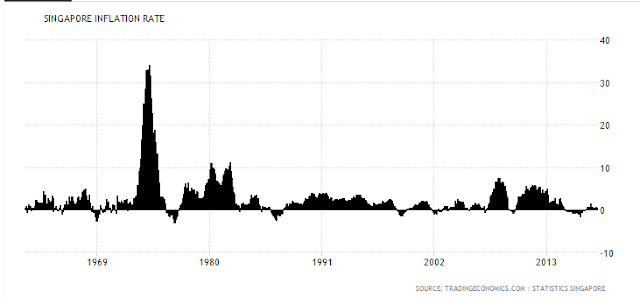

If you have NOT been through at least one full market cycle of Bull-Bear-Bull or Bear-Bull-Bear; you may not understand what Uncle8888 is saying ... Illusive profits during Bullish market but permanent losses in Bear market.

Over the years Uncle8888 have many coffee sessions with Readers/Starfishes who form the two groups of retail investors:

One group are newbies who have started out investing/trading for one or more years; but they didn't not achieve the investment return as expected. So they want to find out from veterans who have been in the market; and hopefully they can learn from veterans' experiences in the market; and see how to correct, revise or adapt their own investing method or strategies to achieve better performance.

The other group have been performing well during bullish market; but they couldn't clearly identify the phases of pull back, correction and stayed over-invested till market crash. Finally panic selling and locked in permanent losses to save whatever capital left on the table. They want to know how to survive market cycles and build sustainable retirement income or wealth for retirement.