We didn't see any investment bloggers posting their net investment losses in 2017. It is like in 2007 if Uncle88888 remembered correctly!

If you are sitting on net investment losses in 2017; you better kick your ass hard and do some deep soul searching whether you should be topping up your CPF accounts instead of investing in the stock market.

In 2007; Uncle8888 was feeling rich with all his paper gains with low cash in his investment portfolio and also set new record net worth too. Bom pi pi!

In 2007; he also looked like he was on target to publish his blog post in 2008 or 2009 on "How I Made $1M In The Stock Market!" LOL!

But; that feeling of rich from the stock market didn't last very long.

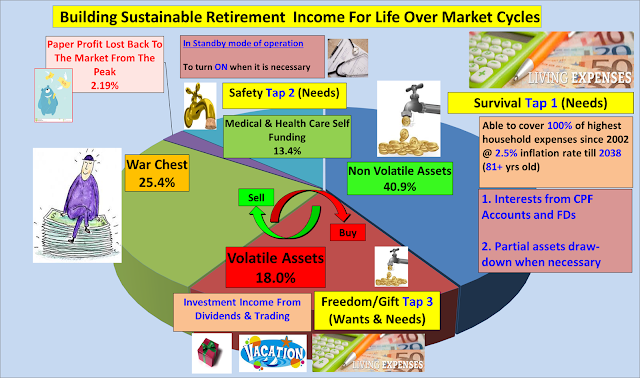

In just 382 days, his investment portfolio was down by -53% and after one decade his investment portfolio is slightly higher than 2007 level. But; this time in 2017 he is not feeling rich but cash rich!

This investing lesson he has learnt the hard way through the last Bull-Bear-Bull cycle on the ground so it is very hard for him NOT to anchor his biasness to what happened in 2007. How to forget!

2,860 days to set a new investment portfolio record without injecting a single cent as investing capital since 1 Jan 2000; and it just took 382 days to go down by -53%! Even after 10 years in 2017; it is slightly better than 2007 level.

The Moral of the Story

It is terrible to recover from future large losses so it is far better to avoid getting into one at the next Bear market without the capability to inject significant capital into investment portfolio!

Good luck!

May the Bull lasts longer into 2019 and beyond!!