Two relevant questions which newbies may like to know.

For retail who are already on their full time job, should they be trading, long-term investing or doing both?

Retail trading is sexy!

It is craftsmanship. You constantly improving on your trading skills by tuning, refining and re-tuning your trading parameters. You keep improving your Entries and Exits. When you made into 10% of retail traders who are successful and consistently profitable; and then you can go around to poke the other 90% of failed retail traders who turned into

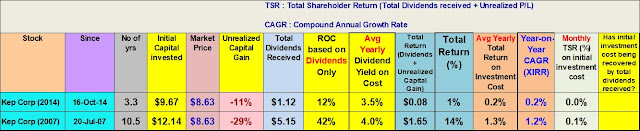

Trading is sexy! Read? Kep Corp : Bought @ $9.64 for Round 95

Every now and then; you can post how you made money from trading. Sexy. Right?

But ..... and when trading failed!

Then trading turned into

This is real life example of a failed trader turning wrong term investor!

Market timing is important. Wrong entries then you spent time in the market to break even.

Retail long term investing is boring!

Even you are successful retail investor; it is still boring as there is no craftsmanship to shout loud. What are those investing parameters to tune, refine or re-tune?

No! Right?

In investing; you better say luck factor plays the important role in your stock pick.

Boring! Right?

What you collect is dividends and paper gains. Paper gain is not real. Right?

Boring!

Ang moh say: U wanna be right, or u wanna make money??!?

ReplyDeleteUncle8888 say: U wanna be sexy, or u wanna make $$$$$$??!?

Newbie say: I wanna be both!!!

:-)

DeleteCW and Spur,

DeleteBotak says, "You figure it out yourself what works best for you. Don't let others tell you what you can or cannot do!"

;)