DBS Group Holdings, Singapore's biggest bank, beat expectations as first-quarter core net profit rose 9 percent to record, helped by strong growth in loans.

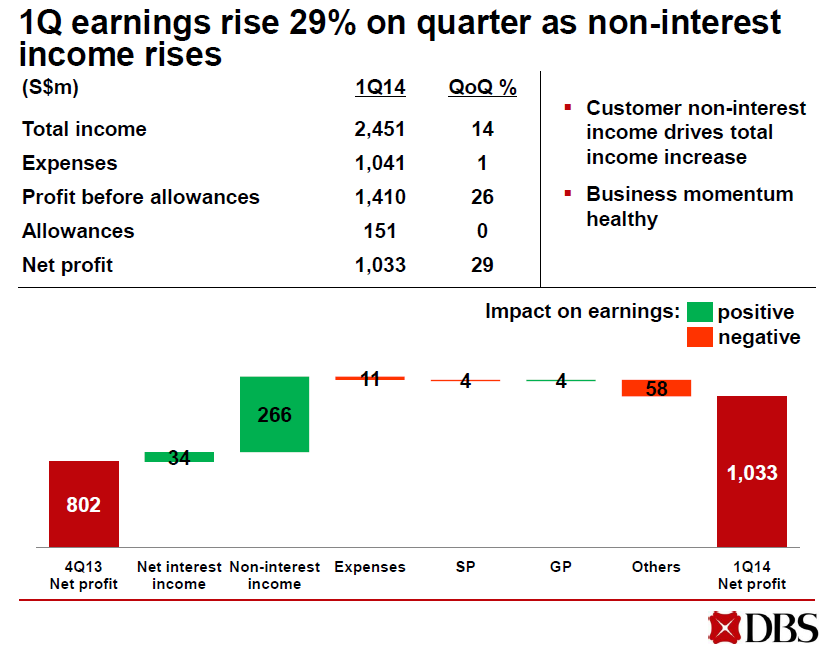

DBS said core net profit came to a record S$1.033 billion ($823 million)for the first three months of 2014, up from S$950 million in the same period a year earlier and above an average forecast of S$857 million from six analysts polled by Reuters.

Net profit including special items, climbed 30 percent to S$1.231 billion, boosted by items such as a one-off gain from the sale of a stake in a Philippine lender.

DBS has so far largely been affected by slower growth in housing market after government cooling measures.

"Despite challenging fixed income markets, quarterly earnings crossed the S$1 billion mark for the first time, a testament to the strength of our franchise," DBS CEO Piyush Gupta said in a statement.

ReplyDelete[SINGAPORE] The chief executive of DBS Group Holdings said on Wednesday that new housing loan applications at the bank are down 45% from a year earlier.

Piyush Gupta was speaking at a media conference, after the lender had earlier reported better-than-expected first quarter net profit of S$1.03 billion (US$820.4 million). - Reuters

From Share Investment:

ReplyDeletePrice To Book Value

DBS Bank has a low price to book ratio of 1.18 as compared to the industry average of 2.97. Most of the assets of a bank can be considered to be highly liquid. A low price to book ratio represents a bargain for investors who are looking to invest in the long run.