Chun bo?

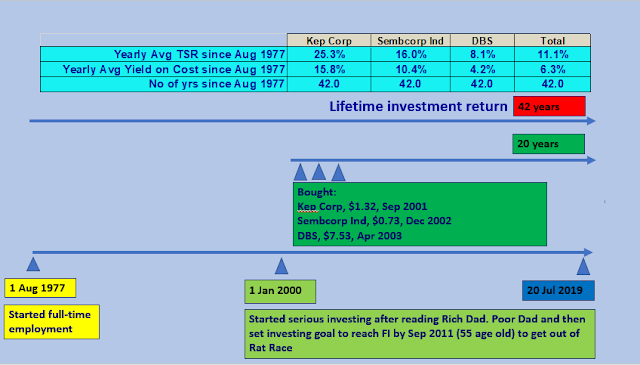

Uncle8888's own investing experience and outcome over the last 20 years find it really hard to accept this common investing advice - Don't time the market!

On hindsight wisdom and back-testing on own data points.

Look more rewarding is to time the market and then let those good ones spending time in the market to provide you with decades or lifetime of cash flow.

Uncle8888's three little pigs core holding

Factors for lifelong investing:

1. Position sizing

2. Money management for capital recycling to diversify, filtering and concentrate down the better ones for time in the market and also accumulating sizable war chest to time the market.

Hi Uncle8888,

ReplyDeleteFor most people, it IS very difficult to time the market due to psychology & emotions.

Even those base on "signals" or "price levels" or "valuations" or "yield" or "system" will find it very very tough to execute in REAL TIME or even to start scaling in. Discretionary actions require a person to overcome a HELL LOT OF FEAR & DOUBTS.

Usually it takes most people to go thru at least 1 major bear market & a decade or 2 of investing / trading to develop the "wisdom" or "instinct".

That is why for the past 30-40 years, many have advocated to dumb down "timing the market" into a no-need to-think system that can be automated e.g. 60:40 with annual re-balancing.

Is this the best results --- not really. But more importantly can it be automated & set aside, no see no touch like CPF-SA? Yes to some extent.

Re-balancing is actually timing the market --- but to automate it on fixed annual basis.

60:40 allocation is actually taking a "permanent" market timing in terms of how positive you feel about risky equities versus safer govt bonds & cash.

Since 2009 GFC, there are also people advocating reducing equities by 10% each year starting 5 years before your target retirement date. And then increasing your equities again each year after retirement.

To offset multi years of inflation in retirement phase; we may have to adjust equities up or down based on market cycles. With 60:40 fix allocation; it is difficult to offset inflation unless one is willing to do asset draw-down. But asset draw-down at market low is terrible.

ReplyDeleteUsually any drawdown is taken from the least volatile asset i.e. cash then bonds.

DeleteNot ideal to drawdown from equities unless size of equities is >= 30X annual expenses.

That is why those "lucky" ones in 1998 and 2009 huat so big!

ReplyDeleteCW,

ReplyDeleteThose people who say don't time the market are salespersons (that include "gurus" who can't trade or invest; can only teach).

If not, how to collect commissions and fees NOW from bei kambings?

Are ber then?

LOL!