Saturday, 6 June 2015, Read? Trinity of Investing??? (2)

This fellow after five months came back again to Uncle8888 to discuss on his investment strategy and want some advice on how to move forward.

Walau!

Super patience or dumb?

Now, he has $40K spare cash as war chest for investing and $20K cash as emergency fund. He has no debts.

BTW, he is FT colleague.

After spending sometime talking and talking about stock investing strategy; he then asked Uncle8888 how about property investment in his hometown. He said that his father-in-law has a few properties in his hometown and surviving on his rental income. No need to work.

He said that with his $40K he can also invest in one property with four rooms and each with its own door for rental.

Walau!

Becoming Landlord with $40K in his hometown or Ikan Bilis stock investor in Singapore with his tiny war chest of $40K?

The answer is clear!

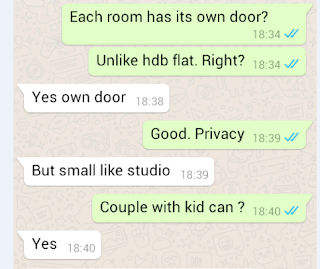

To confirm that Uncle8888 didn't hear it wrongly so he what-apps him in the evening:

Whoa, where is his hometown?

ReplyDeletePinoyland

Delete