A Chasing Sunsets Fund – A Better Way to Plan Nice-to-Haves in Financial

Independence.

-

One of the spending needs that many of you would consider as part of the

income needs for your financial independence (FI) or FIRE, is to have

enough mon...

8 months ago

hahaha... pei fu your charts!

ReplyDeletesimple question for u: buy or sell now or dun do anything? or short?

I will keep buying till STI 800. LOL!

DeleteNext level of buy is at 2,100 and below

DeleteBut now is 2.5k? should we still buy now if we already bought, or wait for next resistance breach?

DeleteAgree that 2100 is next buy (15% drop n next resistance).

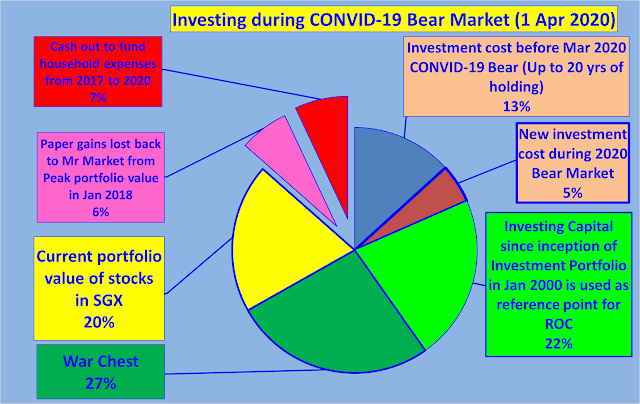

I have just added two more charts and hope it will be clearer. It is hard to know where is the market bottom so we have to pace out our war chest to whichever lower levels that our war chest allows.

DeleteAfter that, we wait for market recovery and hope that a few winners will cover all the losers and still positive for future years of cash flow.

Agree! actually below 2300 is good for me also. But I may not buy sti, there are many good companies also.

DeleteSti traditionally more difficult to have double bagger compared to many companies.

Eg lots of reits can be battered badly who will still be resilent

2020 should be Year of Panadols to ease heartache

ReplyDeletePanadol can cure headache not heartache!

Deletehahahaha....

With so much liquidity in the market, there is also a chance that market will not repeat history but rally again. Of course history always have dead cat bounces

More difficult this time than GFC. Each crisis getting more and more complex and serious!

yes indeed, while I am in a good position now in terms of funds and portfolio, I am also worry for the world and many people will suffer. It will be a sorry state.

ReplyDeleteHow can we be happy with earnings when so many people are suffering and many people are dying, and more will be dying.

Quite sad!