Temasek’s dividend income was a steady S$8 billion last year. This is a robust 18 times over interest expense for the year ended 31 March 2016.

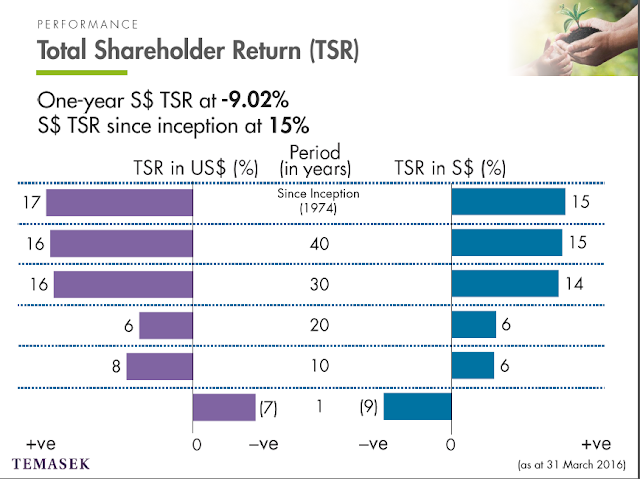

Temasek’s one-year Total Shareholder Return (TSR) was -9.02% for the year, reflecting share price declines of our listed investments, offset by the performance of unlisted assets. This represents a Total Dollar Return of negative S$24 billion.

Longer term 10-year and 20-year annualised TSRs were both 6%. TSR since our inception in 1974 was 15%.

CW8888's benchmarking among the world's well known long-term investors. One Man Gang vs. Temasek's Army of Investment Gurus

WEAKNESS in listed investments, particularly in China and financial services, dragged Temasek Holdings' net portfolio value lower by 9.02 per cent to S$242 billion in 2016, its first loss since 2009.

ReplyDeleteOver a three-year period, Temasek's total shareholder return was 3.25 per cent in Singapore-dollar terms. Over a 20-year period, total shareholder return was 6 per cent.

The decline came mostly from mark-to-market valuations of listed assets. Temasek is especially exposed to the stock markets of Singapore, which fell 15 per cent over the same period, and Hong Kong, which dropped 26 per cent.

China's representation in Temasek's portfolio shrank to 25 per cent from 27 per cent, one of the more notable declines in terms of geography, largely due to a drop in marked-to-market values of listed investments.

does temasek allow for drawdowns for distribution?

ReplyDeleteThank Raymond for spotting the error in extra row for 10 yrs. Remove 2015 row.

ReplyDeleteTemasek's income include dividends and divestment gains. XX% of income are return to Government.

ReplyDeleteRaymond: "It will interesting if we compare Temasek and WB CAGR side by side."

ReplyDeleteOK . Updated with this table for Warren vs. Temasek.

Read? Temasek’s expected earnings to be added to govt revenue

ReplyDeleteUpdated for Warren's 20 and 35 yrs CAGR for comparison to Temasek.

ReplyDeleteWe can see that Warren also finding more difficult to uncover undervalued stocks in 24x7 connected financial world.

Yet there are Trainers who can teach you to invest like Look Alike Warren or Nearly Warren investing method.

ReplyDeleteVery good visual summary of Temasek.

ReplyDeleteWatch video of how it started and building wealth till now.

http://www.temasekreview.com.sg/explore/snippets-from-temasek-review-2016.html

A quick visual guide to Temasek’s sources of funds

http://www.temasekreview.com.sg/generational-investing/ins-and-outs-at-temasek.html