A Chasing Sunsets Fund – A Better Way to Plan Nice-to-Haves in Financial

Independence.

-

One of the spending needs that many of you would consider as part of the

income needs for your financial independence (FI) or FIRE, is to have

enough mon...

8 months ago

Hi Uncle8888,

ReplyDeleteThanks to your wise actions to set aside hefty portions during your working years that has now given you more cash to spend in retirement than when working! 😁

When one uses up too much of their active income on "lifestyle" or own-stay property, that's when they get cash tight when forced to retire.

At least those with nice homes can downgrade. But as anything to do with "lifestyle", it'll be like being forced to eat potatoes instead of rice/noodles for the next 30 years (or vice versa if you're angmoh).

Hi CW,

ReplyDeleteGood for you! Having more cash to spend in retirement is a sign of a successful family wealth manager. One needs less cash to spend during retirement, though, particularly if parents have passed away and children have grown up.

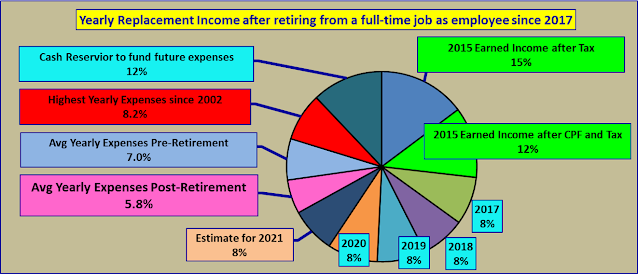

Fully agreed with "One needs less cash to spend during retirement, though, particularly if parents have passed away and children have grown up." and that will mean lower replacement income is required from our investment portfolio during retirement.

Delete