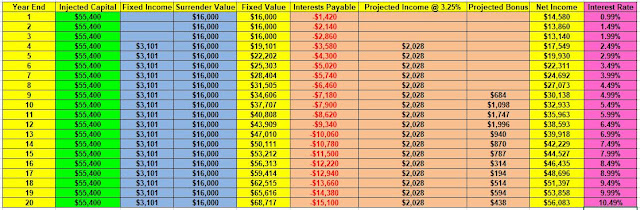

RM's illustration is based on projected income @ 4.75% return on top of guaranteed fixed monthly income and projected bonus.

|

Projected 4.75% return by RM may be too juicy so Uncle8888 used 3.25% to do his Maths!

Actually; the real investment gains from this Premium Financing plan will depend on how well Uncle8888 invests this free up $144K which was previously locked up as Cash asset under AUM in the Bank earning low interests.

Time for him to power up! LOL!

CW,

ReplyDeleteLOL! You have lost the right to poke others for using margin to increase passive income liao ;)

If you do, sure kenna poked back its 50 steps laughing at 100 steps...

I believe some readers were thrown off the track because they were looking at what you did from a "SAVE MORE" perspective.

Glad you have made it clear its an "EARN MORE" exercise ;)

Its no different from taking a home equity loan on our fully paid home, no more asset rich but cash poor!

Or like when I took up a housing loan when my CPF is enough to pay it down in full at the time of purchase.

Notice how we change during our journeys?

Young that time you abhor debt. Quickly paid up your flat in 5 years. Then for equities you only used contra during early days. No margin account ever. Now? Eh, you discovered the "blue pill"?

Then there's that Tarzan young got 3-4 investment properties! Now climbing down the mountain switch track to voluntarily contribute to CPF?

Real people, real stories so very interesting!!!

P.S. Your precision in 2 decimal places can be a bit "distracting".

The most important statement in this whole post is:

"Actually; the real investment gains from this Premium Financing plan will depend on how well Uncle8888 invests this free up $144K which was previously locked up as Cash asset under AUM earning low interests."

And "invests" is not voluntarily contribute to CPF hor!

;)

:-)

DeleteAnyone can answer?

DeleteIs our Housing Loan also classified under AUM with the Bank?

Hi SMOL,

Deletewhen one is climbing down the mountain, it is important that one has already enjoyed the view from the top, and learnt life's lessons when climbing up. Some of these lessons should include "greed has no bounds", "Money is important but is not everything!" and "Learning to let go!"

Admittedly "Learning to let go" can be difficult if one is competitive by nature. Even a leisurely weekend jog among us "uncle" jogging buddies can turn into a competition to see who can run further and faster. Unbelievable and hilarious.

Have been reading local financial blogs the last few days, since cannot travel overseas, and observed that many if not all, have reported investment gains. It seemed surreal that in this pandemic, many have actually made financial gains and some even managed to get better paying jobs after ditching their old ones.

For myself, even while climbing down the mountain, I still have some targets to meet (financial and otherwise) for 2021 for when I turn 60. The pandemic has delayed but not derailed the goals. I should meet two of my financial goals by end this year (3 more days to go).

Finally to answer CW's question on whether housing loan with a bank is classified by the bank as your AUM with the bank, the answer is no. Thats what DBS told me. :-)

mysecretinvestment,

DeleteI'm with you :)

My trading account has gone up 10 fold, but I've only increased my position size 2 fold.

In a sense, we are doing the same thing - dialing down risks as we stroll down the mountain ;)

Our friend is doing the opposite. Whole life no margin, avoid debt. Koala as in SGX stocks only.

Eh? All of sudden into leverage and HK tech stocks?

He reminds me of:

Beware of the Goody Goody Guy

LOL!

Sign of market crash in 2021? Beware! LoL!

DeleteCW,

DeleteI don't know about markets...

But if you start putting on cologne, dye your hair, and don't mind paying up for finer new threads, triple confirm you are making up for "lost time"!

Gentle reminder from our Army days:

Can do anything you want; just don't get caught!

Uncle8888,

DeleteNikkei goes back to same level as 1990/1991.

