A Chasing Sunsets Fund – A Better Way to Plan Nice-to-Haves in Financial

Independence.

-

One of the spending needs that many of you would consider as part of the

income needs for your financial independence (FI) or FIRE, is to have

enough mon...

7 months ago

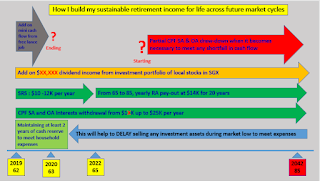

After Point X, we may not have to struggle with market volatility anymore. Let it be!

ReplyDeleteBuying at 4 to 5% yield during market or cyclic low is never the same as buying 8 to 10% yield near bull market. One has probability of higher yield moving forward while the other is the opposite.

ReplyDelete會賣是師父

ReplyDeleteHow many retail are 師父 to realize those large capital gains?