Probably; the difference in the nature of multi-baggers hold by Panda/Koala retail investors in boring Super Terrible Index is their freehold multi-baggers generating lifelong passive income without fear of losing their money ever.

AMONG the first few books I ever read on investing were Peter Lynch's One Up On Wall Street and Beating The Street - which got me excited about "multi-bagger" stocks.

Lynch coined the term to refer to stocks that appreciate by a multiple of their initial value. So, a stock that trebles in value is a 3-bagger, and a stock that quadruples is a 4-bagger.

Then, there were the vaunted 10-bagger stocks. During the 13 years Lynch ran the Fidelity Magellan Fund - from 1977 to 1990 - he is said to have invested in several stocks that delivered 10-fold gains.

The result: Lynch achieved a blistering annual return of 29.2 per cent and his fund saw an avalanche of inflows. The day he resigned, the fund held US$14 billion in assets, up from just US$18 million when he started.

As a result of the influence of Lynch's books, I used to only invest in stocks that I could imagine becoming multi-baggers over time.

It helped that I began investing during the heady days of the early 1990s. It also helped that I had a pretty wild imagination, and an appetite for even obscure micro-cap stocks.

While I am much less of a risk taker now, I still think that investors ought to own stocks for the growth they offer rather than their dividend yields.

In the Singapore market, however, that poses something of a challenge.

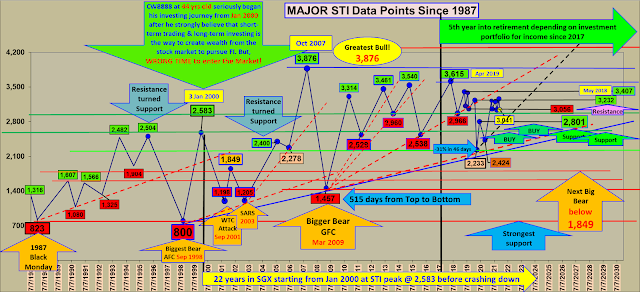

This column has previously highlighted that the local market has performed relatively poorly over the past decade, and the bulk of the Straits Times Index (STI)'s total return has come from dividends rather than stock price appreciation.

Moreover, market watchers here often lament the absence of big tech-oriented stocks that are normally associated with multi-bagger returns.

Is it even possible to find multi-bagger stocks on the local bourse? Could a Peter Lynch wannabe thrive in the Singapore market?

Local multi-baggers

During the 10 years to Dec 10, there were 137 Singapore-listed stocks that delivered a total return of at least 100 per cent (on a dividend reinvested basis) - akin to 2-bagger stocks taking into account their dividends.

While these 137 names included some of the largest blue chip companies in the market - notably DBS (which returned 314 per cent), OCBC (116 per cent) and UOB (161 per cent) - they are clearly skewed towards smaller companies.

The average market capitalisation of these 137 stocks is just over S$2.6 billion. By comparison, the 30 component stocks of the STI have an average market value of more than S$17.1 billion.

Among the better performers, the average market value is even smaller.

For instance, there were 22 stocks that delivered a total return of 500 per cent or more during the 10 years to Dec 10 - including Ban Leong Technologies (583 per cent), Spindex Industries (598 per cent), The Hour Glass (707 per cent) and Riverstone Holdings (734 per cent) - with an average market capitalisation of just over S$463 million.

Among the very best performers, however, the average market capitalisation is somewhat higher.

For instance, the 7 stocks with total returns topping 1,000 per cent during the 10-year period - AEM Holdings (7,231 per cent), Azeus Systems Holdings (2,676 per cent), UMS Holdings (1,658 per cent), Cortina Holdings (1,435 per cent), Micro-Mechanics Holdings (1,306 per cent), GSH Corp (1,120 per cent) and Frencken Group (1,005 per cent) - had an average market capitalisation of nearly S$753 million.

Local stocks with multi-bagger returns over shorter periods of time had a similar market capitalisation profile.

For instance, there were 70 stocks that achieved a total return of 100 per cent or more during the 5-year period to Dec 10, with an average market capitalisation of just under S$2 billion.

Only 18 of those 70 stocks returned 300 per cent or more during the 5-year period - including Rex International (334 per cent), Samudera Shipping Line (334 per cent) and Medtecs International (620 per cent) - with an average market capitalisation of just over S$523 million.

There were 4 stocks with returns topping 1,000 per cent - AEM Holdings (4,031 per cent), Azeus Systems Holdings (2,906 per cent), NutryFarm International (1,120 per cent) and iFast Corp (1,011 per cent) - with an average market capitalisation of nearly S$1.05 billion.

Channelling Peter Lynch

Peter Lynch once explained the virtue of hunting for multi-bagger stocks this way: If you invest an equal amount in five stocks, and one of those stocks turns out to be a 10-bagger while others go nowhere, you would still have nearly tripled your money.

To find these multi-baggers, Lynch would cast his net wide. His fund held as many as 1,400 stocks at any one time, and he has been described as "non-discriminatory" when recommending stocks.

What is the secret to successful stock picking? Lynch puts it down to a combination of art, science and legwork - that is, a knack of imagining how a business might develop and grow, an ability to decipher financial statements, and the stamina to research and keep track of numerous companies.

He also adjusted his investing strategies to suit different types of stocks.

For instance, he maintained significant exposure over the long term to stocks he deemed to have unshakeable fundamentals - among them the Federal National Mortgage Association, better known as Fannie Mae.

Yet, he was quite prepared to buy beaten down cyclicals and deftly trade out of them when he saw no further upside. "Cyclicals are like blackjack," he said, in Beating The Street. "Stay in the game too long and it's bound to take all your profit."

So, how would Peter Lynch be positioned in the Singapore market now?

This is pure conjecture of course: But I imagine he would have found his way into consistent long-term outperformers, large and small - including DBS, Venture Corp (415 per cent total return over 10 years), and Micro-Mechanics.

I would not be surprised if he had bought iFast early last year, and reaped a 10-bagger gain as the stock soared on surging earnings.

Lynch would probably also be holding on to shares of the local watch retailers - Cortina and The Hour Glass - riding their improving profitability while keeping an eye on their valuations.

Looking ahead, he would probably be trying to handicap the potential post-pandemic upside for Thai Beverage (268 per cent return over last 10 years); and figuring out how much Straits Trading (100 per cent return over last 5 years) would be worth once the sale of its stake in ARA Asset Management to ESR Cayman is completed.

Given his penchant for hunting for winners even in dull sectors, Lynch might also be closely watching homegrown companies like Challenger Technologies (145 per cent return over last 10 years) and Tai Sin Electric (335 per cent return over last 10 years) as they try to reposition themselves for the future.

At the dawn of 2022, a year I fear will be marked by rising inflation and interest rates, one of my resolutions is to refocus on the magnificent long-term growth that stocks offer and devote more time to the art, science and legwork of identifying multi-baggers in the local market.

The writer owns shares in Straits Trading, Venture Corp and The Hour Glass.