By Myles Udland | Business Insider

Jeremy Grantham is not a believer in the shale fracking boom.

Back in November, we highlighted

Grantham's full quarterly letter to GMO clients, in which he said, among other things, that the US shale boom had been "a very large red herring."

So while some say the fracking boom has helped keep

oil prices low and aided the US on its

path to energy independence, Grantham thinks it might have set us on a path to nowhere.

"Its development has been remarkable," Grantham writes.

"It will surely be seen in the future as a real testimonial to the

sheer energy of American engineering at its best, employing rapid trials

and errors — with all of the risk-taking that approach involves — that

the rest of the world finds so hard to emulate.

Similarly, it

will always stand out as remarkable proof that, so late in the

realization of the risks of climate change and environmental damage, the

US could expressly deregulate such a rapidly growing and potentially

dangerous activity."

The

overall thrust

of Grantham's letter is that the world will soon be devoid of the

resources it is going to need to sustain our current economic model,

which over the past 150 or so years has been predicated on cheap energy,

namely oil.

A concern Grantham has with fracking is that the boom hasn't been

accompanied by any real concern as to the environmental damage it may be

inflicting. But Grantham is also hugely skeptical on the potency of

the shale boom because it doesn't address the problem of our need for

cheap oil.

Grantham writes: Fracking

"has not prevented the underlying costs of traditional oil from continuing to rise rapidly

or the cash flow available to oil-producing countries like Saudi

Arabia, Iran, and especially Venezuela from getting squeezed from both

ends (rising costs and falling prices)."

And as we saw last week,

OPEC announced

that it would not impose production cuts despite the sharp decline in

oil prices seen over the past few months, and it seems unlikely that

Grantham would be surprised by this.

Because if your national economy is chiefly predicated on exporting oil, you have made your bed and

therefore must lie in it as oil prices drop.

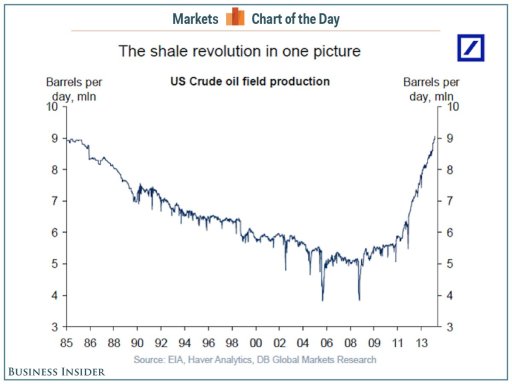

Deutsche Bank The US shale boom, in one chart.

But the US boom, which as Grantham notes has accounted for almost all of the

increase in global oil production over the past several years, has been undertaken by companies, not countries.

And so with an eye toward profit, Grantham writes, these companies

"have drilled, as always, the best parts of the best fields first,

and because the first two years of flow are basically all we get in fracking, we should have expected considerably better financial results by now.

The aggregate financial results allow for the possibility that fracking

costs have been underestimated by corporations and understated in the

press."

And with a decline in oil prices set off by too much supply, it will

be these companies that are forced to pare production, which will

reduce supply, which will create — once again — expensive oil.

"The current fall in price does nothing to offset the squeeze on the total economy from rising costs,"

Grantham writes. "It merely transfers massive amounts of income from

one subgroup (oil producers) to another (oil consumers), in a largely

zero-sum game.

FRED

"Oil consumers tend to spend more and save less than oil companies so short-term impacts are favorable.

But we should not be carried away with enthusiasm because the declining

investment from the oil industry will lower future growth.

When, as now, oil costs are still rising even as prices fall there is of

course a particularly savage effect on the profits of oil companies,

squeezed from both ends.

"They must and will rapidly adapt by reducing expenditures and

therefore oil production with the fairly obvious result that prices will

rise again.

The only longer-term price relief and net benefit

to the economy will come when either we reverse recent history and start

to find more oil more cheaply, which will be like waiting for pigs to

fly, or when cheaper sources of energy displace oil."

And so for Jeremy Grantham, nothing fundamental has changed about our relationship with oil: pigs still don't fly.

My lessons learnt is not so much about following. I knew when I picked it up that our favorite blogger got this at a very very cheap price. I think my bigger challenge is knowing when to let go before it sinks into a very pathetic state. I have a problem of letting things go. Maybe need to watch many times of Frozen :-).

Can you share some wisdom of how you typically let things go so that me and all our readers can learn from you !!!

Most of us will hate losses! Including Uncle8888

Somehow we need to take some losses in order not to lose our sleep in waiting. It is easier to sleep better hoping for recovery with smaller position sizing.

Size matters! Losing too much can cause heart attack!

See what he did in 2008 in order not to lose his sleep and having more nightmares.