Read? Time in the Market > Timing the Market???

Why we always hear this from Gurus, Experts and Financial writers and advisers?

Timing the market doesn't mean lump sum investing through timing the market!

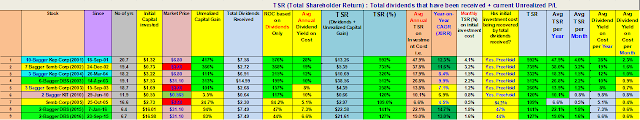

In practice; Uncle8888 actually does timing the market by buying slowly with position sizing and also diversify across sectors; and then sell slowly according to Sardines or Touchstones status.

Sardines are sold!

Salted fishes then sucked fingers, write off and then takes a hit on his investment portfolio CAGR!

Timing the market and then Time in the Market matters by holding on to Touchstones and Multibaggers; you can get fabulous investment outcome after 10, 20 or 30 yrs i.e. freehold investment income for life! But, do we have such patience? LOL!