Saturday, 19 September 2009

Read? Think of Investing in Stock Market as Game of Tug of War

In Children's game of tug of war; it is rather fair on equal number of players on each side; but as retail players in the stock market; it is clearly an unfair game; one side will have many retail players and joined in by heavy weight and powerful BBs. The winners of the momentarily Game will be laughing to the bank at the other side of players as suckers!

Do we know Squid Game's Tug Of War Tactics in the stock market?

When to join which side?

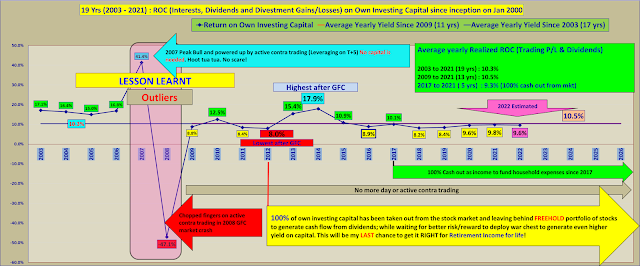

22 years of playing Squid Game's Tug of War in the stock market!

CW,

ReplyDelete;)

You are chill.

You don't let others, with "best of intentions", come disturb you with,

"Ai yoh! Why you let money rot by taking your capital back? See all those dividends you could have collected since 2017!?"

I like to poke these "well intentioned" people back, especially if they are 100% vested in STI ETF or stocks, how much they could have made if they were 100% vested in Nasdaq ETF or FANG stocks instead.

I can play "Opportunity Cost" with them too!

LOL!