A Chasing Sunsets Fund – A Better Way to Plan Nice-to-Haves in Financial

Independence.

-

One of the spending needs that many of you would consider as part of the

income needs for your financial independence (FI) or FIRE, is to have

enough mon...

8 months ago

CW,

ReplyDeleteOn guard for a poke OK?

How much you need per month AFTER retirement you need a formula to tell you?

You don't trust your own feet? Trust a ruler more to tell you what shoes would fit better?

You already got 3 years of monthly expenses AFTER retirement tracked and pasted to powerpoint. What's the point of doing that if you can rely on this "theoratical" one-size-fits-all formula?

Eh?

P.S. I just know if AFTER retirement I want a wine, women, and song lifestyle, no money is ever enough. If I herbivore (not interested in sex), then I need a lot less... LOL!

Trust but verify - SMOL

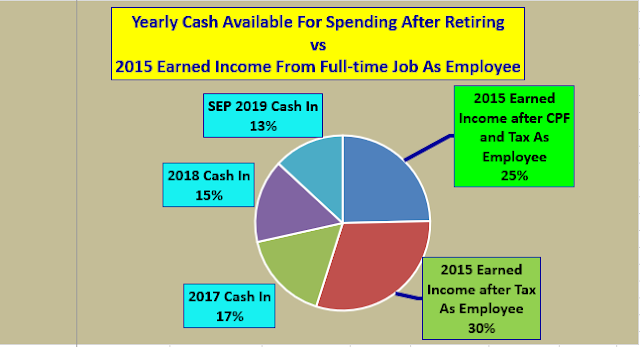

ReplyDeleteData points to verify theoretical formula by FAs Vs actual and measuring our own feet.

What is the variance?

:-)