The Dow Jones Industrial Average rallied more than 800 points on Friday, rebounding off the lows of the bear market last week and capping its first weekly advance since May.

The Dow rose 823.32 points, or 2.68%, to 31,500.68, with gains accelerating in the final hour of trading. The S&P 500 was 3.06% higher to 3,911.74. The Nasdaq Composite advanced 3.34% to 11,607.62.

The major averages wrapped up a big comeback week for stocks. The S&P 500 is up nearly 6.5% for the week, while the Nasdaq Composite gained 7.5%. The Dow is 5.4% higher.

Hmm market thinking that inflation will be lower 6 mths later? Or that there won't be recession or just a very mild one? Or ceasefire in Ukraine in a few months?

ReplyDeleteSome +ve RSI and MACD divergences in weekly S&P500 and the weekly advance-decline line.

The % of S&P500 stocks above their 200 dma has also gone from below 15% to above 15%. I used this to call the 2020 bottom, but it hasn't gone below 10% yet like previous confirmed recessions.

Just feels a bit too early for bear bear to end like this. Market needs to prove itself more.

Haven't nibbled or bitten 0anything yet since 17 Jun...

Mr Market is whimsical. Nobody knows what he will do next.

ReplyDeleteFor some years now, I have divided my investment funds into two portions. One for monthly buys and another pool as warchest. I have been nibbling bitcoin and VOO and local stocks using the monthly-buy fund for monthly buys. This is to address the FOMO should Mr Market suddenly feels exuberant.

Havent deployed the warchest pool yet as the crisis indicators have appeared but are not very strong yet. Crisis indicators would be:

1. High retrenchment numbers

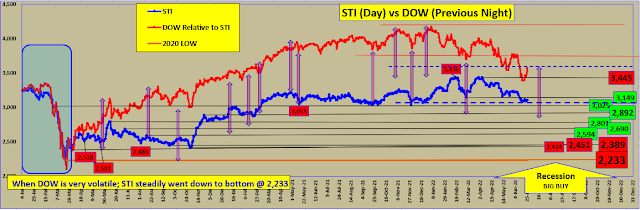

2. Big Stock market retracement. The STI has been quite resilient

3. Governments stepping in to bail out businesses and the citizenry