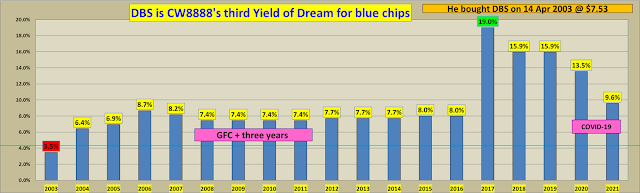

Read? Yield of dreams: Investors have "a once in a lifetime opportunity" in blue chips (13)

Broken dream of yield! Sibei sianz!

DBS final dividend for FY 20 declared is $0.18 and assuming same dividends for 2021 remaining at $0.18 *4

Another year of pain for retirees depending on dividend income in 2021.

CW,

ReplyDelete2003 is a fine year, isn't it?

As a former Buyer, we often say a merchandise well bought is a merchandise well sold ;)

Most retail bei kambings often forget the selling part... Especially if their day job does not involve profit and loss responsibilities...

But you are safe. You have taken quite a bit of your capital back.

If market revisits 2009, 2003, or the even more frightening 1997 (STI below 1000!!!), you're fine and ready.

If market melts up from here, you are OK too! (Earn less is better than waiting and hoping to breakeven one day...)

P.S. Eh, your DBS is just reverting to mean lah. You think everyday is Sunday like in 2017?

Need to deploy or risk more cash to top up investment income. No more Sundays!

DeleteCW,

DeleteYou are not alone in the search for yield...

Since 2009, central banks have "screwed" savers as they lower interest rates to bailout speculators.

Money that would have gone to savers have now ended up as capital gains to those who are not only 100% vested, but margined to the max!

Good times for youths who don't know what cannot be done :)

Hi Uncle8888,

ReplyDeleteWith yield curves steepening, NIM will improve.

As world gets vaccinated & open up, NPLs & loan provisions will decrease.

With 5 years of oil price destruction & under-investment flipping the supply-demand equation, bad debts in the oily sector are bottoming out & turning around.

Don't be surprised if banks announce bumper dividend increases this year. 😛

Else you can always jump on the bitcoin bandwagon & put some money in on the next -30% decline! DBS crypto exchange! 🤣

DBS crypto exchange has retail trading?

DeleteOpen to II's and AI's.

DeleteTechnically you're an AI 😛

But probably the fees will kill you (if bitcoin's volatility doesn't do the job in the first place!). Better to be a "mini owner" of the exchange than to be its customer! LOL!

For 2022, I am taking 80% of 2019 dividends for my estimation. Now is at 60%. Waiting eagerly for Ah Kong to set the guidance for 2021

ReplyDeletethe US$ would collapse if it is no longer the world's reserve currency, need to do away with the Petroldollar system for this to happen. one potential threat to US$ dominance could be when China's digital currency becomes a reality (facilitated by China's hugh global trades) Losing the US$ world's reserve currency status mean US can't continue printing money at will to finance its miltary (GFC & COVID are black swans events, printing money to finance its military is there all the times). But this is unlikely to happen anytime soon, too many countries have stakes in maintaining the status quo. On a personal level, my life insurance is denominated in US$, legacy to my children will be aversely affected if the US$ collapse. On SWIFT, still don't understand how the system works. SWIFT is so powerful that when the Carrie Lam (HK Chief Executive) was sanctioned by US because of passing of the Natonal Security Law , she get her salary paid in cash. Having an account with Bank of China still can't help escape from the claws of SWIFT.

ReplyDelete