STI still got hope!

Boom first, then crash. LOL!

Quote "But if you start putting on cologne, dye your hair, and don't mind paying up for finer new threads, triple confirm you are making up for "lost time"!"

DeleteQuite true! Got real person. Real story!

My wife recently told me that she took the same lift down with old uncle neighbor who was wearing flowery shirt, tight pant and strong cologne. She said old uncle freedom liao! Now can go havoc!

His wife passed away few month ago!

CW,

DeleteLOL!

True right!?

Otherwise known as collateral.

ReplyDeleteLOL!

ReplyDeleteAll of sudden this has become england vocabulary class ;)

most associate levearge with equity tarding/investment. Too volatile & risky for me, used leverage for years in other ways, for my life insurance, invest grade corporate bonds and annuity. Bought annuity in September 2019 on ~85% levearge (before COVID, with prevailing 1 month SIBOR at ~2%). Was aware of the risks - insurer return even lower than the illustrative low of 3.25%, SIBOR goes above 2%, may not live long to enjoy the benefits of annuity - who benefits most under CPF Life? those who live to 66 or those to 100? . Nonetheless proceeded because (1) RM offered upfront discount and borrowing at 1 month SIBOR + 0.5%, even better than my equity housing loan (2) insuerer investment return (typically ~ 60% bond + reamining 40% in equity, property etc) would move in tandem with interest rate (3) Benefit of my life insurance (read family) moves in opposite direction as my annuity

ReplyDeleteHi Uncle8888,

ReplyDeleteIn this case, the bank's collateral is your life ... insurance. :P

Hmm, you must be getting pretty good benefits from priority banking to maintain your AUM.

I mean, paying fees to take cash from illiquid property is one thing.

To pay fees to take cash from cash... 🤔

I gave up my DBS Treasures many years ago after I felt that it wasn't doing much for me ... felt more like their cow being milked LOL. Maybe they've improved by now!

Do the Maths and see any worse off in converting from WL to Annuity. Annuity is more towards spending our money in our life time while the WL is leaving behind as inheritance.

ReplyDeletecollateral for my annuity loan is the policy iself. likewise, collateral for life insurance loan is the life insurance policy & collateral for equity proprietray loan is my residential property. That is, all borrowings are ringfenced.

ReplyDeleteKnew my DBS Treasure RM for many years since she introduced me to equity property loan money making. For several years after WFC, could get ~ 5% coupon for investment grade corporate bonds, wheraes housing loans were around ~1.5%. Called me every other month for new investment oppoturnities as they arose - currency trading, gold trading, structured notes, leveraged life insurance, leveraged annuity etc. Took up suggestions where they made sense, rejected if not. Most make money, a very satisfying experience overall for the last 12 years.

annuity is mainly to supplement RSS/CPF life as a form of regular passive incomes for retirees (like me). CPF schemes have higher return & certainty (thank to garmen) than private. without levarage, annuity return is generally close to OA 2.5% or lower because of expected low interest enviroment for many years to come (just received my endowment payment, rate of return at compounded 2.9+% for 10 years, not too bad). if risks are acceptable, leverage annuity annualised return could range from 4% to 10% or more, if live to 90 and beyond.

ReplyDeleteWith no margin calls for leveraged annuity plan; it should be less stressful for retirees than to leverage on margin account for a basket of REITs/stocks for dividend income to supplement CPF Life

DeleteYes uncle 8888

Deleteduring this march speed melt, seen many margin account with reits/dividend stocks kana calls like gf/wife gives u missed calls.

btw your annuity also comes with disability income benefits?

No. Only death benefit which higher than surrender value

Deleteother than my own report card, that is the first time i see so many reds.

Delete

ReplyDeletelife insurance is for family/legacy, annuity is for own (indirectly family). Best to leave them as they are.

Margin call when annuity payout is less than interest payment. But very remote (keep finger crossed), unlike equity trading on margin

Loan rate still remain on lower end

ReplyDeleteDec 19 : 0.99%

Jan 20 : 1.05% (Higher)

Feb 20 : 0.99% (Drop back to Dec 19 rate)

Average : 1.01%