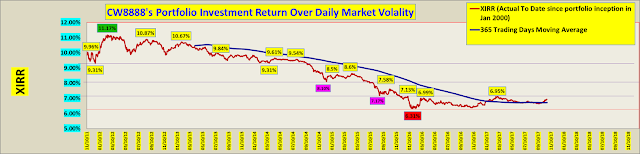

Is waiting for GSS by Mr. Market good investing idea without sacrificing too much on investment portfortlio peformance?

How many measure their investment performance down to fine detail to know the real impact or we just accept the myth of rotting cash theory?

Uncle8888,

ReplyDeleteHeheheh... did you ever estimate what will be your XIRR if you didn't "take back" your 100% capital .... instead leaving it in the market?

When we no longer have large active income (or time!) as bandages to cover & recover from large injuries by Mr Market ..... more important to protect portfolio than to chase all-out performance ... yup agree fully!!

However there are many ways to skin a cat ... in terms of psychology & risk management & money management :)

Showing your big picture & long-term graphs .... people may have better idea that Uncle8888's strategy is not buy & hold until kingdom come .... Neither izit sell all & move to cash & wait for exploding bombs & machine guns before peeking at what stocks to buy. LOL!

Hi Uncle 8888,

ReplyDeleteIt is both, isn't it?

It is a stabilizer when equity returns are falling (crash) but will drag returns when equity returns are climbing (bull).

Cash is what makes us sleep more soundly at night and it's what we do with the cash over market cycles that counts, no?