SG Physiotherapist6 November 2018 at 17:48:00 GMT+8

Hi there,

May I know which author’s form of retirement planning/ drawdown do you subscribe to?

ReplyDelete

Uncle8888 happened to see these :

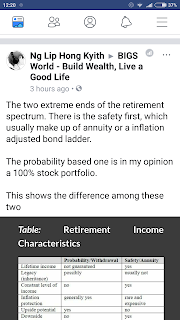

Let us see for ourselves the comparison table :

Uncle8888's Three Taps Solution model for sustainable retirement income for life

Mixed method is preferred

ReplyDeleteHeheh ... people forget that all those research & studies are based on angmoh countries where they have pensions & free elderly medical.

ReplyDeleteThe US (where most of research is done) has among the lowest of benefits among the developed angmoh countries.

More or less free medical after 66 that is probably equivalent to our C class standard.

US pension is about 40% of last few years salary if retire at 66 or 67. Can retire at 62 but pension much reduced. Their pension also has inflation adjustment every few years.

So their investments are extra on top of pension.

As Sinkies, we can also tap on CPF where possible as part of overall portfolio.

Yalor. We need Sinkie bloggers to talk about retirement planning in Singapore for Singaporeans and PRs on top of CPF scheme as one of our Taps.

DeletePut resources in different baskets.

ReplyDeleteYes. Another school of thought for retirement planning is 3 to 5 buckets theory

Delete