Read? Time in the Market > Timing the Market???

Why we always hear this from Gurus, Experts and Financial writers and advisers?

Timing the market doesn't mean lump sum investing through timing the market!

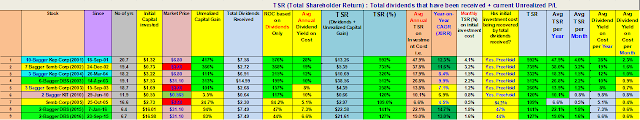

In practice; Uncle8888 actually does timing the market by buying slowly with position sizing and also diversify across sectors; and then sell slowly according to Sardines or Touchstones status.

Sardines are sold!

Salted fishes then sucked fingers, write off and then takes a hit on his investment portfolio CAGR!

Timing the market and then Time in the Market matters by holding on to Touchstones and Multibaggers; you can get fabulous investment outcome after 10, 20 or 30 yrs i.e. freehold investment income for life! But, do we have such patience? LOL!

CW,

ReplyDeleteThat's so they don't have to explain to their students why the more they invests, the more they're losing!?

Unrealised losses are not real....

Just buy more as prices go lower; stocks always go up one!

Trust!

Trading gurus need to have new cannon fodders every other year. That's because most bei kambings just need 1-2 years to realise whether the methods work or not. Hence trading gurus ever so often, need to move from city to city, country to country searching for new pastures ;)

Investing gurus, especially those who spin long term or passive, have it "easier"... It takes a full bull/bear cycle before their Stockholm Syndrome cult followers can see whether their shepherds got wear swimming trunks or not! By then, 7 to 10 years would have passed. Good luck asking your course fees back after 10 years!

We all know this truth but pretend don't see:

1) Super traders will eventually setup their own prop trading firms. Train and recruit others to trade for them!

2) Great investors will setup their own hedge funds or family offices.

Uncle8888,

ReplyDeleteMost people with day jobs are probably better off DCA-ing into S&P500 or Global index funds & just focus on their job/career skills.

Over 20 years, US and global stocks always go up! Unless there's a major nuclear war with >10 major cities being destroyed by nuclear warheads.

Those with hole in the heart or hate their day jobs, can try with 20% active investing. See if their 20% portion can perform consistently better than the 80% passive DCA portion. Over 5-10 years they will have the answer whether to focus more on their jobs or investing! Lol.

Over the past 10 years, my liquid assets are basically grouped into 40:40:20

40% primarily buy & hold, with planting & harvesting at the margins based on extreme sentiments, overbought / oversold, significant corrections or exuberant outperformance e.g. S&P500 going up almost 100% from 2019-2021.

40% using trend / momentum. At the end of each month I see the 10-month performance of 6 ETFs corresponding to S&P500, DM ex-US, EM, commodities, 20+ yr treasuries, and T-bills (cash equivalent). Then I move or retain money in the best performing. That's it.

20% more of discretionary. Like leveraged commodity funds or bearish inverse tech ETFs. Now I'm getting interested in bombed-out tech & semiconductor ETFs.

Maintaining a cash warchest of 10%-30% of the overall portfolio is useful for psychological ballast, as well as for allocation tweaks particularly for the buy & hold and discretionary portions.

Smol has said the truth ... good investors / traders will either quietly invest/trade for themselves, or set up hedge funds if they want to go into business.

Setting up businesses where the primary revenue source is from training fees rather than investment/trading gains, tells you all there is to know about that guru or company. ;)

Those who can time the market should time the market. Those who have no time, no interest or simply cannot do it should do dollar-cost-averaging into stock indices.

ReplyDeleteDon't listen to other people, particularly those with snake-oil vested interests, to tell us whether we should time or not time the market until we try out ourselves. They are telling us what to do based on what is good for them, not what is good for us.

However, I think most people should do dollar-cost-averaging because their talent and interest lies elsewhere outside the financial markets. This is up to each of us to find out for ourselves.