We often read from comments/advices in investment or trading forums that we can recover from losses if we are younger.

Don't worry! Keep trying. Keep investing or trading! You will recover your losses one day!

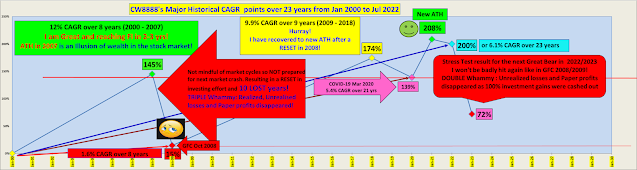

While we can recover from financial losses in the market by injecting new capital or switching horse and/or recycling capital to recover from past losses; but we can't never recover from those lost years from an ATH to next new ATH!

The LOST years!

Uncle8888 learnt this lesson!

He spent 10 out of 23 years (about 43%) in the market just to recover the fall from ATH in 2007 to the next new ATH in 2018.

Now; he often stares at his stress test of his portfolio and don't make that same mistake in 2007!

Read? Make hay while Sun shines and not pulling out winter weeds

CW,

ReplyDeleteThat's why awareness on our personal circumstances is key.

What shoes fit our own feet we know best!

The best target for snake oils are those 60 plus bei kambings with ZERO Earn More experience.

Flushed with cash, they suddenly get a rush of shit to the brains!?

Uncle8888,

ReplyDeleteHalf the fun is navigating through the mountains & gorges of markets.

If markets just go up, where's the fun in that? :P

Local market not much fun these few years.

ReplyDeleteMust compensate for 13 years of fun mah :P

Deletelocal market sti is suck, hopless. U be better off at wall st.

DeleteHi CW,

ReplyDeleteConventional wisdom says that as one ages, a person should reduce exposure to equities and move more into fixed income instruments. Think this advice is precisely to address the problem of older investors particularly retirees who do not have the runway to recover from a major market meltdown.

While a market meltdown is generally a "good" event for young investors, it can be devastating for retirees. Young investors that have small exposures to equities would find such events good opportunities to add to their stock holdings. For older people nearing the end of their work career as well as retirees and with substantial investment in the market, such events would wipe out substantial value off their investment. And these seniors would not have the runway to recover their losses (even paper losses).

Market crashes are thus important reminders for investors, young and old, to have a plan on how to enter and exit the temperamental market according to their life stage.

If you want to hold on to your substantial exposure to equities as you age and approach retirement, it very important to build up a separate and secure stash somewhere. This is where the CPF comes in handy. And it is no surprise what you and AK71 have done and are advocating. You at 65 (66 this Oct) have $1M in your OA, and AK has $1M in his total CPF savings at 50. Very admirable.

With these kind of buffers in the CPF, it is easy understand why both of you are still confidently dabbling in the stock market.

For myself, I have clear goals what I want to achieve in my wife's and my CPF savings. And thats the beauty of the CPF. One can actually project the savings trajectory into the future with high certainty.

If we can achieve our savings goal of 4M65 in our combined CPF, we can then afford to let our equity holding roll along with Mr Market's frequent tantrum and just collect dividends from our stocks as panadols.

Wah! Didn't know SGX try to protect old bei kambing

ReplyDelete