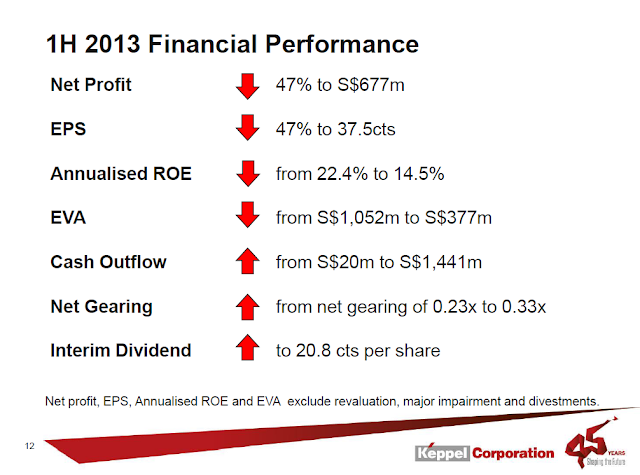

1. 1H 2013 net profit decreased 47% to S$677 million, compared to 1H 2012's S$1,272 million.

2. Earnings per Share of 37.5 cents, down 47% from 1H 2012's 71.0 cents.

3. Annualised Return on Equity of 14.5%.

4. Economic Value Added decreased from S$1,052 million to S$377 million.

5. Cash outflow of S$1,441 million.

6. Net gearing of 0.33x.

7. Interim dividend of 20.8 cents per share.

Note: The financials exclude revaluation, major impairment and divestments.

Address by Mr Choo Chiau Beng, Chief Executive Officer

SECOND QUARTER AND FIRST HALF ENDED 30 JUNE 2013

17 We aim to develop more winning designs by working closely with the end-users of our products. I am pleased that our FLNG FEED study for Golar will be completed in 3Q2013, while our ice-class jackup design with ConocoPhillips will be ready at the end of the year.

18 Finally, after rounds of inputs from customers and oil companies, we have developed what we believe to be a compelling drillship solution for the market. We will be working hard in the year ahead to commercialise this new design.

(CW8888: Hitting back the Korean yards at their drillships???)

Net Margin still stable at 13%

No comments:

Post a Comment