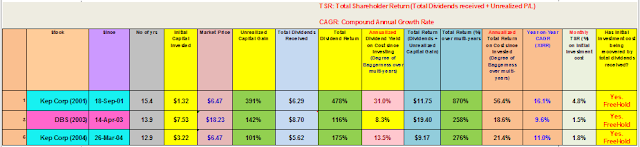

Two very young investors; look younger than Uncle8888's two older children stayed back to chat with him on that night and leading to this discussion - The Wow Factor!

Uncle8888 shared with them his experience with Wow Factor when he was newbie in the stock market!

In Uncle8888's early days; there was no personal blogs and chatboxes; but there were public forums and chat rooms where many newbies got caught by the Wow factor and unintentionally got burnt!

Uncle88888 strongly believe it was definitely UNINTENTIONAL as they have no vested commercial interests!

They are kind, truthful and well experienced retail investors sharing their trades.

They have double, triple or quadruple their positions!

Wow!

Strong conviction!

Let follow as what many newbies would do!

Uncle8888 also followed!

How wrong can it be to follow strong conviction by the veterans?

Without knowing their position sizing relative to their capital, portfolio or net worth; double, triple or quadruple of their positions is quite meaningless.

BUT, we like to THINK that double, triple or quadruple is STRONG CONVICTION!

Mathematically it is!

But, .... Think deeply the moral of the story again!

Are you Hen or Pig?

The Hen & the Pig Go To Breakfast

A Hen and a Pig were sauntering down the main street of an Indiana town (yes, this is another shaggy dog story!) when they passed a restaurant that advertised “Delicious ham and eggs: 75 cents.” “Sounds like a bargain,” approved the Hen. “That owner obviously know how to run his business. “It’s all very well for you to be so pleased about the dish in question,” observed the Pig with some resentment. “For you it is all in the day’s work. Let me point out, however, that on my part it represents a genuine sacrifice.”