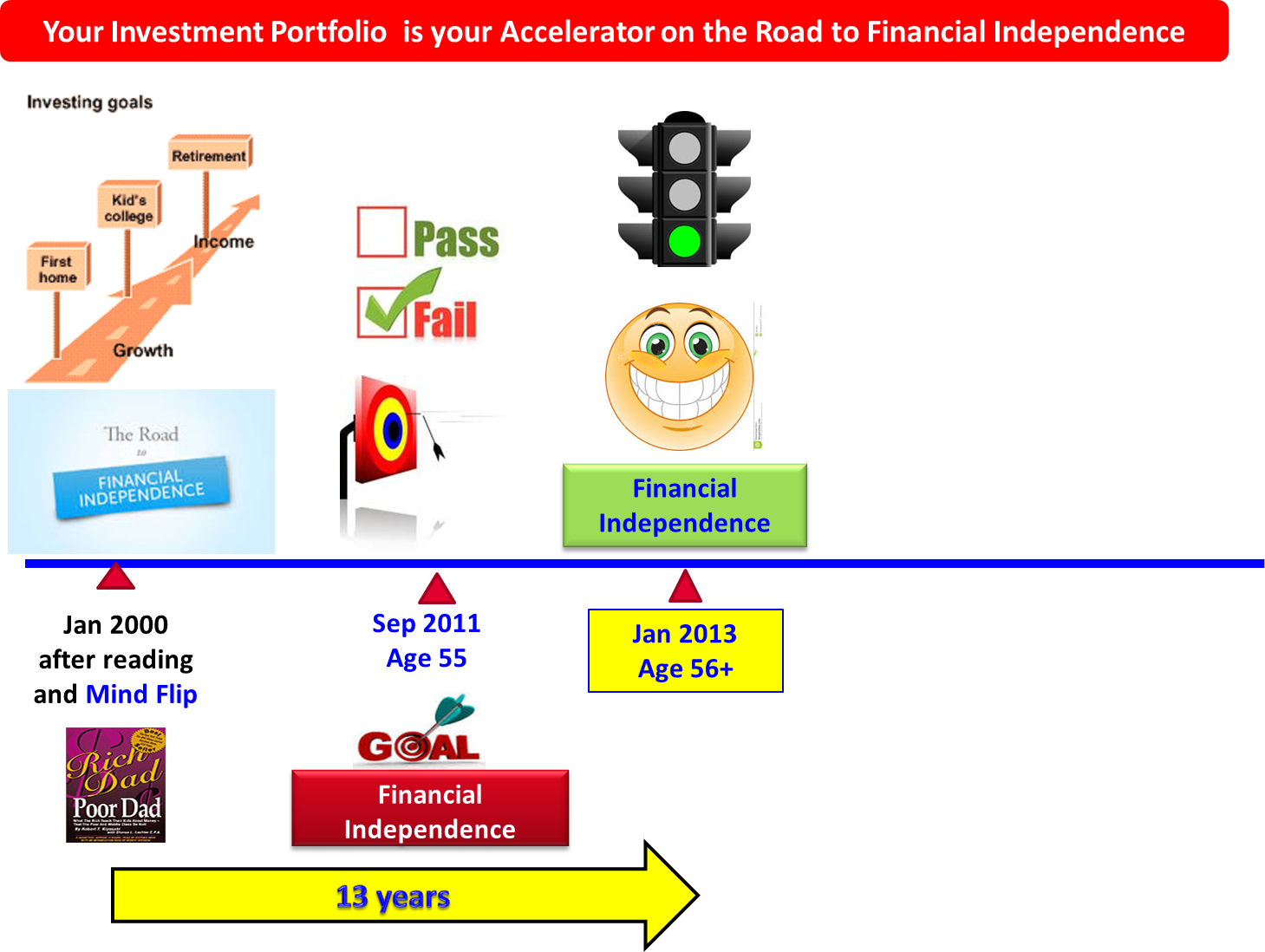

Here is Uncle8888's milestones on his Road to the Edge of Financial Independence and beyond (hopefully not fall back too much due to market volatility)

How his investing journey begin?

1. A Mind Flip after reading this book and determination to get out of Rat Race via Investment path.

2. The Road to Financial Independence began ...

3. Set Investing Goals and target date to reach Financial Independence by 55 at Sep 2011.

4. We can plan but doesn't mean it will succeed.

FAILED!

Uncle8888 didn't reach the Edge of Financial Independence at 55

5. Finally, Uncle8888 has arrived at the Edge of Financial Independence on Jan 2013 at 56+, more than one year late.

6. Moving farther away from the Edge of Financial Independence and hopefully not fall back too much due to market volatility.

Congrats uncle CW on achieving your goals for financial independence. 1 year late is still better than not reaching at all.

ReplyDeleteCoincidently i read that book too and that got me started in my financial journey. You read it in year 2000 while i read it in year 2010. Exactly 10 years later and the same book had the same effect. Impressive!!

:-)

DeleteGood book!

Many have read it but no mind flip.

I read the book in 2009 and have the same effect too ;)

ReplyDeleteHeres uncle cw a person who have done it didit and sharinf it with other people. Maybe you should start a book one day too :)

Many retail investors may just invest their spare cash. They may not have any serious investment plan or willing to put in enough time and effort to train themselves to be skillful investors over the next few years.

DeleteWe can easily borrow many investment books from NLB. Till now I am still borrowing investment books to read and this proves that there are still some/new books not read even after so many years.

For the things we have to learn before we can do them, we learn by doing them." - Aristotle

I was the retail investor who didn't put into serious efforts on improving myself though I started my financial journey in 1997 (unfortunately being a herd, blindly followed the buying tips of my ex-bank colleagues & thought I possess first mover advantage).

Delete... My dad's admission to hospital after paralysed on left side of his body due to stroke in 2011, woke me up on the importance of attaining financial freedom.

... Ultimately, my financial teacher's intriguing phase, "Why Not YOU? Why Not NOW " (originated from Jim Rohn) spurred me to spend my quality time on achieving the goal of unconscious competence.

Hope that more employees will come to understand this Wealth Formula on Human Asset, Financial Assets and Cash Flow.

ReplyDeleteRead? Investing Lessons From Conversation With Uncle8888 (1)