Read? 2015 Investment Performance Report

2016: The Year when investing in the Land of Distribution and De-cumulation of Wealth begins ...

The Strategy

Embracing Three Taps Solutions to Retirement Income For Life Model

Estimated Total Cash Flow Outcome for 2016

After Uncle8888's 60th birthday in Sep 2016, he will UNJOB himself from the corporate world from minding Bosses' KPIs to minding his own money and receives cash flow as follows:

(1) Basic Annual Pay (It is more like fixed income with small variation on year-to-year) : Interests

(2) Variable Bonus: Dividends from his local SGX stocks portfolio.

(3) Performance Incentive or Claw back: Trading P/L. This is 100% performance based on his trading skill or craft. It is either incentive or claw back.

Knowing his annual household living expenses

Sources of Cash Flow

Plan B (Backup Cash Flow from Tap 1)

Not depending 100% on Mr. Market for survival!

Building Sustainable Retirement Income For Life

Survival

Tap No 1: Cover 90%

of Highest Annual Household Expenses Since 2002 @ 2.5% Inflation Rate Till 2038 (81+

years old)

A Goal-based Approach Investing Strategy

Uncle8888 has adopted a Goal-based Approach investing strategy by setting for himself a 10-year progressive Goal Targets to be achieved for each year from 2012 to 2021.

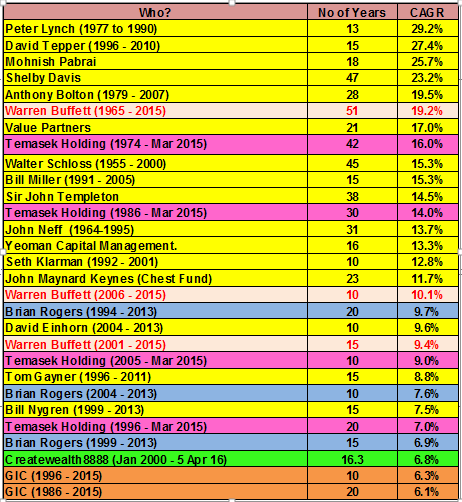

Our investing journey is not Horse Race or Rat Race where we compete against others. No! It is our investment Marathon Race where we set our own pace and compete against ourselves to win our own race.

Year 5: Q1 2016 Result for Tap No 3 (Cash Flow from Investment Portfolio)

Achieved 35.7% against 44% of 2021 Goal Targets.

Investment Portfolio XIRR

Track, Measure and Visualize!

Without doing it; how to revise investing strategies and to improve year-on-year investing performance?

Investment Portfolio's XIRR includes all investable cash plus the current stocks value at market closing price as on 31 Mar 2016.

Since one year ago: -8.5%

Since 1 Nov 2008: 0.43%

Since 1 Jan 2003: +7.4%

Since 1 Jan 2000: +6.9%

The reality of riding market cycles of Bull and Bear