Read? So hard to sell!

Read? How to Hold a multi-bagger?

Buy, Right and Hold and then becomes so hard to sell!

Uncle8888 also find so hard to sell his Three Little Pigs to the Wolf!

Why like that?

Lacking in ...

TA

FA

FATA

Freehold. So can bo chap?

Endowment bias is far too strong?

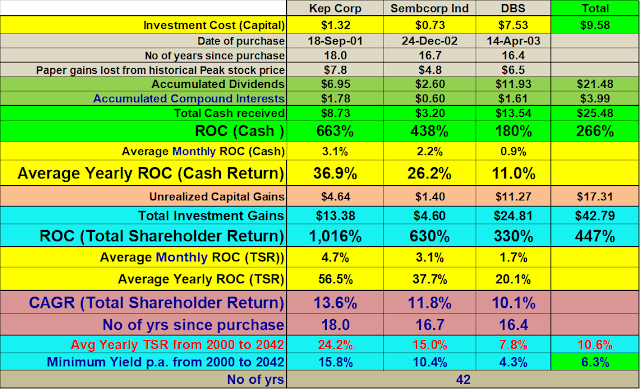

"Passive" income at MINIMUM yield on cost @ 6.3% p.a. for life over 42 years till 85 age old.

It is better than his RA Minimum Sum yearly payout with variable higher payout.

Hmm ..

RA Minimum Sum: A lifetime of CPF contributions till 55 after 34 years as employee

Three Little Pigs : 20 years as retail investor taking emotional roller coaster ride up and down through market cycles and periodically hearing bad news and then time to sell and finding so hard to sell! Sigh!

Are we smart trader or dumb investor?

Can we really become mutually inclusive as smart trader and smart investor at the same time?

Can we still find potential multi-baggers with implementation of trailing stops to protect profits over market and economic cycles?

Hi Uncle8888,

ReplyDeleteFreehold endowment bias basically raises pain threshold! Kekeke!!!

So you're mentally prepared for -60% drawdown in event of financial crisis type bear markets.

Preservation against a temporary 3-5 year paper loss in your existing stock positions is not such a key consideration. Especially when viewed as a portfolio approach with your other CPF assets & war chest.

I can see 2 factors to consider:

(1) Permanent or near-permanent loss of capital due to significant impairment/disruption of company or industry fundamentals.

What if any of your piggies slowly become like NOL, Starhub, SPH, or SMRT & M1 (privatisation or re-nationalisation)?

(2) Yield decay or impairment.

What if yields go below RA for 2-3 consecutive years?

Unfortunately cannot recycle into RA or SA!

Maybe recycle into leveraged REITs! LOL!! 🤣😛

LoL. One day become dementia. No care about market anymore

DeleteDon't lose money after lifetime of investing is good already

ReplyDeleteFH property. Hosay liao!

ReplyDelete