Read?

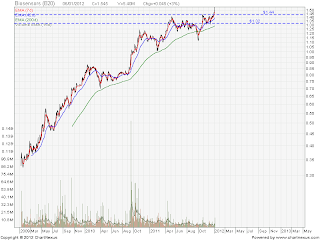

XIRR/CAGR: Investor's true performance indicator! (3)

Another good reason why we must fully aware of our average rate of return over market cycles.

Read on. You may understand it better.

Retirement: how much is enough?

Funding your retirement years comfortably is a trade-off between playing it safe, taking risks and spending prudently

By BEN FOK

AT A FAMILY function, my 60-year-old cousin Peter asked me for my views on retirement planning. He said that over the last 35 years he has worked hard, consistently saved and prudently invested his money. When he retires in two years' time, this should provide him with a nest egg of about $500,000. As I listened to him, it seemed that he had secured his financial future. But he kept asking: 'Is it really enough?'

At this age, many would expect to have a significant retirement nest egg. If they don't, they had better do something about it now.

In Singapore, our official statistics show that there are more than 300,000 individuals aged between 50 and 54 who are due to retire in 10 to 15 years' time. As a financial adviser, I often discuss this subject with my clients but often this issue is not treated as a top priority. Understandably, there are other priorities, such as children's education and mortgage repayments or other immediate needs, that take precedence over retirement planning.

Given the current economic volatility, the outlook for those planning their retirement is very cloudy. Over the last two years, we have seen the cost of living here increasing yearly, making retirement more expensive and resulting in many more Singaporeans having to put off retirement for a few more years. With higher longevity and people not saving enough, the working population of those aged 60 and over will inevitably continue to rise.

In Peter's case, he and his wife are healthy and they are likely to have a long life ahead of them. So it would be a mistake to concentrate solely on what's happening now or even on what might happen months from now. Rather, they should focus on coming up with a spending and preservation plan that can assure them of enough money to live comfortably for the next 25-30 years, if not longer.

Hence,

funding your retirement years is a trade-off between playing it safe, taking risks and spending prudently.

With the nest egg that Peter has accumulated, he can create a cash flow, and that is the most important consideration during his retirement. At this point, he has to set a reasonable withdrawal rate that will give him the spending cash he needs but won't deplete his nest egg too soon. Peter asked: 'How much can I safely withdraw from my retirement fund every year?' It is obvious that a miscalculation could result in an involuntary return to the workforce or having insufficient funds for retirement.

To help Peter understand how much he can withdraw, I produced a

table to show the number of years his money will last.

The table shows withdrawal rates ranging from 4 per cent to 13 per cent and annual growth rate of investment from 3 per cent to 12 per cent, which resembles a 100 per cent stocks to a 100 per cent bonds portfolio.

It also shows how many years a sum will last at

various withdrawal rates and various rates of return. If the withdrawal rate and the rate of return are the same, the principal will not change. For example, when $100,000 earns 8 per cent per annum and 8 per cent is drawn, the principal stays the same. This is another strategy by which a retiree can create an income stream. So if Peter invests $500,000 in a diversified investment that can give him 5 per cent returns, he can make $25,000 per year of withdrawals without affecting his principal.

However, if $100,000 earns 4 per cent per annum ($4,000) and 8 per cent ($8,000) is withdrawn annually, the $8,000 annual income will continue for 17 years before the principal is gone.

It is important to understand that the rate of return and the withdrawal rate determine how many years the principal will last. There are no guarantees, of course, but generally the lower your withdrawal rate, the better the chances that your money will last throughout your retirement. But when the earnings are less than the amount that is taken out, you are dipping into your principal, so your money will not last for a long time.

If you start withdrawing a small amount from your portfolio, and adjust it for inflation, the chances are that your money will last longer whether you invest relatively conservatively or aggressively.

So to enjoy a decent retirement, you need to be responsible for your old age by starting to save adequately and invest prudently for your retirement as early as possible. I also believe that it is just as important that people take financial advice well in advance of their anticipated retirement. We have to carefully assess their investment portfolios, as this could make all the difference in the long run.

Singaporeans are intending to retire later, and those planning to stop working between the ages of 60 and 65 will double in the future. With increased longevity comes increased risk of potentially outliving one's retirement assets.

Another point to note is the unexpected 'life events' that may happen. No one can predict what lies ahead in their retirement journey. While we can determine when we want to retire and exercise to keep in good health, there are no certainties in life. Planning for one's retirement years must include taking into consideration life events that have the potential to disrupt your retirement years.

Hence, certain protection products - like medical, hospitalisation and long-term care insurance - are still needed during one's retirement to protect against the potentially devastating effects of unexpected life events like death and chronic illness. We need to have a financial strategy that is flexible enough to adapt to a person's changing needs and circumstances. Retirement can truly be great, but only if you carefully manage your money throughout your golden years.

Note: The strategy described in this article may not be suitable for all readers. If you are in doubt, consult a financial adviser.