A Chasing Sunsets Fund – A Better Way to Plan Nice-to-Haves in Financial

Independence.

-

One of the spending needs that many of you would consider as part of the

income needs for your financial independence (FI) or FIRE, is to have

enough mon...

8 months ago

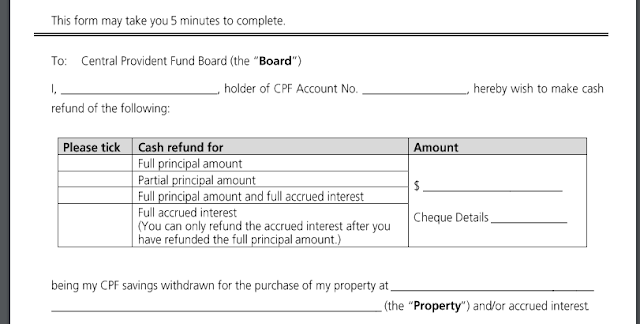

If you still have outstanding mortgage loan, the Net Amount Used and Accrued Interest will still show despite you're >55 years old.

ReplyDelete