CW8888's Blog Mast Head : Create wealth through long-term investing and short-term trading.

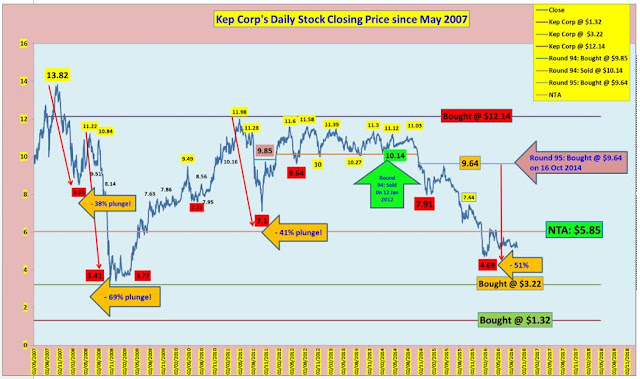

15 years of long-term holding Kep Corp for its dividends and 95 rounds of short-term trading for trading P/L.

Read? Kep Corp : Bought @ $9.64 for Round 95

This is what long-term investing and short-term trading all about.

Holding long-term for its yield and trading short-term for its cash flow is not as that easy over market and oil cycles - the boom and doom.

We must remember our investing experience and future approach to investing is always personal and that is the reason why we have to understand ourselves, our investing goals and the most important our account size really matters.

Uncle8888 is very discipline in risk control and he knows enough is enough and he will never ever lose any money in Kep Corp!

You get what he is saying?

Any clue in the chart above what he didn't do?

average down?

ReplyDeleteTry to understand what is position sizing before even thinking of average down. Too many retail die in investing due to average down till no hope of recovery.

DeleteI am just answering your question of what you didn't do, which is "average down"! :)

ReplyDeleteSo what you didn't do?

LOL! You are right!

Delete