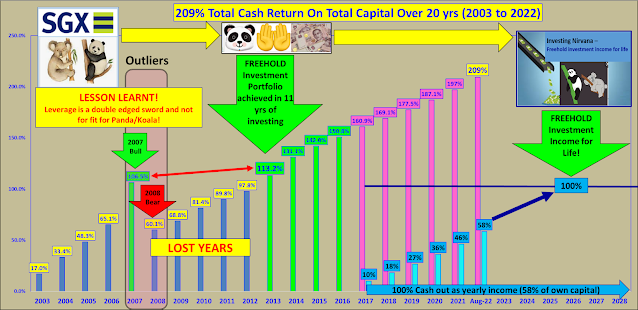

With all stocks in Uncle8888's portfolio declared 2022 H1 dividends as of today; minimum investment income @ 12.3% ROC has been achieved for 2022. Now he can let his war chest to rot while waiting for itchy hand to make some kopi money if market continues to run up to 3,800. LOL!

A Chasing Sunsets Fund – A Better Way to Plan Nice-to-Haves in Financial

Independence.

-

One of the spending needs that many of you would consider as part of the

income needs for your financial independence (FI) or FIRE, is to have

enough mon...

7 months ago

Well done CW!

ReplyDeleteThats what we signed up for as dividends investors. Collect dividends till the stocks become free-to-hold.

Only a handful of my stocks are free-to-hold stocks but am happy with the dividends collected so far this year. With the announced dividends for up to Sep 2022, the YTD dividends have amounted to $72,000. Am quietly optimistic that the full year dividend can hit $80,000.

On a separate note, the tenancy agreement with my tenant is expiring this month and my agent told me my neighbour with a similar size unit, was asking $3,800 pm! My current tenant is paying me only $3,150 pm. So lets see how much rent I can raise it to. 🤔

On the CPF front, my total CPF savings will kiss $1.8M in Sep, growing by $100K from Sep 2021. So it will take me another 2 years to hit my target of $2M in CPF.

Look like any form of income will depend on market timing. :-)

ReplyDelete