SINGAPORE (EDGEPROP) - Rumours are that liquidators are trying to seize the assets of Singapore-based crypto hedge fund Three Arrows Capital (3AC), which became the latest victim of the crash in cryptocurrency. Two partners at advisory and consulting firm Teneo have been appointed to handle 3AC’s liquidation.

3AC was put under liquidation by a court in the British Virgin Islands on Monday, June 27, after 3AC failed to repay creditors. On June 30, the Monetary Authority of Singapore (MAS) reprimanded the firm for providing false information and for breaching fund management industry licensing rules.

The firm was co-founded by former Credit Suisse traders Su Zhu and Kyle Davies at the kitchen table of their apartment in 2012, according to a Bloomberg story last year. The two of them are only in their mid-30s.

Zhu is co-founder, director, CEO and CIO of 3AC, while Davies is co-founder and chairman of the firm. Their crypto assets had reportedly been worth several billion dollars at one point.

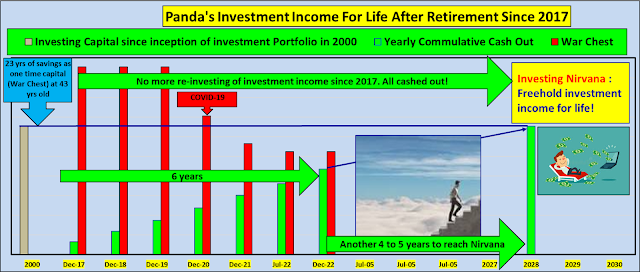

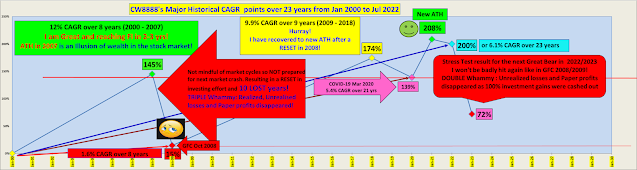

CW8888: One of our tasks as investors is to recognize or acknowledge this illusion of wealth in market during bullish market and has strategy in place to keep part of this illusion of wealth in the market really safe from the next market crisis.

So my sifu is right!

It is far better to regret not making more money than to feel sorry of losing your hard earned money.

My sifu started trading and investing at age of 18 following the foot-steps of his father into the stock market.

Choose Regret or Sorry?

It is in our own hands. It is our own making!

Read? Lesson NOT Learnt in 2007 STI Bull and Lesson Learnt in GFC Bear And Then Applied Along The Way To COVID-19 Mini Bear and Continue ...