A Chasing Sunsets Fund – A Better Way to Plan Nice-to-Haves in Financial

Independence.

-

One of the spending needs that many of you would consider as part of the

income needs for your financial independence (FI) or FIRE, is to have

enough mon...

8 months ago

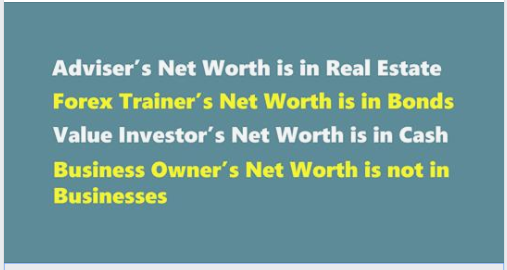

People will be surprised at how much safe govt bonds & US Treasuries formed the bulk of most billionaire investors' portfolios ;)

ReplyDeleteEven Buffett personal holdings ... I won't be surprised if 50% were in Treasuries, municipal bonds etc. I read like during the dotcom boom, he was practically sitting in 90% bonds & cash.

People always confuse his *professional* portfolio in Berkshire Hathaway with his *personal* one. :)

Ownself money and other People money are not the same.

DeleteI learnt early in my life that a teacher and a master are two different roles. He who teaches, may not be a master of the subject.

ReplyDeleteAbsolutely right. Nowadays that why we have Masterclass training. They also know the difference :-)

DeleteHmm.. Teachers are usually employees and Masters are self employed?

ReplyDelete