Read? XIRR/CAGR: Investor's true performance indicator! (4)

Read? Two Bank Accounts? No, You may need Four! - (4)

How can I easily maintain and track investible and virgin cash?

It is lot easier if you have your investment bank account linked to your broker and CDP.

See the following examples. No sweat tracking.

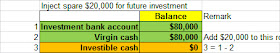

When I add more spare cash e.g $20,000 into investment bank account for future investment opportunity in stocks

When I sell $20,000 stock, my bank account will be credited with 20,000 by my broker.

Still blur?

Then you have to buy Lasksa set at ToastBox for 1-to-1 coaching. LOL!

why cant we create something transactional? isnt that a much recurring way of management - + cash.

ReplyDeletewhat i find is that if i do that alot of + - + - the calculation cannot throw out an XIRR. it becomes useless.

Hmm.. I like to simplify matters and break them up for easy maintenance.

ReplyDeleteI measure XIRR is separately from stock transactions and dividends received.

One excel worksheet containing only XIRR measurement

Row 1: Date and initial capital

Row 2: Date and new added capital

Row N: Date and new added capital

Last row: Current date and Portfolio Value

------------------

Portfolio Value is maintained in another worksheet and seperate from XIRR and stock transctions

Portfolio Value

Left Column

Row 1: Current stocks value at market closing prices

Row 2: Investible Cash

Row 3: Total

Right Column

Row 1: Total capital

Row 2: Total Realized P/L (including stock dividends recieved)

Row 3: Total Unrealized P/L

Row 4: Total

Total of LHS = Total of RHS

Stock transactions and dividends

Track in whatever method or ways. Free form tracking but must be able to produce two items:

1. Realized P/L (including stock dividends received)

2. Unrealized P/L

uncle let me try to see if i can incorporate it.

ReplyDeleteincorporate at where?

ReplyDelete