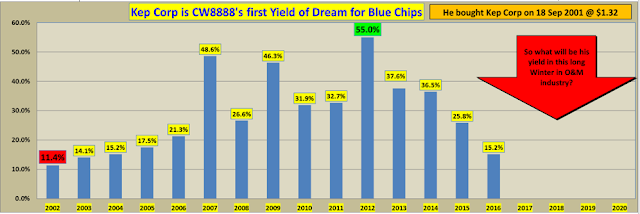

Ants have been busy preparing for the next Winter. They will know how much to gather to survive through the Winter and still have enough spare time after their hard work to dance in the Sun and Rain!

The hindsight and foresight of tracking and measuring.

It is all about relying on the PAST to live within our means in the PRESENT and forecasting and sustaining the FUTURE with high level of confidence.

Ants have this reliable tool to forecast their FUTURE!

The PAST, THE PRESENT and managing the FUTURE with caution!

The PAST, the PRESENT (Somehow; even NOT within Uncle8888's CONTROL; it still happen somewhat like those past years. How come?, and will the FUTURE may be some variations of the PAST.