Sunday, 30 December 2018

Have We truly Understand How Inflation Affects Us And Our Retirement Planning? (2)

Read? Have We truly Understand How Inflation Affects Us And Our Retirement Planning?

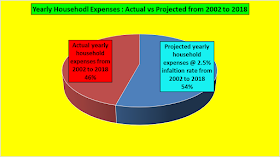

So far based on Uncle8888's past 17 years (2002 to 2018) actual data points; he is not too concerned on inflationary impact on future household expenses as he still has some fat to trim during those difficult years.

He is actually spending 8% below the projected multi-years inflationary rate at 2.5% over 17 years since 2002.

Probably, inflation will impact more on those who are already spending at their lowest possible living costs so there is not much fat to trim during hard times.

How to beat inflation?

Spending a bit more to build up those extra fat during good years. LOL!

That's becoz Singapore's inflation over the last 30-40 years has been only about 1.7% per annum.

ReplyDeleteAnd this is including property & car inflation.

If exclude property & car, will be even lower. Those who had locked in their property price before 1995 will have enjoyed very very low inflation all these decades (probably deflation or close to it!) :)

That is true! We are all impacted by national level inflation in different way along our life journey. All not of us are the same. We should do our retirement planning based on our life journey and not based on some theoretical number provided by financial advisers.

Delete