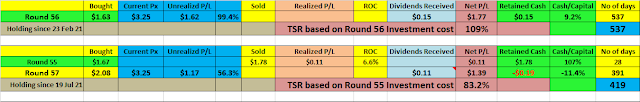

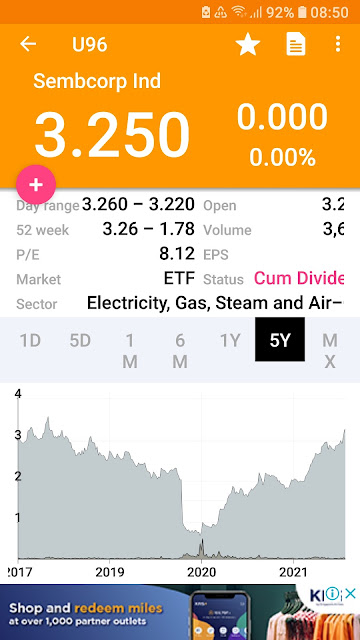

Read more? Sembcorp Ind

Even with more than 20 years following closely on SCI and everyday staring at its stock price also has no balls to add more when it was dirt cheap as low can be lower and can be taken private!

FA or TA or FATA requires big ball to convince ourselves. Investing is really hard for retail!

KNS!

CW,

ReplyDeleteYou think why so many veterans after sometime are also "fans" of CPF voluntary contributions?

If we only share with bei kambings our winning positions, who would leave money on the table by opting for CPF's 4%?

Especially when CPI is 6% or more currently?

That's because a guaranteed -2% loss in purchasing power is better than sitting on -20% to -30% unrealised losses when STI is above 3200...

If Earn More was easy, no one in their right mind would voluntarily contribute to CPF! LOL!

Let see next year how much is CPF top up since SSB is rising. :-)

ReplyDeleteUncle8888,

ReplyDeleteNot easy to continually add more & hold when it's a cyclical business ;)

Let's see whether SCI (and Kep) can transform into a more steady growth business.