Spur commented on "Sembcorp Ind + 4.9 SML in specie Is Greater Than Sum of parts for Semcorp Ind with 61% SML holding ???"

Jun 2, 2021

Hi Uncle8888, The 8th ed. of Winning The Loser's Game is out. Think you've read the previous editions liao. 😉 Some nuggets from this article about the book: - More important than understanding the market is to understand who you are. "If you don't know who you are, this is an expensive place to find out," Adam Smith famously wrote in The Money Game. - Ellis' key insight for investors is this: The winner is the person who makes the fewest mistakes. To make the fewest mistakes, focus a little less on returns and more on managing risk, particularly the risk of serious permanent loss. I think the main thing new for this latest edition is a chapter on longer duration bonds ... and the conclusion is that they're bad for long-term holding at current prices. Another unspoken conclusion from this article is this: To beat the market on a long-term sustainable basis, you may need to focus on companies/things which are not mainstream & certainly not in the news or covered by 20 bank/broker analysts. 😛

Read? Winning The Loser's Game (2)

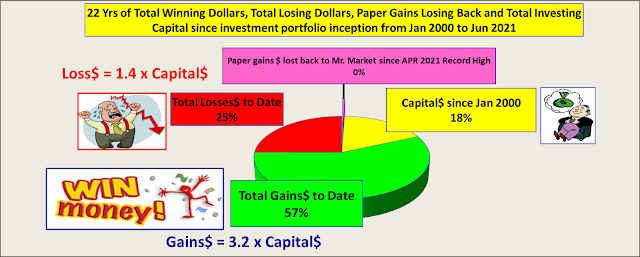

CW8888: More important than making fewest mistakes is don't ever make a few large permanent losses which may make us chopped our fingers and never touch the market anymore!

Read? Luckily, Me in Merdeka Generation Didn't Start Younger To Invest/Speculate in My 30s During 1990s

Read? Lost Your Money In Hyflux???

Read? 3M's - Method, Money, Mind (6)

Hi CW,

ReplyDeleteChop hand permanent loss is definitely one to avoid. I am worried about that, hence I have a no bigger than 5 percent at cost of portfolio rule.

That's only me. In the bloggersloogersphere. You can easily find 2 camps of diversification and concentration play.

I no balls. I play diversification, so that if one day I kena permanent loss, I need not chop handa